Analysis of Forbes' 'Ignored Stock Indicator' Claim: Sentiment vs Market Performance Disconnect

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

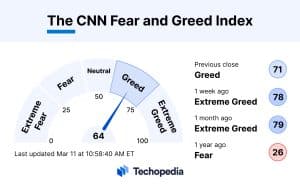

This analysis is based on the Forbes article [1] published on November 22, 2025, which claims media narratives of fear (e.g., generational conflict) are disconnected from actual market indicators. The article highlights two key points: (1) the CNN Fear & Greed Index at 11 (extreme fear) as of November 21 [2], and (2) closed-end fund (CEF) average discounts to NAV narrowing to ~5.3% (below the long-term average of ~7%). Verified data shows the S&P500 is up ~11.08% year-over-year (Nov2024-Nov2025) [0], supporting the article’s claim of a sentiment-performance disconnect. However, the article’s CEF discount claim lacks publicly available November 22 data—September 2025 sector-specific discounts (e.g., Municipal Bond funds at -4.6%, US Stock funds at -9.8%) [3] are the latest verifiable figures.

Cross-domain insights include:

- Sentiment-Performance Disconnect: Extreme fear (Fear & Greed Index 11) has not translated to negative market returns, indicating potential overreaction in media narratives.

- CEF Valuation Gap: The article’s claim of narrower CEF discounts suggests reduced value opportunities, but this requires verification with real-time data [4].

- Media Narrative Influence: The article’s critique of generational conflict narratives underscores how non-market factors can shape investor sentiment without aligning with fundamentals.

- Short-term volatility: Extreme fear levels (11) historically correlate with increased market swings [2].

- CEF valuation risk: If CEF discounts are indeed narrower than average, investors may face limited upside from discount narrowing.

Opportunities: - Contrarian plays: The sentiment-performance disconnect could present opportunities for investors willing to bet against prevailing fear.

- Sector-specific CEF value: Wider discounts in US Stock CEFs (Sept2025: -9.8%) [3] may offer selective value.

This analysis synthesizes the Forbes article’s claims with verifiable data:

- Fear & Greed Index: 11 (extreme fear) [2].

- S&P500 YoY return: +11.08% [0].

- CEF data gap: November22 average discount claim (5.3%) needs verification [1].

- Latest CEF data: September2025 sector-specific discounts vary widely [3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.