Analysis of Google's 1000x AI Capacity Expansion Plan & Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 22, 2025, a Reddit post [1] revealed Google’s AI Infrastructure Head Amin Vahdat’s plan to double AI serving capacity every six months to achieve a

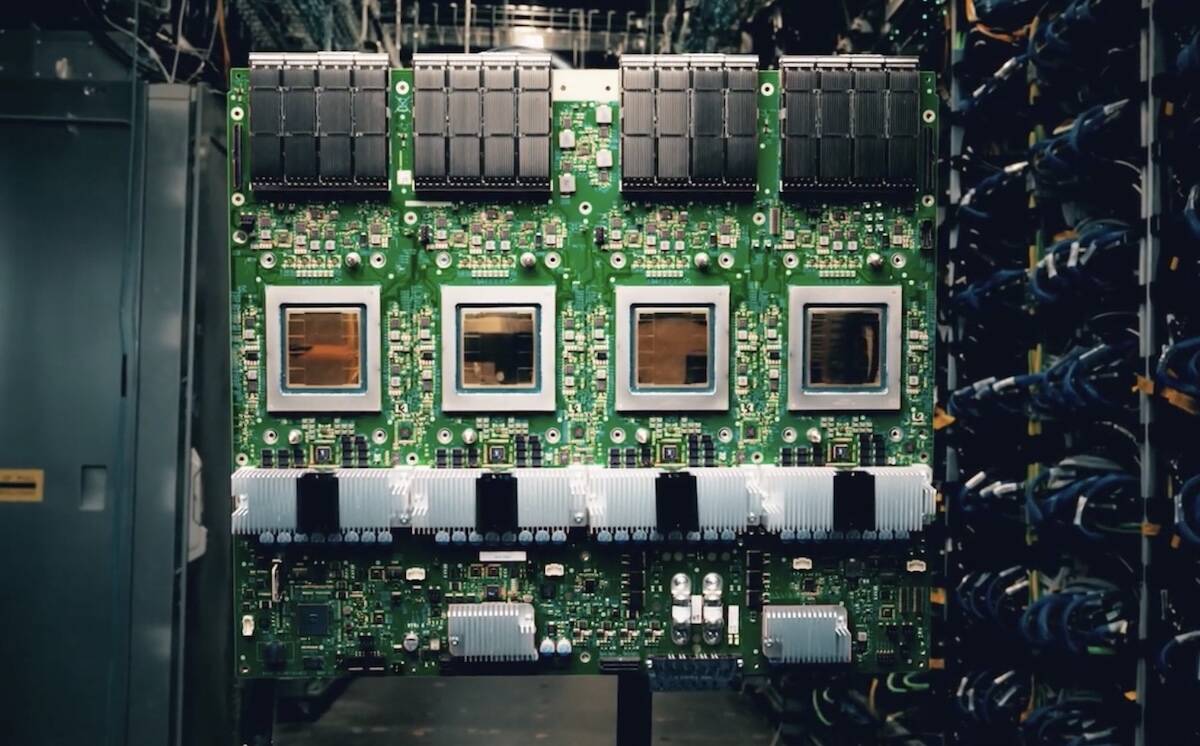

Google will leverage custom Ironwood TPUs (7th-gen) to reduce Nvidia GPU reliance [3], validated by Anthropic’s plan to use up to 1M Ironwood TPUs [0]. Market impacts: GOOGL closed at $299.66 (+1.09% Nov21 [0]), NVDA fell 1.3% [0], and the tech sector underperformed with a 0.146% gain [0].

- TPU Strategy Differentiator: Ironwood TPUs balance Nvidia dependence (80% AI chip market share [5]) and AI workload optimization.

- CapEx-Growth Tradeoff: 2025 CapEx target ($91-93B [0]) aligns with Google Cloud’s $155B backlog (46% QoQ [0]).

- Long-Term Demand Validation: The 1000x plan contradicts bubble fears, reflecting industry-wide AI investment confidence [1].

- CapEx Pressure: 7% YoY Q3 CapEx growth [0] may compress margins if AI revenue lags.

- Execution Risk: Aggressive capacity targets could lead to delays/cost overruns [2].

- Competitive Threat: Nvidia’s ecosystem dominance limits TPU market share gains [5].

- Cloud Growth: >200% YoY AI revenue growth [0] supports infrastructure investments.

- TPU Ecosystem: Third-party adoption (Anthropic’s 1M TPUs [0]) drives optimization.

- AI Leadership: Successful execution solidifies Google’s infrastructure position.

- Financial Metrics: Q3 2025 revenue ($102.3B [0]), cloud margin (23.7% [0]), AI tokens (1.3T monthly [0]).

- Investment: 2025 CapEx ($91-93B [0]), Ironwood TPUs [3].

- Market Impact: GOOGL (+1.09% Nov21 [0]), NVDA (-1.3% Nov21 [0]).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.