Analysis of Fair Value Gap (FVG) Trading Strategies: Retest Dilemma & Market Context

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

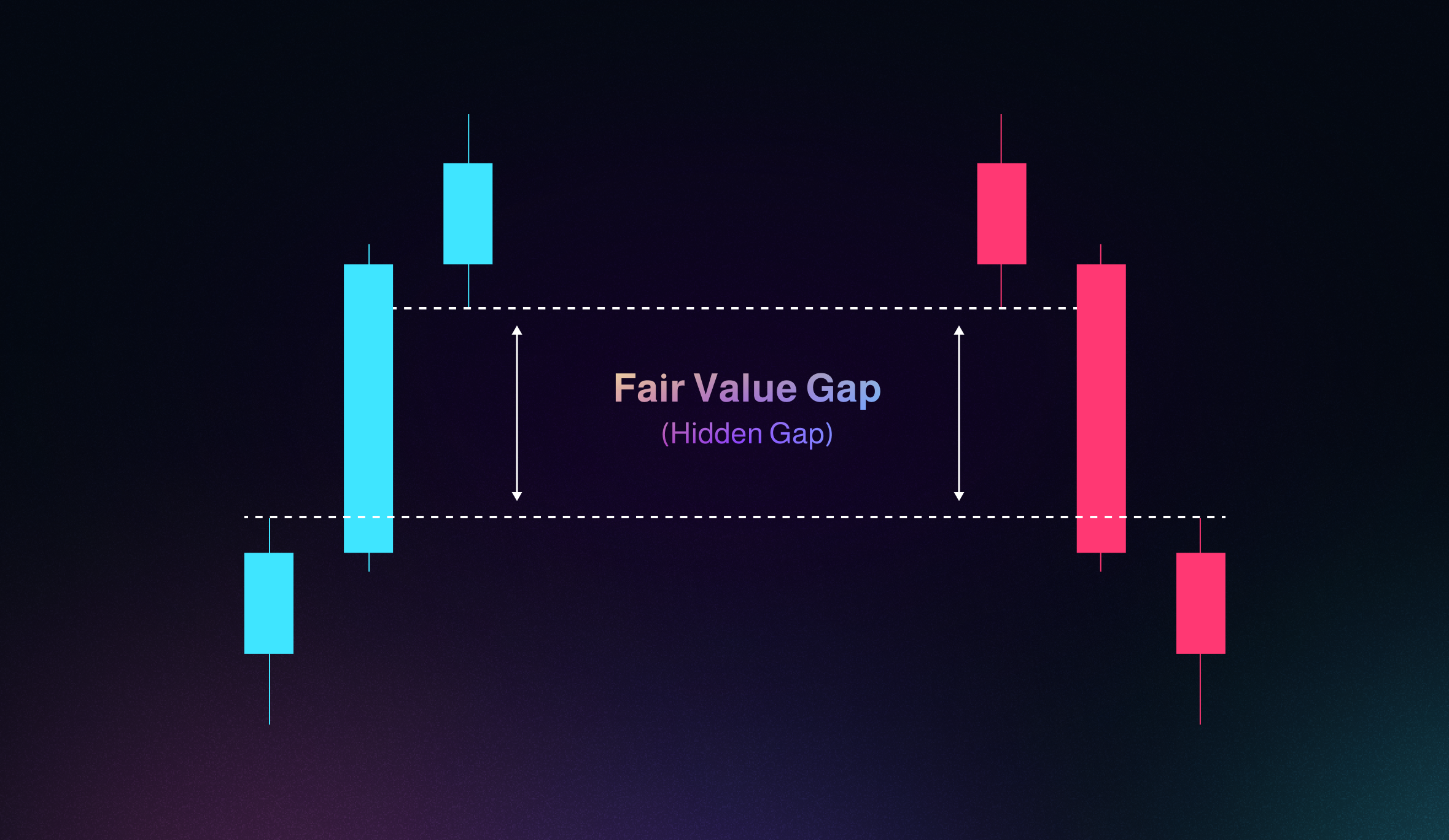

The analysis originates from a Reddit discussion [0] where traders debate waiting for Fair Value Gap (FVG) retests. FVGs are untraded price zones from impulsive three-candle moves [1][2]. Key arguments:

- Consistency over retests: Execution consistency matters more than rigidly waiting for retests [0].

- Market context impact: AI bubble nervousness reduces retests, leading to faster, unretracted moves [0][4].

- Mechanical rules: A rule-based approach (HTF bias + 1-min structure shift + confirmation) eliminates emotional decisions [0].

The AI bubble context (45% of fund managers view AI as a bubble [4]) creates volatility where retests are less frequent [0][5].

- Sentiment-strategy interaction: AI bubble nervousness directly alters FVG behavior, requiring adaptive strategies.

- Emotional risk mitigation: Mechanical rules reduce FOMO, a common pitfall when waiting for retests [0].

- Contextual flexibility: No single rule applies—traders must balance FVG signals with market conditions [0][3].

- Risks: Waiting for retests misses 1-2 continuation trades per fast leg [0]; emotional decisions lead to poor entries.

- Opportunities: Rule-based strategies capture more trades in volatile markets [0]; adapting to AI bubble sentiment aligns with current dynamics [4].

FVGs are untraded zones from impulsive moves [1]. Traders face a dilemma: wait for retests (risking missed trades) or use mechanical rules (capturing opportunities). Market context (AI bubble) reduces retests, making adaptive, rule-based strategies relevant [0][4]. Consistency in execution is prioritized over rigid retest rules [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.