Reddit Portfolio Analysis: Growth Stocks vs Blue Chips (2025-11-22)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit post (2025-11-22) where an OP shared a portfolio with

For growth stocks:

- LRN: $500M buyback program [11] with mixed institutional activity (UBS added29.1% Q22025, Fuller & Thaler reduced by41.4% [12]).

- IOVA: Positive NSCLC clinical data (26% objective response rate [13]) with launch expected H22027 [14].

- AUR: Analysts (Bleecker Street Research) question 2027 profitability target due to capital needs ($750M to breakeven) and deployment risks [16].

- CCCX: Merging with Infleqtion (quantum tech) at $1.8B valuation; INFQ data unavailable (merger pending [17]).

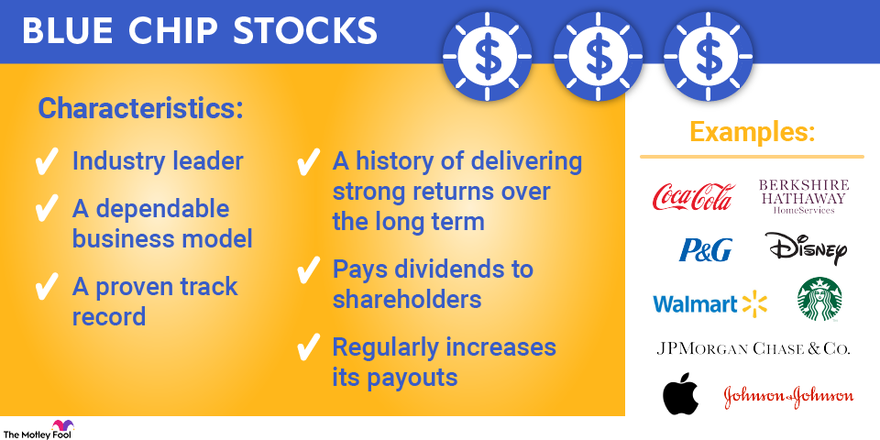

Blue chips demonstrated stability: GOOG (+3.33% [5]) and SPY (+1% [9]) reflected broad market strength.

- Growth vs Blue Chip Trade-off: The OP’s aggressive growth allocation (40%) contrasts with user recommendations to limit non-blue-chip stocks to10%, aligning with historical speculative stock losses cited in the discussion.

- LRN’s Mixed Signals: Low P/E ratio (10.23 [4]) and buyback support [11] are offset by weak enrollment trends [12].

- IOVA’s Long-Term Potential: Positive clinical data [13] suggests upside, but the 2027 launch timeline means extended negative cash flow [14].

- AUR’s Skepticism: Analyst concerns about capital needs and deployment delays [16] highlight risk in its profitability target.

- AUR: Potential capital shortfall ($2.2B-$3.1B needed vs projected $750M) may lead to dilution [16].

- IOVA: Ongoing losses (EPS: -1.19 [3]) and long NSCLC launch timeline (H22027 [14]).

- CCCX: SPAC merger risks (regulatory approval, shareholder votes [17]).

- LRN: Weak enrollment trends could impact revenue [12].

- LRN: $500M buyback program to support share value [11].

- IOVA: Clinical progress in NSCLC therapy [13] may drive future valuation.

- Blue Chips: Stability (e.g., GOOG’s gain [5]) offers a hedge against growth stock volatility.

- Portfolio Allocation:40% blue chips,40% growth stocks.

- Market Performance: Blue chips outperformed growth stocks on Nov22,2025.

- Key Metrics: LRN P/E=10.23 [4], IOVA NSCLC ORR=26% [13], AUR market cap=$7.32B [0].

- User Sentiment: Bearish on speculative stocks, positive on LRN, recommend limiting non-blue-chip allocation to 10%.

This summary provides objective context for decision-making without prescriptive investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.