Eli Lilly (LLY) $1 Trillion Market Cap Analysis: Drivers, Valuation vs NVO, and Risk Factors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

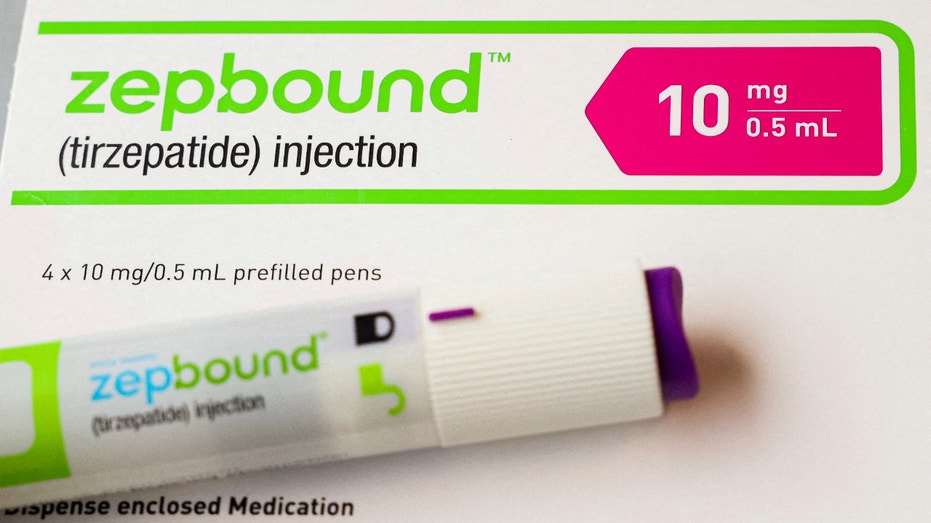

Eli Lilly (LLY) reached a $1 trillion market cap on Nov22 2025, marking a milestone as the first pharmaceutical company to achieve this feat [1]. The surge is driven by strong demand for its GLP-1 drugs Zepbound (weight loss) and Mounjaro (diabetes), with the stock rising 27.26% over the past 30 days [0]. The TrumpRx deal, which allows LLY to sell Zepbound to Medicare beneficiaries for the first time at discounted prices ($299-$449/month), is expected to expand market access significantly [5]. LLY’s valuation is premium compared to peers: its P/E ratio of 51x is four times higher than Novo Nordisk’s (NVO) 12x [2,3]. Clinical data supports LLY’s market leadership, with Mounjaro showing superior efficacy (up to 26.6% weight loss over 84 weeks vs Ozempic’s ~15%) [4].

- TrumpRx Deal Impact: The agreement unlocks a large Medicare customer base, a critical long-term growth driver for Zepbound [5].

- Valuation Disparity: The 4x gap between LLY and NVO’s P/E ratios suggests market expectations may be overextended, despite LLY’s superior drug efficacy [3].

- ROE Context: LLY’s low ROE (1.02%) is not a sign of poor performance but reflects its massive equity base ($951B market cap) [2].

- Side Effect Risks: Ongoing lawsuits for GI side effects (stomach paralysis, intestinal obstructions) require monitoring as they could impact reputation and regulatory standing [4].

- Valuation Risk: LLY’s high P/E ratio (51x) makes it vulnerable to a correction if growth slows or market sentiment shifts [2,3].

- Lawsuit Risk: Legal claims against Zepbound and Mounjaro could lead to fines, reputational damage, or increased regulatory scrutiny [4].

- Analyst Consensus Gap: The 10% difference between the current price ($1059) and analyst consensus target ($948) indicates potential overvaluation [2].

- Expanded Access: TrumpRx adoption is expected to boost Zepbound sales via Medicare access [5].

- Pipeline Growth: Orforglipron (oral GLP-1) and other pipeline drugs could further solidify LLY’s market position [5].

- Efficacy Leadership: Superior clinical results may maintain customer loyalty and market share [4].

LLY’s $1T market cap milestone is a result of strong GLP-1 drug demand and strategic deals like TrumpRx. Key metrics include a 27% 30-day gain, 36% YTD growth, and a 51x P/E ratio. The valuation gap with NVO (12x P/E) highlights market expectations for continued growth, but risks like overvaluation and lawsuits need attention. Opportunities lie in expanded access via Medicare and pipeline innovations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.