Century Therapeutics (IPSC) Analysis: Pipeline Catalysts, Market Sentiment, and Growth Potential

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

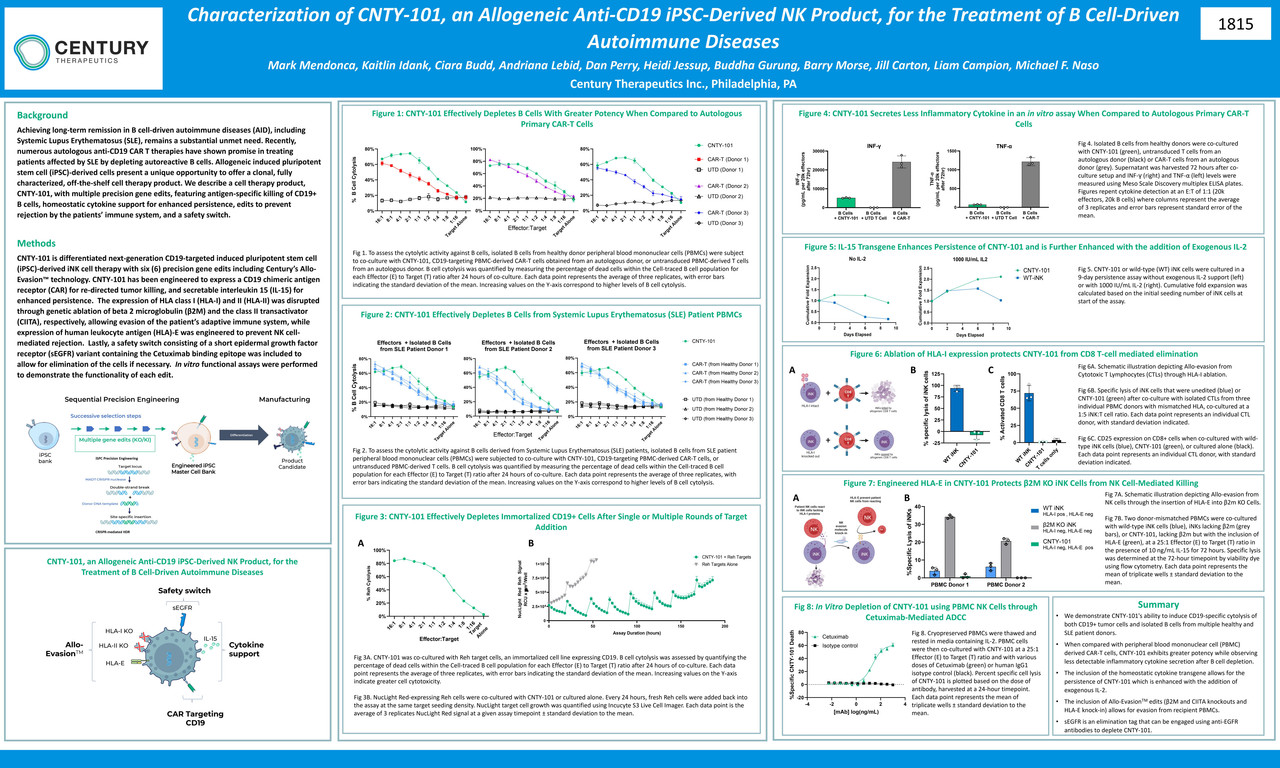

Century Therapeutics (IPSC) is a biotech firm specializing in induced pluripotent stem cell (iPSC)-derived therapies, with recent focus on pipeline re-prioritization and clinical trial advancements [0,2]. The company’s lead candidate, CNTY-101, entered Phase 1 CALiPSO-1 trial in March 2025 for B-cell mediated autoimmune diseases, with data expected by end of 2025 [0,1]. This trial, along with strategic pipeline focus on four key programs (including CNTY-101 and CNTY-308), aligns with the growing iPSC market projected to reach $4.36B by 2027 [0].

The company’s financial position includes a strong cash runway extending into Q4 2026 [0], supporting pipeline development. However, IPSC has experienced significant stock volatility in 2025: recent decline of -61.1% from peaks, though technical analysis suggests oversold conditions and potential rebound to $9 from current ~$4.97 levels [0]. Market capitalization stands at ~$42-47M [0], positioning it as a small-cap player in the pharma sector.

- The Reddit community’s positive sentiment toward IPSC’s potential T1D cure aligns with the company’s pipeline focus on autoimmune diseases, though the lead trial for CNTY-101 targets B-cell mediated conditions (not explicitly T1D yet) [0,4].

- Technical indicators showing oversold conditions [0] combined with upcoming clinical data (end of 2025) create a potential near-term catalyst window [0,1].

- Pipeline re-prioritization (March 2025) has streamlined resources to high-impact programs, which may improve operational efficiency [0,2].

- Risks: Persistent earnings losses [3], recent stock decline (-61.1%) [0], and competitive pressure in the biotech sector [0]. Investors should note the high volatility inherent in small-cap biotech stocks with early-stage pipelines [0,3].

- Opportunities: Growing iPSC market (CAGR ~10% 2022-2027) [0], potential rebound from oversold levels [0], and upcoming clinical data catalyst for CNTY-101 [0,1]. The company’s European expansion (CTA authorizations in Germany, France, Italy) opens new markets for trial enrollment [0].

Century Therapeutics (IPSC) is a small-cap biotech firm focused on iPSC-derived therapies. Key highlights include:

- Lead candidate CNTY-101 in Phase 1 trial (data expected end-2025) [0,1].

- Cash runway extending to Q4-2026 [0].

- Market cap ~$42-47M [0].

- Recent stock decline (-61.1%) but technical signals of potential rebound [0].

- Pipeline re-prioritization to four core programs [0,2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.