November 2025 Market Sentiment Shift Analysis: Tech Cooling & Fed Rate Cut Expectations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

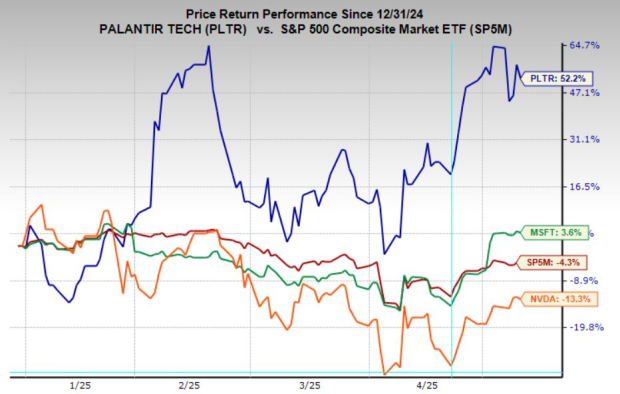

November 2025 witnessed a significant shift in U.S. market sentiment, marked by tech sector underperformance, plummeting Federal Reserve rate cut expectations, rising volatility, and investor rotation to defensive sectors. Market expectations for a December Fed rate cut have dropped from near certainty a month ago to below 25% [4], with the December 10 FOMC decision now viewed as balanced [5]. Key AI-related stocks like NVIDIA (NVDA) declined 4.84% over 30 days, while Palantir (PLTR) fell 13.34%—despite strong earnings—amid ongoing “AI bubble” discourse [1,2]. The CBOE Volatility Index (VIX) rose 20.46% to 23.43, indicating heightened uncertainty [3]. Sector performance shows healthcare leading with a 1.73% gain, tech lagging at 0.15%, and utilities as the only declining sector (-0.89%) [0].

- Price Over Fundamentals: Narrative is driven by price movements rather than fundamentals, as observed in tech stocks declining despite strong earnings.

- Tech Weakness Signal: Leading tech stocks showing weakness on positive earnings may indicate potential further downside.

- Fed Policy Catalyst: Shifting Fed rate cut expectations are the primary driver of the current sentiment shift [4,5].

- Defensive Rotation: Investors are rotating from high-growth tech to defensive sectors like healthcare, aligning with sector performance trends [0].

- Risks: Further reduction in Fed rate cut expectations, deepening tech sell-off, and unexpected jobs data surprises [4,5].

- Opportunities: Potential buying opportunities if market fear escalates (current sell-off is not extreme enough for panic levels), and defensive sectors like healthcare offer safe-haven potential [0].

- December Fed rate cut expectations: Below 25% [4].

- NVDA 30-day decline: 4.84% [1]; PLTR 30-day decline:13.34% [2].

- VIX rise:20.46% to23.43 [3].

- Leading sector: Healthcare (+1.73%) [0]; lagging: Tech (+0.15%) [0].

Note: All data is for informational purposes only and not investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.