Analysis of Google's Aggressive AI Infrastructure Expansion Plan and Market Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

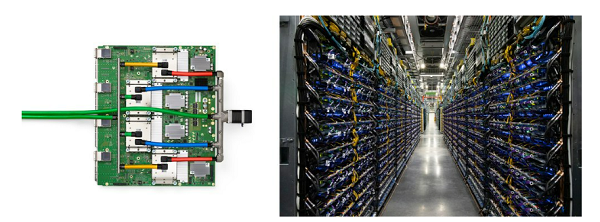

Google’s AI infrastructure head Amin Vahdat announced the company must double AI serving capacity every six months and aim for a 1000x scale in 4-5 years to meet growing demand [1][2]. This drove Alphabet (GOOGL) stock up 3.53% to $299.66 with doubled average volume [3], while Nvidia (NVDA) fell 0.97% to $178.88 due to Google’s shift to custom Tensor Processing Units (TPUs) to reduce GPU reliance [4][10]. Google’s capex plan increased 50% from $60B to $91-93B for 2025 [7], supported by strong profitability (net margin:32.23%, ROE:35% [5]). NVDA’s data center revenue accounts for 88.3% of FY2025 revenue, making it vulnerable to cloud providers’ custom chip strategies [6].

Cross-domain insights include Google’s capex representing 15% of its 2024 revenue ($629B [5]), highlighting the urgency of its AI infrastructure push. Anthropic’s commitment to 1M Google TPUs (tens of billions in revenue [8]) validates TPU’s price-performance advantage. NVDA’s high P/E ratio (43.87x [6]) and data center dependency underscore valuation risks amid custom chip adoption.

- Capex Overhang: Google’s aggressive capex expansion may erode profitability if AI demand growth slows [5][7].

- Valuation Vulnerability: NVDA’s high P/E ratio makes it sensitive to customer churn to custom chips [6].

- AI Bubble Concerns: Pichai’s warning about “elements of irrationality” in the AI market suggests potential volatility [1].

- Google’s AI Leadership: Custom TPU strategy positions Google to dominate AI infrastructure [1][8].

- TPU Market Growth: Google’s TPUs are projected to generate $3.1B in 2025 [9].

- NVDA’s Short-Term Demand: Blackwell chips are sold out through 2025, supporting near-term revenue [10].

- GOOGL: YTD return (+58.19%), 6-month gain (+75.37%), net margin (32.23% [5]).

- NVDA: Data center revenue ($115.19B FY2025 [6]), P/E ratio (43.87x [6]).

- AI Chip Market: Nvidia’s AI-related revenue expected to hit $49B in 2025 [9].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.