AI Bubble Concerns: Market Reaction to Concentration in Tech Giants (NVDA, MSFT, GOOG)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Seeking Alpha article [6] highlighting concerns about an AI bubble due to concentrated gains in NVIDIA (NVDA), Microsoft (MSFT), and Alphabet (GOOG). The market reaction was mixed: NVDA (-0.97%) and MSFT (-1.32%) declined slightly, while GOOG (+3.33%) rose—likely due to company-specific factors not covered in the bubble article. The Technology sector was the weakest performer (+0.14%) on the day, lagging defensive sectors like Healthcare (+1.73%), indicating investor caution [3].

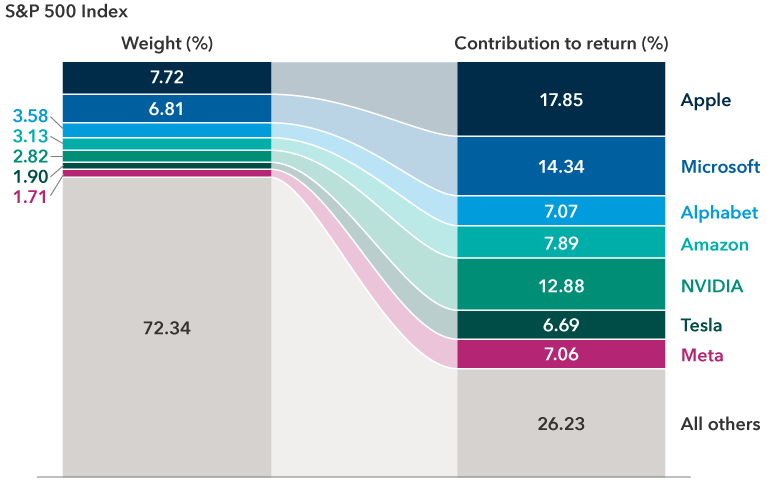

Valuation metrics show elevated levels: NVDA’s P/E ratio of 44.28x, MSFT’s 33.56x, and GOOG’s 29.55x [0,1,2]. Trading volumes were well above 30-day averages for all three stocks, signaling increased volatility [0,1,2]. Over 60 days, the NASDAQ (dominated by large-cap tech) gained 2.97% while the Russell 2000 (small-cap) declined by -0.49%, underscoring concentration risk [4].

- Company-Specific Factors: GOOG’s positive performance suggests that individual company news can offset broader sector concerns, highlighting the need for granular analysis beyond sector trends.

- Sector Rotation: The tech sector’s underperformance relative to defensive sectors indicates a shift in investor sentiment toward lower-risk assets amid bubble concerns.

- Concentration Risk: The divergence between large-cap tech (NASDAQ) and small-cap stocks (Russell 2000) confirms that AI gains are concentrated in a handful of giants, as warned in the article.

- Valuation Risk: NVDA’s P/E ratio (44.28x) is significantly above the S&P 500 average (~20x), increasing downside risk if growth expectations are not met [0].

- Concentration Risk: Overexposure to a few AI-focused stocks leaves portfolios vulnerable to sector-wide corrections [4].

- Volatility: Above-average trading volumes for all three stocks indicate heightened investor uncertainty [0,1,2].

- Monitoring NVDA’s upcoming FQ3’26 earnings report can provide clarity on whether growth justifies current valuations [5].

- Event: Seeking Alpha article warns of AI bubble due to concentrated gains in NVDA, MSFT, GOOG [6].

- Market Reaction: Mixed performance with tech sector underperforming [0,1,2,3].

- Valuations: Elevated for NVDA and MSFT relative to market averages [0,1].

- Key Metrics: 60-day NASDAQ gain of 2.97% vs Russell 2000 decline of -0.49% [4].

This summary provides objective context for decision-making without prescriptive investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.