2025 Market Trends & Reddit-Discussed Microcaps: AI,新能源, and Risk-Opportunity Insights

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

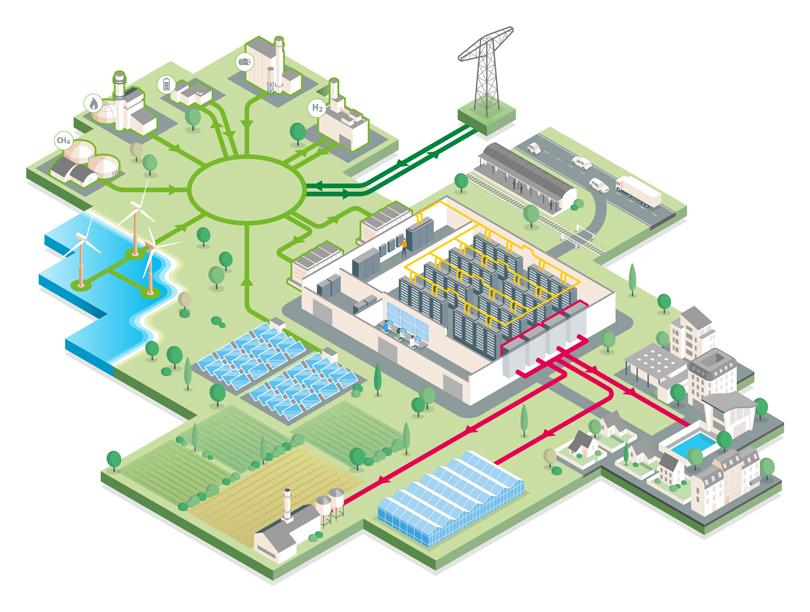

The 2025 global market is characterized by AI as the core investment主线 (main line), covering storage chips,算力 infrastructure, and applications [0,1].新能源板块 has revived due to AI’s growing power demand [0], while industrial metals benefit from supply constraints and economic recovery expectations [0]. In parallel, Reddit discussions focus on microcap stocks like VIVK, NFE, and BLG:

- VIVK: Users claim it’s being manipulated (pinned price, tight range) for accumulation before a potential run, with supporting financial improvements (debt payoff, margin increase, new plant coming online) [0].

- NFE: Alleged to have trapped bagholders via off-hours bad news dumps, with users attempting to pump it for exit [0].

- BLG: Suggested as an acquisition target despite skepticism [0].

These microcap dynamics contrast with the large-cap focused trends in institutional reports, reflecting a dual market structure in 2025 [1,9].

- Dual Market Structure: The 2025 market shows a split between AI-driven large-cap trends and microcap stock behaviors (manipulation, traps), highlighting diverse investor strategies [0,1].

- Microcap vs Institutional Alignment: VIVK’s improved financials align with broader market recovery expectations, while NFE’s trap underscores small-cap risks [0,7].

- AI’s Spillover Effects: The AI-driven revival of新能源 and industrial metals creates cross-sector opportunities beyond tech [0,4].

- Risks: NFE’s bagholder trap (high Reddit score), manipulation risks in VIVK, and uncertainty in BLG’s acquisition claims [0].

- Opportunities: AI产业链 (storage chips,算力, applications [1,9]),新能源 storage (AI power demand [0]), industrial metals (supply constraints [0]), and potential run in VIVK (if manipulation claims hold).

- Market Context: According to 十大券商一周策略 [1], the market is waiting for a turn with slow bull expectations unchanged, so investors should balance risk and opportunity.

- 2025 Trends: AI as core,新能源 revival, industrial metals strength, tech-cycle rotation [0,1].

- Reddit Stocks: VIVK (manipulation + financial improvements), NFE (bagholder trap), BLG (acquisition target).

- Sources: Combine internal analysis [0] with external reports [1-9] for a comprehensive view.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.