Genesis Mission Executive Order Analysis: Market Impact on NVDA, OKLO, and SPY

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

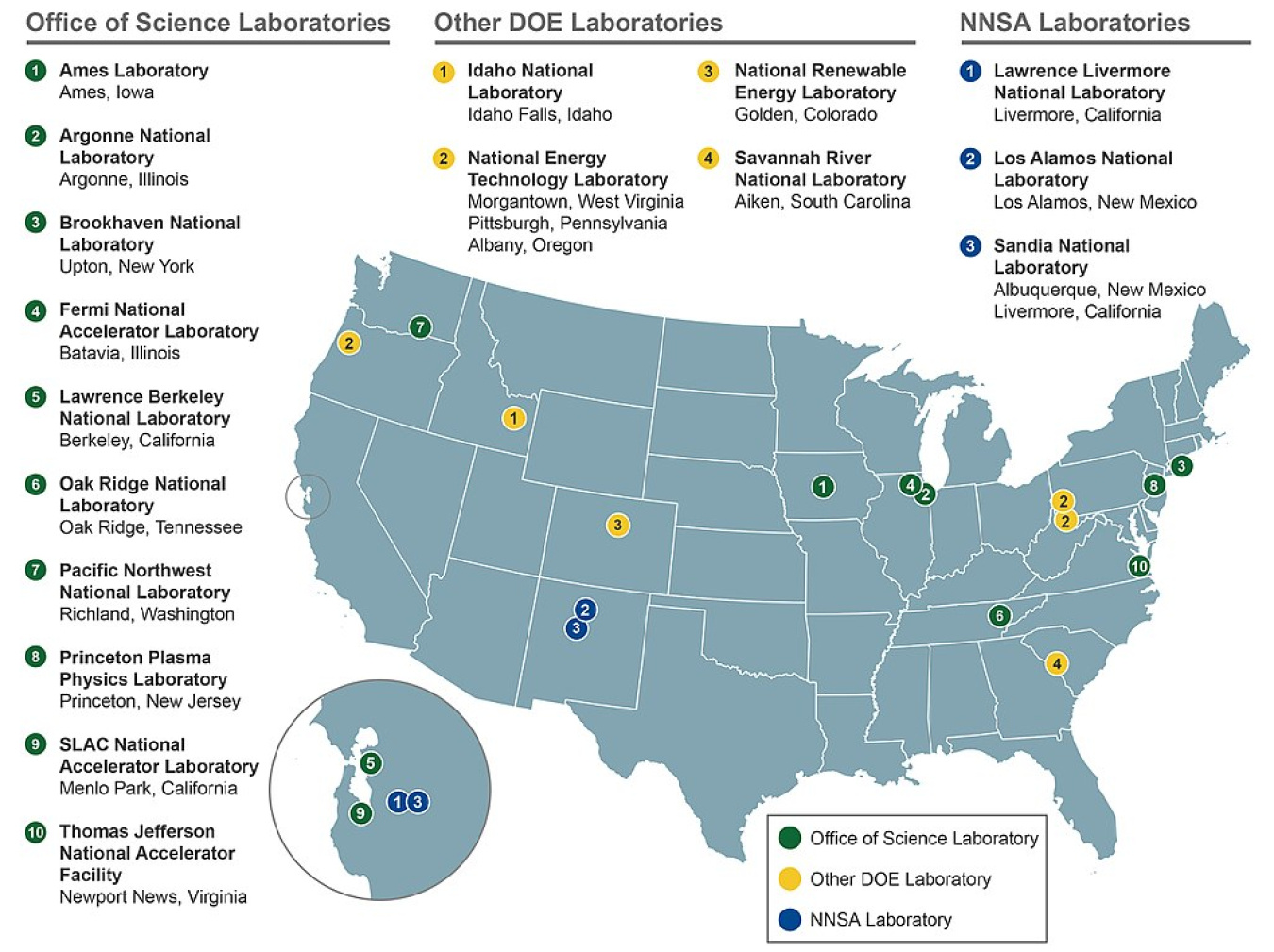

On November 22, 2025 (EST), Reddit discussions highlighted President Trump’s planned “Genesis Mission”—an executive order to accelerate U.S. AI development via a Manhattan Project-scale national effort led by the Department of Energy (DOE). The initiative aims to advance frontier AI, next-gen nuclear tech, streamline regulations, and counter global competitors, involving national labs and industry partners [8]. According to a DOE official cited by Yahoo Finance, the order will be formally announced at the White House and may direct national labs to prioritize AI research and public-private partnerships [1].

-

Short-term Impact:

- SPDR S&P 500 ETF (SPY) closed at $659.03 (+1.00%) on November 23, 2025, with volume (115.62M) exceeding its 79.02M average—indicating broad market optimism [0].

- NVIDIA (NVDA) closed at $178.88 (-0.97%) with above-average volume (343.47M vs. 192.04M avg), despite existing DOE partnerships to build seven AI supercomputers [0,5].

- Oklo Inc. (OKLO) closed at $88.17 (+0.20%) with volume (21.67M vs.19.78M avg), supported by its $1.68B Oak Ridge nuclear facility investment but no confirmed Genesis Mission link [0,2].

-

Market Sentiment:

Mixed reactions: SPY’s gain reflects general market confidence in AI policy support, while NVDA/OKLO’s muted performance suggests uncertainty about direct Genesis Mission benefits [0].

| Metric | NVDA | OKLO | SPY |

|---|---|---|---|

Price Change |

-0.97% | +0.20% | +1.00% |

Volume |

343.47M (178% of avg) | 21.67M (109% of avg) | 115.62M (146% of avg) |

Market Cap |

$4.36T | $13.78B | $679.62B |

P/E Ratio |

44.28 | -157.45 (loss-making) | 27.83 |

Source: [0]

- Directly Impacted: NVDA (AI chips), OKLO (nuclear energy), SPY (broad market).

- Related Sectors: AI, semiconductors, advanced nuclear energy, data centers.

- Supply Chain: For NVDA—chip fabrication partners; OKLO—nuclear fuel suppliers and reactor component manufacturers.

- No official confirmation of Genesis Mission-specific government chip purchases for NVDA [3,6].

- Oklo’s Oak Ridge plans are independent of Genesis (no official partnership announced) [4,5].

- Exact funding amount for Genesis Mission remains undisclosed [1,6].

- Bullish: Existing DOE-NVDA collaborations (7 supercomputers) and Oklo’s DOE partnerships suggest potential indirect benefits from Genesis [5,4].

- Bearish: OpenAI’s $13.5B H1 2025 losses raise concerns about AI sector sustainability, though White House denies federal bailout plans [3,7].

- NVDA: Unconfirmed Genesis-linked chip purchases may fail to deliver expected stock gains [3].

- OKLO: Nuclear projects face regulatory delays; Genesis Mission benefits are speculative [2,5].

- AI Sector: OpenAI’s significant losses [7] and potential bubble risks warrant caution: “Users should be aware that OpenAI’s $13.5B first-half 2025 losses may impact investor sentiment toward the broader AI sector” [7].

- Official Genesis Mission announcement details (chip purchases, funding) [1,6].

- NVDA’s DOE contract updates for Genesis-related projects [5].

- Oklo’s official involvement in Genesis Mission [4,5].

- OpenAI’s funding strategy and financial performance [3,7].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.