Caixin Development (000838) Consecutive Limit-Up Analysis: Real Estate Sector Rebound Driven by Policy Support and Capital Inflows

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

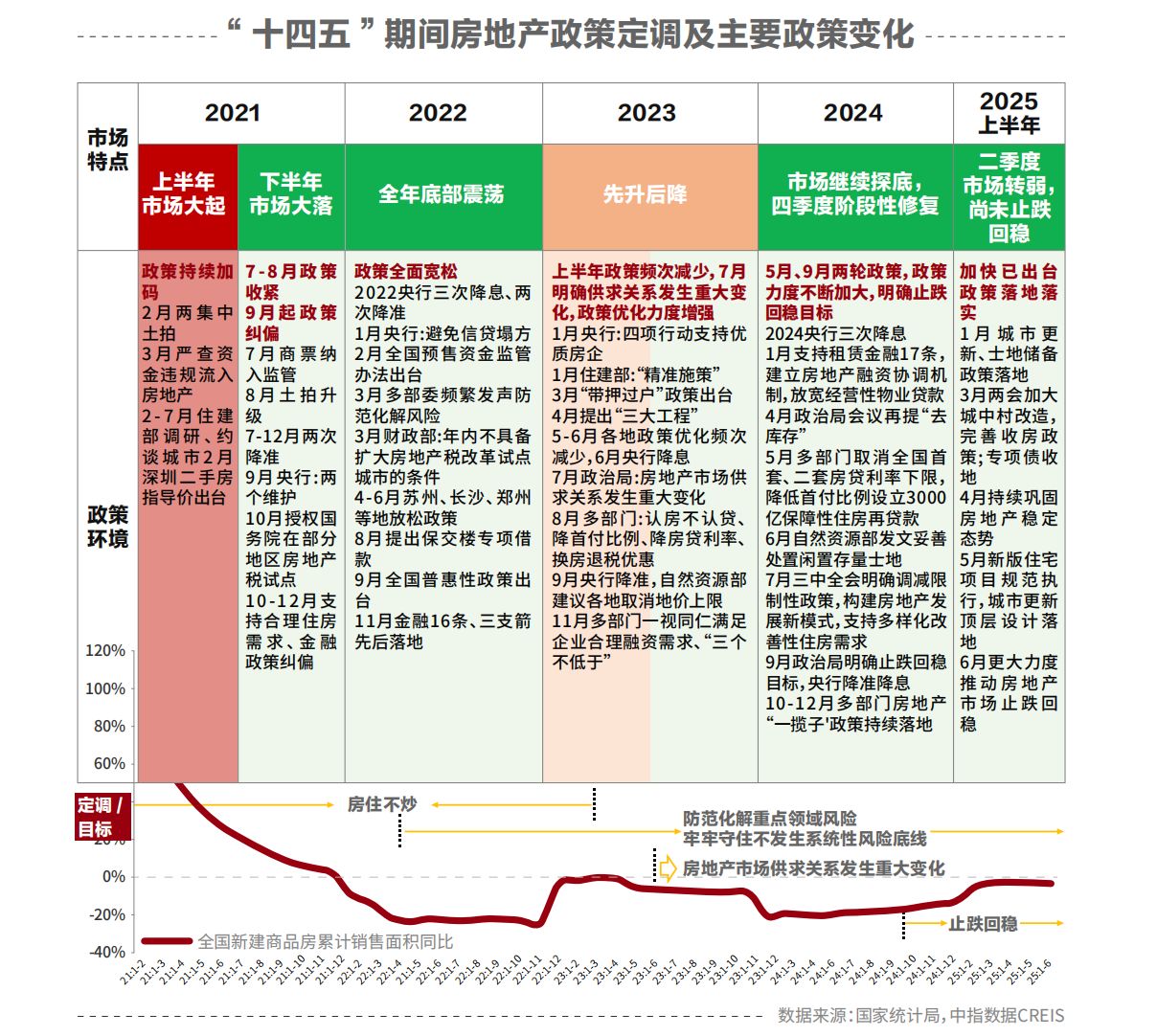

Caixin Development (000838) hit the daily limit on November 21, 2025, closing at 3.74 yuan with a 10% gain and a turnover of 660 million yuan, indicating a significant increase in market activity [1][2]. The stock has closed at the daily limit for two consecutive trading days, with a net inflow of 35.2446 million yuan from main funds, accounting for 0.89% of the circulating market value, reflecting sustained increased attention from capital [3]. Its rise is mainly driven by multiple factors: First, expectations of favorable policies for the real estate sector, including the intensive implementation of policies to lift purchase restrictions in first-tier cities such as Shenzhen’s Luohu District [4]; second, the Federal Reserve’s 25 basis point interest rate cut, which creates favorable conditions for domestic policy easing [5]; third, company-specific factors such as the progress of environmental protection technological transformation and expectations of controlling shareholder restructuring [6]. In addition, the stock is an oversold rebound; its 2024 net profit was -260 million yuan, and its previous valuation was at a relatively low level [2].

- Resonance of Policy and Capital: The relaxation of policies for the real estate sector and improved liquidity have resonated to drive the stock’s rise. The lifting of purchase restrictions in first-tier cities directly benefits real estate stocks, while expectations of Fed rate cuts have reduced external constraints on domestic policy easing [4][5].

- Oversold Rebound Characteristics: The consecutive limit-ups against the backdrop of the company’s 2024 losses indicate market expectations for its fundamental improvement, especially the expected governance optimization and resource injection from the controlling shareholder’s restructuring [6].

- Capital Flow Signal: The continuous net inflow of main funds indicates that institutional investors are optimistic about the short-term trend of the stock, but attention should be paid to the volatility risk brought by the high turnover rate [3].

- There are still uncertainties about the overall recovery of the real estate industry, and the sustainability of policy effects remains to be seen [4];

- Against the background of the company’s historical losses, the actual progress of fundamental improvement may fall short of expectations [2];

- The short-term increase is large, and there is pressure for profit-taking [1].

- If policy easing continues to intensify, the real estate sector may usher in a phased market, and the stock is expected to benefit [5];

- If the controlling shareholder’s restructuring progresses smoothly, it may bring an opportunity for the company’s value revaluation [6].

The recent consecutive limit-ups of Caixin Development (000838) are the result of the combined effects of favorable policies, capital promotion, and oversold rebound. Investors need to pay attention to the subsequent implementation of real estate policies, the progress of the company’s restructuring, and changes in market capital flows to make rational decisions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.