Analysis of Price Structure Formation & Smart Money Concepts for XAUUSD Trading

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

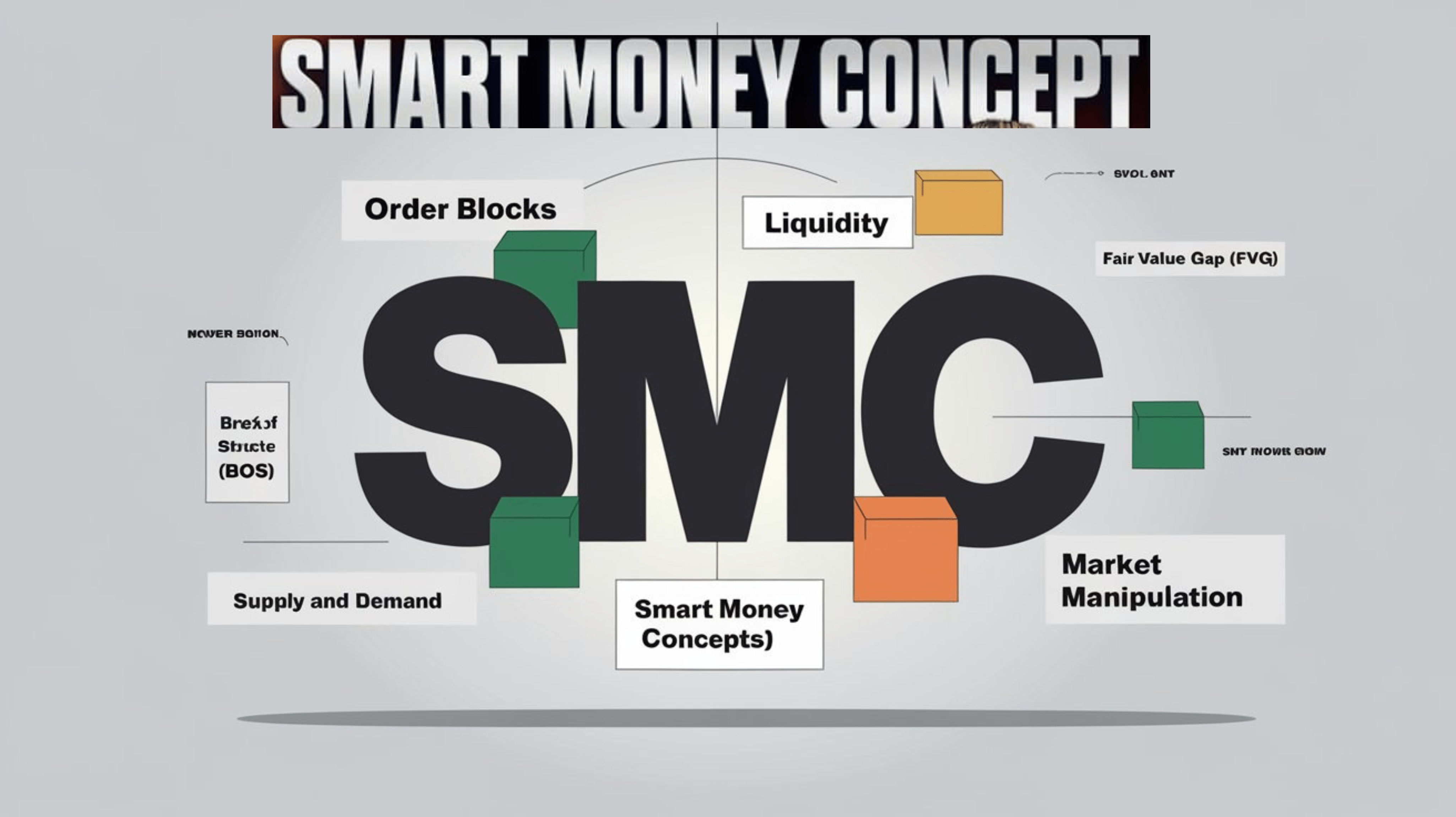

Price structure formation in XAUUSD is driven by institutional behavior targeting liquidity pools (stop-losses at swing highs/lows) [3]. Liquidity sweeps occur when price breaks key levels to trigger stops, then reverses—confirming order blocks (zones where institutions entered positions) [2,4]. Fair value gaps (price imbalances) act as retracement magnets, enhancing order block entries [5]. XAUUSD’s high volatility makes these structures more visible, ideal for SMC [3,6].

- Confluence of structure elements (liquidity sweep + order block + fair value gap) reduces random entries and tightens risk [1,5].

- Higher timeframes (daily/weekly) define market direction; lower timeframes (30min/1h) provide execution precision [1].

- SMC aligns with smart money behavior, which dominates gold markets, leading to higher-probability trades [3].

- Indicators are lagging and should be replaced with structure-based filters for volatile assets like XAUUSD [4].

- Risks: Lack of long-term empirical data comparing SMC vs indicator-based strategies; need for rigorous backtesting to validate performance.

- Opportunities: SMC’s effectiveness in volatile markets like XAUUSD offers traders an alternative to lagging indicators.

Smart Money Concepts (SMC) is a viable approach for XAUUSD trading, focusing on liquidity sweeps, order blocks, and fair value gaps. This method reduces random entries and tightens risk but requires careful application and backtesting. No empirical data exists to confirm long-term superiority over indicator-based strategies, so traders should exercise caution and validate with historical data.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.