Century Therapeutics (IPSC) Type 1 Diabetes Cell Therapy: Market Potential and Investor Sentiment Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

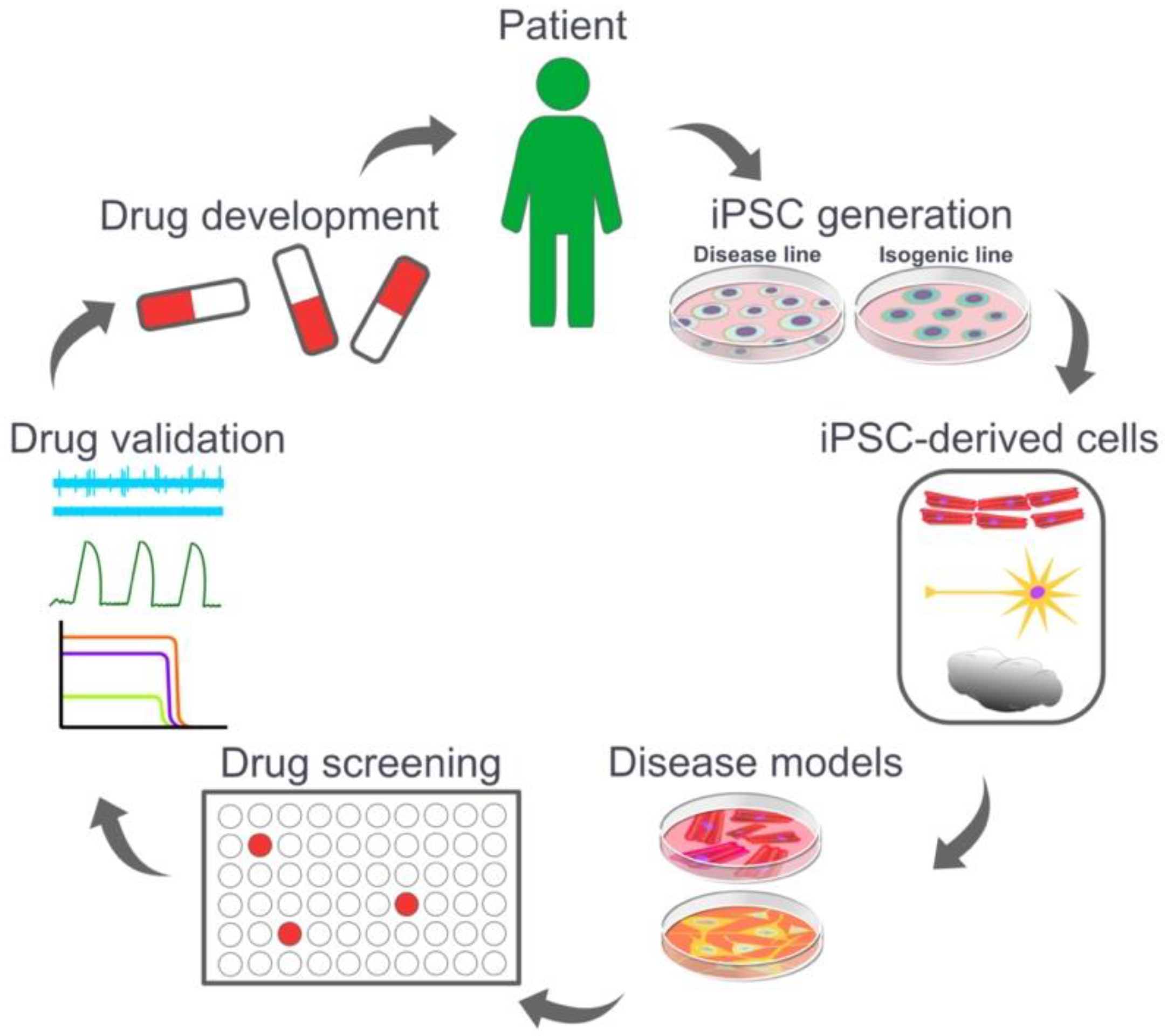

Century Therapeutics (IPSC) has emerged as a focal point in the biotech sector due to its innovative Type1 Diabetes (T1D) cell therapy using induced Pluripotent Stem Cell (iPSC) technology with immune-evasion features [1]. The company’s therapy aims to restore natural insulin production, addressing a high unmet need in T1D treatment [1]. Reddit investors express strong positive sentiment, citing potential upside (1500x-4000x) and limited downside (trading below cash) [0].

Market context supports this interest: the global iPSC market is projected to grow from $33B (2024) to $52.9B (2029) at a CAGR of9.6% [2], while the broader biotech sector is experiencing robust growth—恒生生物技术指数 rose104.6% in2025, and the global biotech market is expected to grow at12.9% CAGR (2025-2030) to $3.93T [5]. Century Therapeutics, with a market cap of ~$47M and stock price of $0.54 (2025), is positioned within this growing landscape [0].

- Valuation-Sentiment Gap: Reddit investor optimism (upside claims) aligns with expanding iPSC/biotech markets, suggesting a potential disconnect between current valuation (below cash) and perceived long-term value.

- Differentiating Technology: The company’s immune-evasion tech (from Chad Cowan) could be a competitive edge in the cell therapy space [0].

- Sector Tailwind: Strong 2025 biotech sector performance may benefit small-cap players like IPSC, though clinical trial outcomes remain critical.

- Clinical trial uncertainty: Biotech therapies face high failure rates in development [0].

- Volatility: Small market cap ($47M) makes IPSC susceptible to price swings [0].

- Competition: Other iPSC and T1D players may pose challenges [3].

- T1D therapy potential: A successful cure could capture significant market share [1].

- Sector growth: Projected biotech expansion provides a favorable environment [5].

- Valuation buffer: Trading below cash may limit downside risk [0].

Century Therapeutics (IPSC) is a small-cap biotech company focusing on iPSC-derived immune-evasive cell therapy for Type1 Diabetes. Reddit investors express positive sentiment, citing upside potential and limited downside. The global iPSC market grows at9.6% CAGR, and the biotech sector expands rapidly. Current market cap is ~$47M with a $0.54 stock price (2025). While opportunities exist in T1D and sector growth, clinical trial risks and volatility are important considerations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.