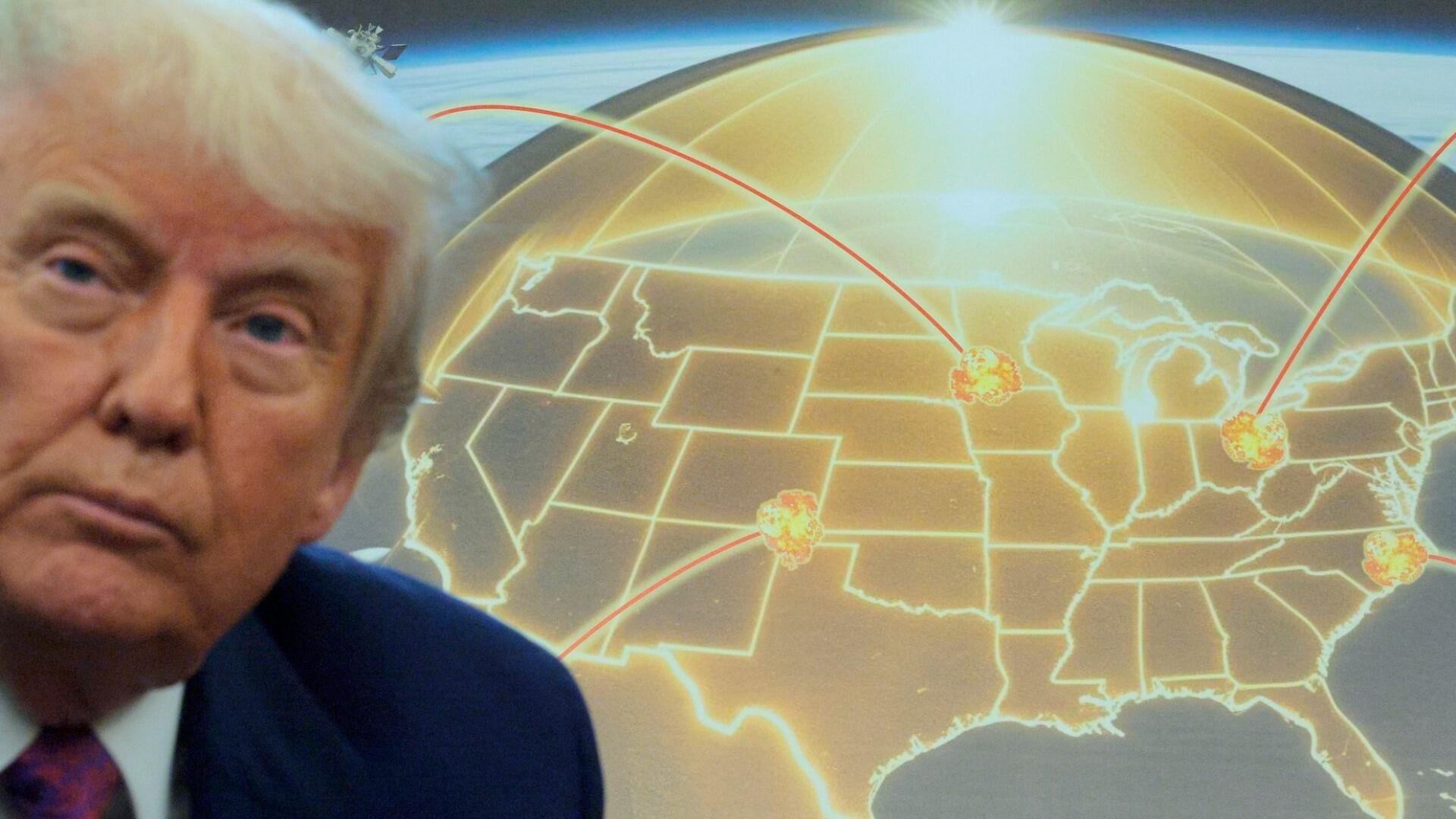

Analysis of Trump's Genesis Mission: Market Impact on AI and Nuclear Technology Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Genesis Mission, a $500B DOE-led initiative framed as a Manhattan Project-like effort to advance U.S. AI and next-gen nuclear tech, integrates public-private partnerships and regulatory streamlining [1][2][3]. For NVIDIA (NVDA), the initiative builds on an existing $500B DOE deal to supply Blackwell chips for 7 AI supercomputers, ensuring long-term revenue visibility [4][5]. Oklo (OKLO) benefits from DOE partnerships (Advanced Nuclear Fuel Line Pilot Projects) but faces execution risks due to Q3 2025 EPS miss (-$0.20 vs forecast -$0.13) [6][7]. OpenAI’s CFO mentioned potential government loan guarantees, signaling possible future funding support under the mission [8][9].

- Cross-Domain Integration: The mission links AI (NVDA) and nuclear tech (OKLO), creating synergies for energy-efficient computing and fusion research.

- Regulatory Shift: Plans to override state AI rules may accelerate national AI deployment but risk legal challenges [2].

- Geopolitical Alignment: The initiative counters global AI competitors, aligning with NVDA’s Saudi Arabia deal (though subject to scrutiny) [2].

- OKLO’s financial performance: Q3 EPS miss and $36.3M operating loss may impact stock [7].

- OpenAI’s dependency: Loan guarantee discussions raise concerns if revenue growth slows [8][9].

- Regulatory uncertainty: State rule preemption could delay mission implementation [2].

- NVDA’s long-term revenue: $500B DOE deal represents 3x 2024 revenue, driving sustained growth [4][5].

- OKLO’s upside: Analyst target of $106 (20% upside from current $88) reflects confidence in DOE-backed projects [7].

Critical metrics include:

- Genesis Mission total investment: $500B [1][3].

- NVDA-DOE deal size: $500B [4][5].

- OKLO Q3 EPS: -$0.20, cash reserves: $1.2B, analyst target: $106 [7].

- OpenAI annualized revenue: $20B [9].

All data is as of November 24, 2025, with sources cited for verification.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.