Analysis of Reddit Discussion on Market Downturn Rules & Investment Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

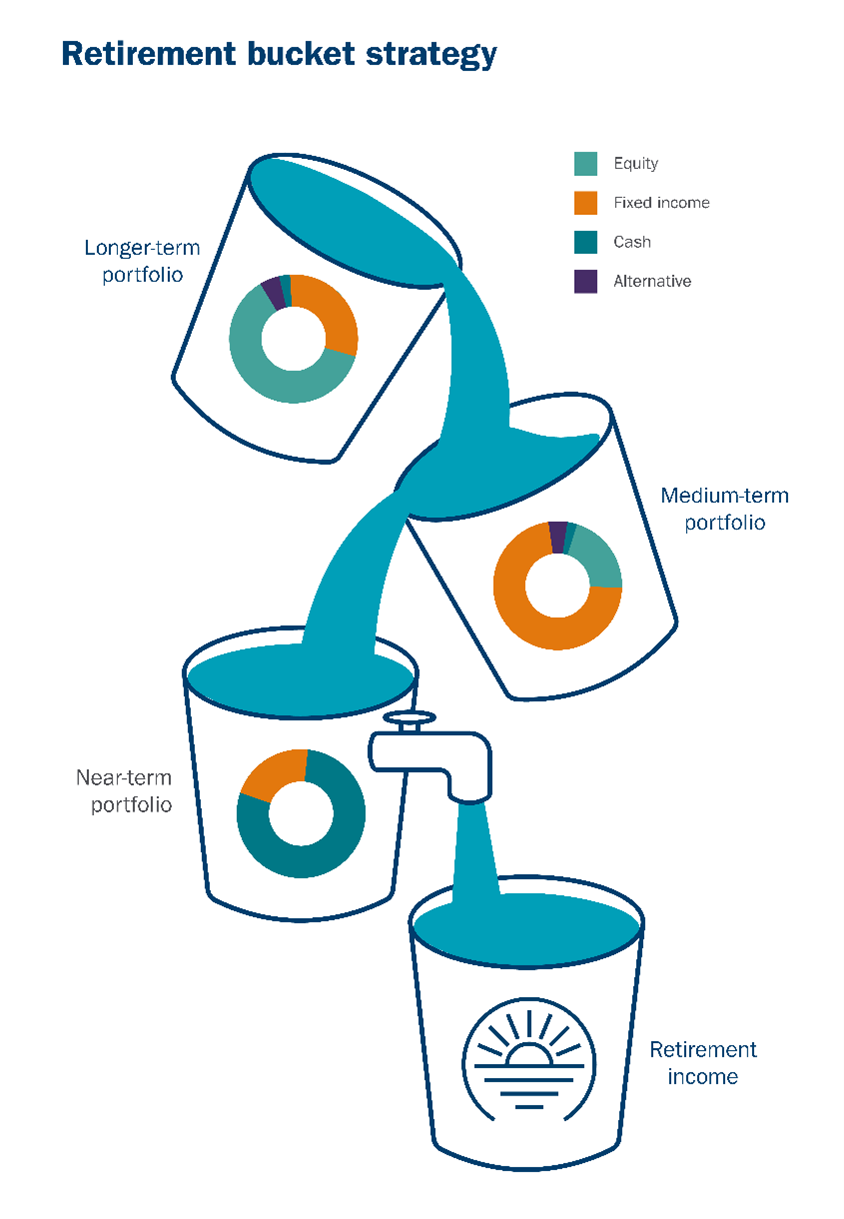

The 3-bucket strategy (short-term cash/bills, intermediate bonds, long-term equities) is designed for retirement cash flow management but underperforms fully invested allocations in terms of returns [1]. Long-term recovery focus is supported by historical data, with the S&P 500 recovering from all downturns [5]. Strategy alignment depends on individual goals—near-term needs (e.g., house purchase) benefit from liquid buckets, while long-term goals (e.g., retirement) align with growth-focused buckets [2][3]. Reddit posts as a buying signal lack empirical validation; while Reddit activity influences retail trading, it is not a reliable market reversal indicator [6][7].

- Trade-off in Bucket Strategy: Stability for cash flow management comes at the cost of lower long-term returns [1].

- Long-term Investing Validity: Historical recovery data confirms the value of ignoring short-term noise [5].

- Goal-Dependent Alignment: Personalized planning improves strategy adherence [3].

- Reddit Signal Limitations: Anecdotal claims about Reddit posts as bottom signals are not backed by empirical evidence [6][7].

- Risks: Overreliance on Reddit signals may lead to premature trading; choosing the bucket strategy for maximum returns risks underperformance [1][6].

- Opportunities: Long-term investing during downturns leverages historical recovery trends; goal-based planning optimizes strategy fit [3][5].

The 3-bucket strategy is not intended for maximum returns but for cash flow stability. Long-term investing is empirically supported, while Reddit-based signals require validation. Strategy selection should align with individual time horizons and goals.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.