Community Discussion Analysis: XAUUSD Price Structure Trading vs Technical Indicators

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

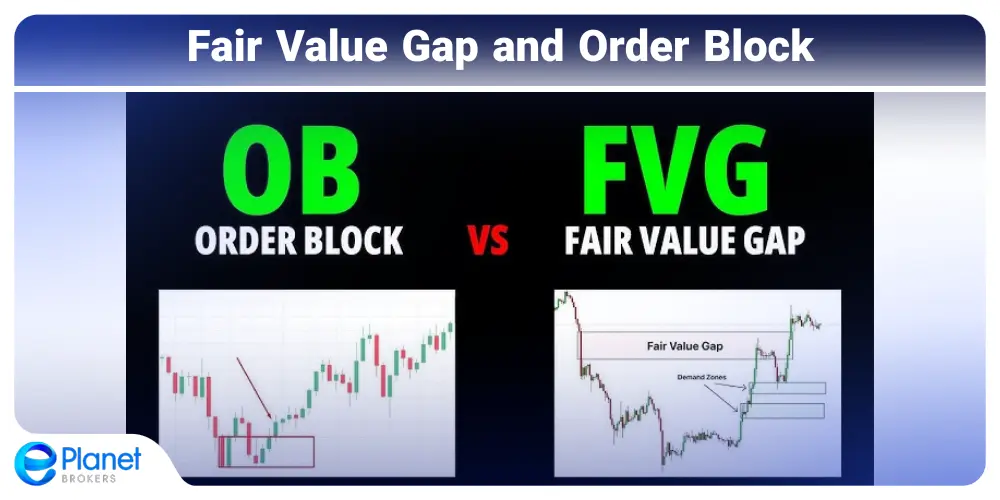

The event is a community discussion (Reddit/X, [0]) where traders advocate for structure-based trading for XAUUSD, emphasizing liquidity sweeps, break of structure (BOS), fair value gaps (FVG), and order blocks over lagging technical indicators like RSI or MACD. Market impact analysis reveals a sentiment shift among retail traders toward these “smart money” concepts, supported by TradingView data showing structure-based setups for XAUUSD [1]. On Nov22,2025, XAUUSD traded in a33.6-point range (4055 low to4088.6 high), closing at4066.0 (down0.53% from open) [3]. This range aligns with community-identified liquidity zones at4000-4100 [1]. ICT concepts are gaining traction in gold trading, though traders warn against “cultishness” around terminology [2].

- Sentiment Shift: Retail traders are moving from indicator-dependent strategies to structure-based approaches for XAUUSD, citing reduced random entries and tighter risk [0].

- ICT Relevance: ICT concepts (e.g., liquidity sweeps) are applicable to gold futures, as observed by traders [0][2].

- Range-Bound Alignment: Nov22 XAUUSD price action (narrow range) supports structure-based trading, where key levels (4000 support,4100 resistance) are critical [1][3].

- Fundamental Override: Structure-based trading may ignore market-moving fundamentals (e.g., Fed policy, geopolitics) that can break technical zones [1][3].

- Overfitting: Traders risk over-relying on past structure patterns that may not repeat in volatile markets [0].

- Indicator Exclusion: Ignoring indicators like RSI entirely may increase false positives, as they can filter misleading structure signals [0][1].

- Tighter Risk Management: Structure-based strategies can help traders identify precise entry/exit points, reducing risk exposure [0].

- ICT Adoption: Applying validated ICT concepts (without cultishness) may improve XAUUSD trading outcomes [2].

The discussion underscores a growing preference for structure-based trading (liquidity sweeps, BOS, FVG) over lagging indicators for XAUUSD. Nov22 price data shows a narrow range aligning with community-identified liquidity zones. Traders should balance structure-based approaches with fundamental analysis and indicator filters to mitigate risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.