FedWatch December Rate Cut Probability Jumps to ~70% on Dovish Fed Remarks (Nov 21,2025)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

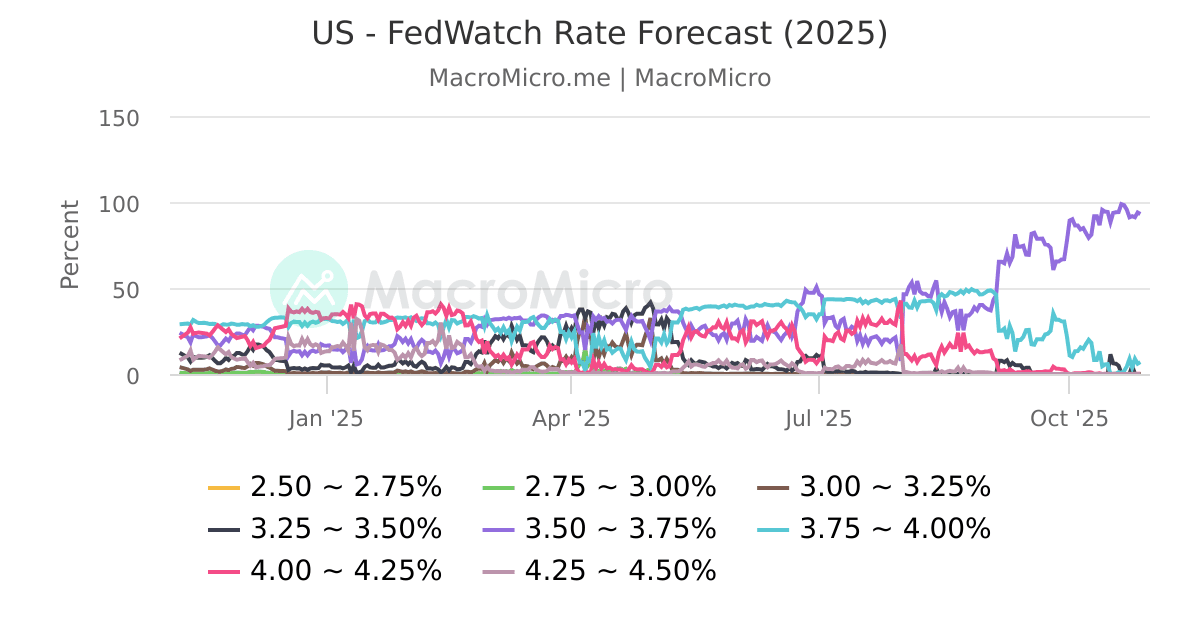

This analysis is based on a Reddit post [0] published on November21,2025, which noted the CME FedWatch Tool’s probability of a December 2025 Federal Reserve rate cut jumped from ~44% to ~70%.

The sharp shift in rate cut expectations to ~70% (71.3% per official reports [1]) was primarily driven by collective dovish remarks from multiple Federal Reserve officials on November21,2025[1]. These comments reversed a recent downward trend in rate-cut expectations (which had dropped below30% earlier) and reignited market speculation about an imminent cut[1].

Key contextual factors include:

- The next Federal Open Market Committee (FOMC) meetings are scheduled for December10,2025 and January28,2026[1].

- The November Consumer Price Index (CPI) data— a critical inflation indicator—will be released on December18,2025, after the December FOMC meeting[1]. This timing amplified the impact of the officials’ remarks, as markets adjusted expectations without access to pre-meeting inflation data.

Reuters [2] noted that the increase in rate-cut bets acted as a tailwind for Wall Street indexes, though markets posted mixed results for the day.

- Fed Communication Impact: Collective dovish remarks from Fed officials can drive rapid, significant shifts in market rate expectations (as seen in the ~26 percentage point jump in FedWatch probability).

- Data Timing Sensitivity: The absence of key inflation data before the December FOMC meeting allowed Fed communications to have an outsized influence on market sentiment.

- Expectation Volatility: Rate-cut expectations remain fluid, with recent swings indicating high market sensitivity to Fed signals and economic data.

- Expectation Misalignment: If the Fed does not cut rates in December, markets may face disappointment, leading to potential volatility.

- Data-Driven Reversal: Post-meeting CPI data (Dec18) could contradict current expectations, triggering another shift in rate-cut probabilities.

- Rate-Sensitive Sectors: Sectors like technology, real estate, and consumer discretionary may benefit if rate cuts materialize, as lower borrowing costs support growth and valuation.

- FedWatch Tool’s December rate cut probability jumped to ~70% (71.3% per Weex) on Nov21,2025, up from ~44% earlier.

- Primary driver: Collective dovish remarks from multiple Fed officials.

- Key dates: December10 FOMC meeting; December18 CPI release.

- Market reaction: Mixed results for the day, with rate-cut bets acting as a tailwind but overall volatility persisting.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.