Analysis of Reddit Portfolio Discussion: High-Growth Stocks & Risk Considerations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

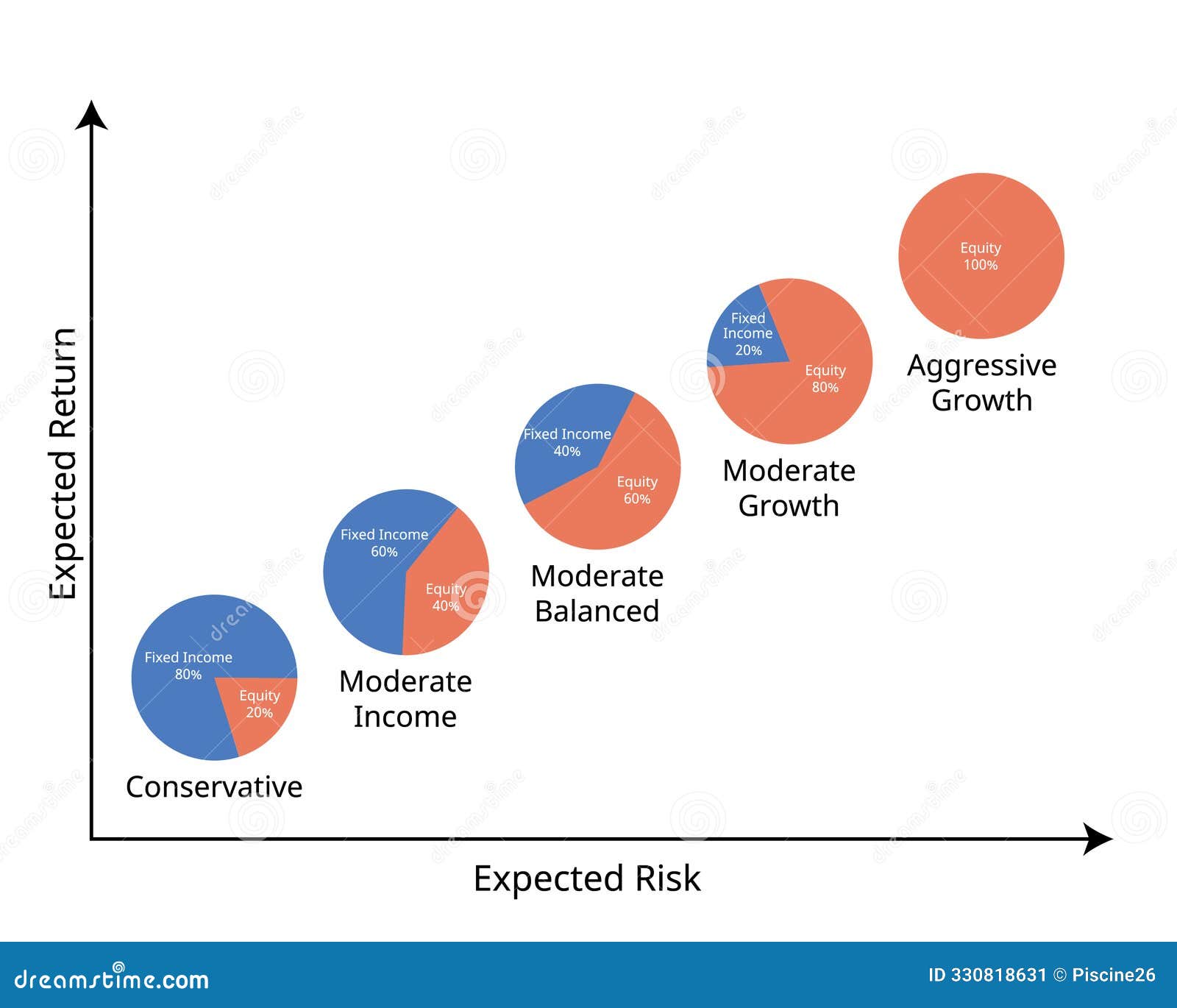

The Reddit user’s portfolio allocates 40% to high-growth stocks (AUR, CCCX, IOVA, LRN) alongside blue chips (SPY, GOOG, MSFT, AMZN, META). Market data [0] shows mixed performance: LRN dropped ~7% (Nov3-21) post-buyback [2] but faced a 49% plunge due to platform failure and legal probes [3]; AUR declined 27.7% amid profitability concerns [4]; CCCX fell 30.8% due to SPAC merger uncertainty with Infleqtion [7]; IOVA gained 4.19% but had high volatility (8.7% daily std dev) [0]. Financial metrics [0] highlight risks: AUR’s extreme net loss (-40150%), IOVA’s negative margin (-161.44%), and CCCX’s lack of revenue.

Cross-domain correlations include: (1) LRN’s operational issues (edtech) overshadowing its buyback program; (2) SPAC merger uncertainty (CCCX) impacting quantum computing sector sentiment; (3) The user’s 40% high-growth allocation aligns with bearish discussion points on speculative stocks (citing past 90% losses). Deeper implications: Unprofitable high-growth stocks (AUR, IOVA, CCCX) carry significant risk despite user rationales (e.g., AUR’s 2027 profitability target).

- AUR: Extreme net loss (-40150%) and steep price decline indicate high operational risk [0,4].

- LRN: Platform failure leading to legal probes raises operational stability concerns [3], offsetting its buyback [2].

- CCCX: SPAC merger with Infleqtion is subject to regulatory approval, introducing valuation uncertainty [7].

- IOVA: High volatility (8.7% daily std dev) and negative margins pose cash burn risk [0].

- LRN: Low PE (9x) and $500M buyback program offer potential upside if operational issues resolve [0,2].

- IOVA: FDA-approved TIL therapy (lifileucel) provides a competitive edge [6].

The portfolio’s 40% allocation to high-growth stocks includes mixed-outlook assets: LRN has solid fundamentals but operational challenges; AUR faces extreme losses; CCCX has merger uncertainty; IOVA has approved therapy but volatility. Decision-makers should monitor: (1) LRN’s legal resolution and enrollment recovery; (2) CCCX’s merger approval [7]; (3) AUR’s fleet scaling timeline [4]; (4) IOVA’s sales growth of lifileucel [6]. No investment recommendations are provided.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.