NVDA Chip Obsolescence Debate & AI Sector Sustainability Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The event stems from a Reddit discussion [6] on November22,2025, focusing on NVDA chip obsolescence and AI sector implications. Key concerns: AI cost underreporting via extended depreciation, unsustainable yearly capex, AI bubble risks [6]. NVDA’s stock:7.81% drop Nov20,1.30% Nov21 [0]; tech sector gained 0.146% Nov22 (lagged others) [0].

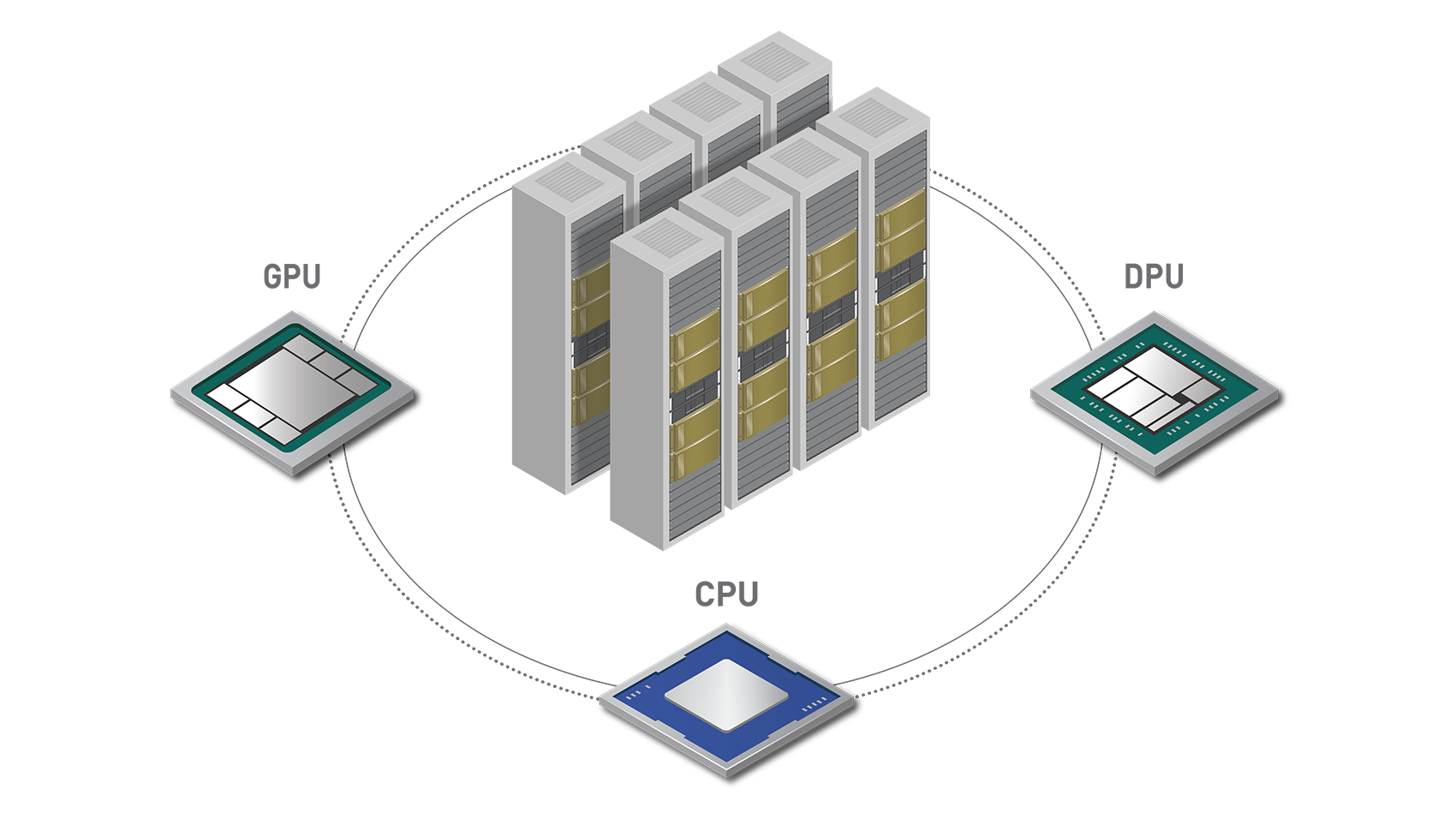

NVDA’s exposure: data center revenue 88.3% of FY2025 total [0]. Core debate: chip depreciation (2-6 year schedules [1,2]). Michael Burry argues for2-year obsolescence [3]; CoreWeave CEO claims older chips retain95% value for non-frontier workloads [1]. NVDA cites $500B Blackwell/Rubin revenue visibility [4].

- Cross-Domain Impact: Obsolescence concerns link NVDA revenue to AI firms’ cost structures—extended depreciation may mask profitability issues [6].

- Valuation Sensitivity: NVDA’s43.87x P/E (above industry avg ~20x) [0] amplifies risk if demand weakens.

- Dual Narrative: Bull (older chips’ utility [1], NVDA revenue visibility [4]) vs bear (obsolescence risks [3], high P/E [0]) views shape sentiment.

- Valuation Risk: High P/E leaves limited room for demand disappointments [0].

- Demand Sustainability: Faster obsolescence could trigger $1T+ AI infrastructure write-downs [1].

- Regulatory Scrutiny: Potential investigation of AI depreciation practices [5].

Opportunities: - NVDA’s $500B Blackwell/Rubin revenue visibility [4].

- Older chips’ utility for non-frontier workloads [1].

NVDA’s volatility reflects obsolescence concerns; data center revenue dominance (88.3%) [0] and high P/E (43.87x) [0] increase sensitivity. Depreciation debate (2-6 years [1,2]) impacts AI profitability and NVDA demand. Analyst consensus target: $250 (+39.8% upside) [0], but3 sell ratings highlight分歧 [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.