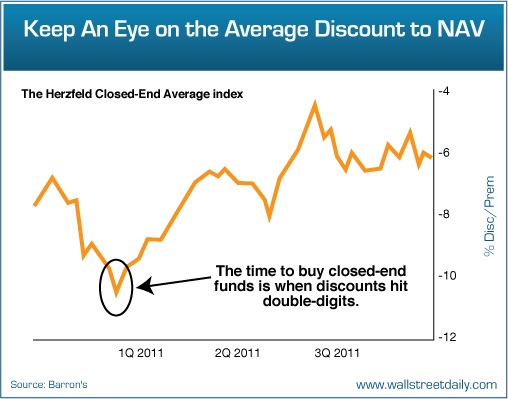

Market Analysis Report: Overlooked Indicator Signals Potential Upside (Nov 22, 2025)\n\n## Event Summary\nOn November 22, 2025, Forbes published an article highlighting an overlooked market indicator—closed-end fund (CEF) discounts to net asset value (NAV)—as a bullish signal for investors [1]. The article contrasts media-driven narratives (e.g., intergenerational conflict, AI bubble fears) with data-driven indicators to argue that current market sentiment is overly pessimistic. The author emphasizes that CEF discounts, which reflect the gap between a fund’s market price and its underlying asset value, are a reliable measure of investor sentiment often ignored by mainstream media [1].\n\n## Market Impact Analysis\n### Short-Term Impact\nThe article’s focus on CEF discounts as a buying signal may increase investor interest in CEFs, particularly those trading at wider discounts. This could lead to a narrowing of discounts in the short term as demand rises [1]. For the broader market, the contrast between extreme fear sentiment (per the CNN Fear and Greed Index) and positive year-over-year performance suggests potential for a sentiment-driven rally if investors shift from fear to greed [3].\n\n### Medium-Term Impact\nMedium-term performance will depend on whether CEF discounts continue to narrow and if the Federal Reserve follows through with expected rate cuts in Q4 2025 and H1 2026 [2]. If rates fall, preferred and municipal CEFs—already trading at attractive discounts—could see significant upside as their fixed-income holdings benefit from lower rates [2].\n\n### Sentiment Shift\nThe article challenges prevailing negative narratives by showing that:\n- First-time homebuyer ages are younger than media reports suggest (36 vs 40, per Fed data) [1]\n- CEF discounts are narrower than historical averages, indicating investors are not as bearish as media portrays [1]\n- The S&P 500 has delivered solid year-over-year returns despite fear-driven headlines [0]\n\n## Key Data Extraction\n| Metric | Value | Source |\n|--------|-------|--------|\n| Average CEF Discount to NAV (Nov 22, 2025) | ~5.3% | [1] |\n| S&P 500 Year-over-Year Change (Nov 21, 2025) | +11.08% | [0] |\n| CNN Fear and Greed Index (Nov 21, 2025) | 10.51 (Extreme Fear) | [3] |\n| Q3 2025 Traditional CEF Discount | -5.53% | [2] |\n| S&P 500 20-Day Moving Average | $6763.17 | [0] |\n| S&P 500 Current Price (Nov 21, 2025) | $6602.98 | [0] |\n\n## Context for Decision-Makers\n### Information Gaps\n- Exact sector-specific CEF discounts as of Nov 22, 2025 (broader averages are available but not sector breakdowns)\n- Latest S&P 500 price (data available up to Nov 21)\n- Investor flows into CEFs post-article publication\n\n### Multi-Perspective Analysis\n-

Bullish

: CEF discounts are near historical averages, S&P 500 is up double digits YoY, Fed rate cuts expected\n-

Bearish

: S&P 500 is below its 20-day moving average, Fear and Greed Index is at extreme fear levels, CEF discounts could widen if economic data weakens\n\n### Key Factors to Monitor\n1. Federal Reserve policy announcements (rate cuts)\n2. CEF discount trends (weekly premium/discount reports from CEFA)\n3. S&P 500 performance relative to moving averages\n4. Media narrative shifts from fear to neutral/positive\n\n## Risk Considerations\n-

Market Sentiment Risk

: Extreme fear levels could persist, leading to further market declines despite positive fundamentals [3]\n-

CEF Discount Risk

: If interest rates rise unexpectedly, CEF discounts could widen, eroding returns [2]\n-

Short-Term Price Risk

: The S&P 500 is currently trading below its 20-day moving average, indicating potential short-term weakness [0]\n-

Media Influence Risk

: Continued negative media narratives may delay a sentiment shift, prolonging market underperformance relative to fundamentals [1]\n\nUsers should be aware that market sentiment indicators like the Fear and Greed Index are backward-looking and may not predict future performance. Additionally, CEF discounts can be volatile and depend on multiple factors including interest rates, fund management quality, and investor demand.