Analysis: Nvidia CEO's 'No-Win' Dilemma Amid AI Bubble Concerns and Market Volatility

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

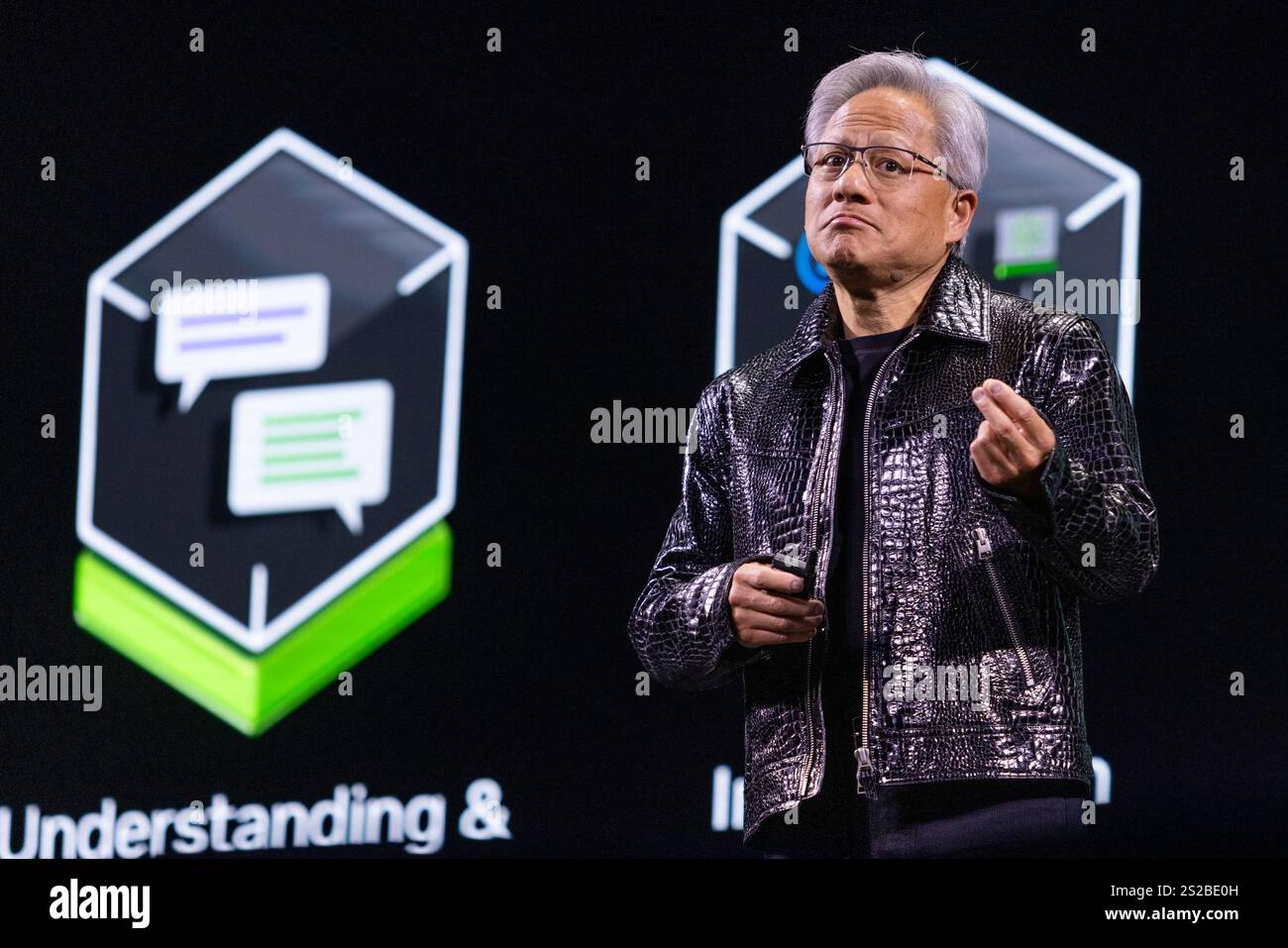

On November 21, 2025, Fortune reported Nvidia (NVDA) CEO Jensen Huang told employees in a leaked internal meeting the company faces a “no-win” market dynamic: strong results fuel AI bubble fears, while any miss would confirm them [1]. This came despite NVDA posting record earnings and guiding for $500 billion in revenue over 2025-2026.

NVDA’s stock declined 1.30% on November 21 (closing at $178.88) with high volume (346.93 million shares), following a 7.81% drop the previous day [0]. The tech sector underperformed, posting a minimal 0.146% gain—second-worst among sectors—indicating selling pressure on AI-focused stocks [0]. Healthcare (1.73% gain) and industrials (1.52% gain) outperformed, suggesting a rotation away from tech [0].

- Fundamental-Sentiment Disconnect: NVDA’s strong earnings and guidance contrast with market sell-off, driven by AI bubble narrative [1]. Huang’s comments highlight the company’s struggle to align market perception with operational performance.

- Sector Rotation: Defensive sectors outperformed tech, signaling potential investor shift from growth (AI) to defensive stocks [0].

- Volatility Signals: High trading volume (346.93M shares) on November21 indicates intense investor reaction to conflicting signals (strong fundamentals vs. bubble fears) [0].

- AI Bubble Narrative: Ongoing chatter may continue to pressure NVDA’s stock, even with strong fundamentals [1].

- Sector Rotation: Persistent shift from tech to defensive sectors could further impact NVDA’s valuation [0].

- Guidance Execution: Failure to meet $500B revenue target would amplify bubble concerns [1].

- Competition: Developments from AMD/Intel in AI chips may erode NVDA’s market share.

- If the AI bubble narrative fades, NVDA’s strong fundamentals could drive recovery (conditional, not a recommendation).

NVDA faces a “no-win” situation due to AI bubble fears, with stock declines despite record earnings. The tech sector underperformed, and defensive sectors gained, indicating rotation. Key data points: NVDA’s 1.3% drop on Nov21, high volume (346.93M), tech sector’s 0.146% gain. Info gaps include full meeting transcript, leak timing, and institutional sentiment.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.