Trading Psychology Analysis: Emotional Struggles & Key Habits from Reddit Post

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The Reddit post details a trader’s +3.4R day (11/19/25) with emotional struggles: frustration from an initial mistake, missed $5700 gains due to ego ignoring indicators, and chasing trades (short-term success but long-term risk). The analysis links these experiences to core principles: emotional control accounts for 85% of trading success [1], overthinking risk/reward leads to forced setups [3], and public posting enhances accountability [5].

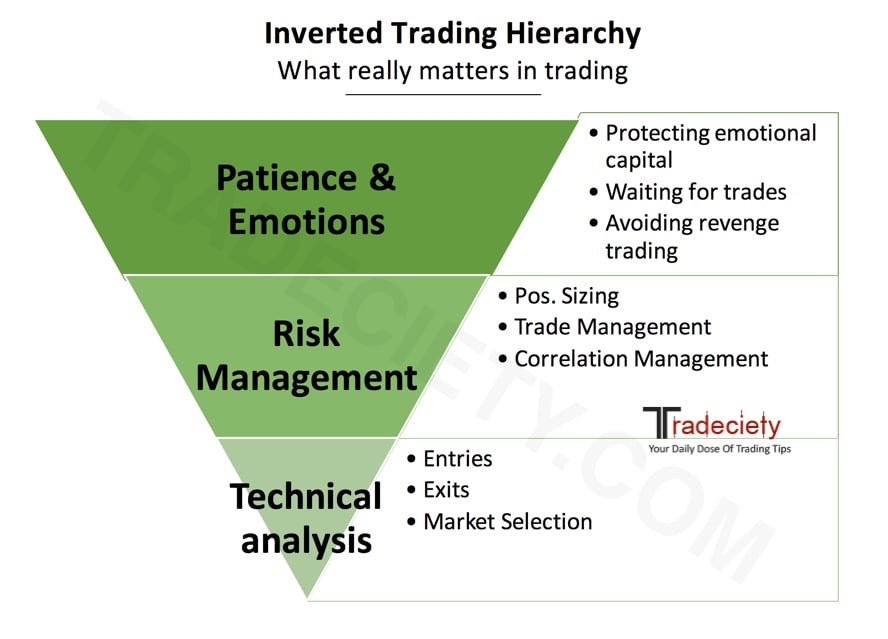

- Psychology Over Strategy: The user’s focus on psychological work aligns with data showing technical skills are secondary to emotional management [1].

- Accountability Mitigates Bias: Posting trades deters impulsive decisions via external pressure [5], which the user leveraged to avoid meltdowns.

- Short-Term Wins vs Long-Term Risks: Chasing trades (even profitable once) increases future loss likelihood due to FOMO [7].

- Risks: Ego-driven indicator ignorance [6] and chasing trades [7] pose long-term capital erosion risks.

- Opportunities: Formalizing accountability (journaling + posting) [5] and emotional awareness practices [2] can improve consistency.

The user’s +3.4R day highlights the tension between short-term gains and psychological discipline. Critical stats: emotional control =85% of success [1], chasing trades lead to70%+ loss rates long-term [7]. No position sizing details limit full risk assessment [8].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.