Analysis of Pinming Technology (688109) Strong Performance: Drivers and Sustainability Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Pinming Technology (688109) is a STAR Market company focusing on digital construction technology in the construction industry [5]. Its stock price has performed strongly recently, with a cumulative increase of 558.17% this year and a 291.64% increase in the past 60 days [0]. The driving factors include:

- Performance Outbreak: Net profit for January-September 2025 was 48.43 million yuan, a year-on-year increase of 267.42%, far exceeding revenue growth [0][3].

- Policy Dividends: National intelligent construction policies promote digital transformation of the construction industry, and BIM technology is supported [0][4].

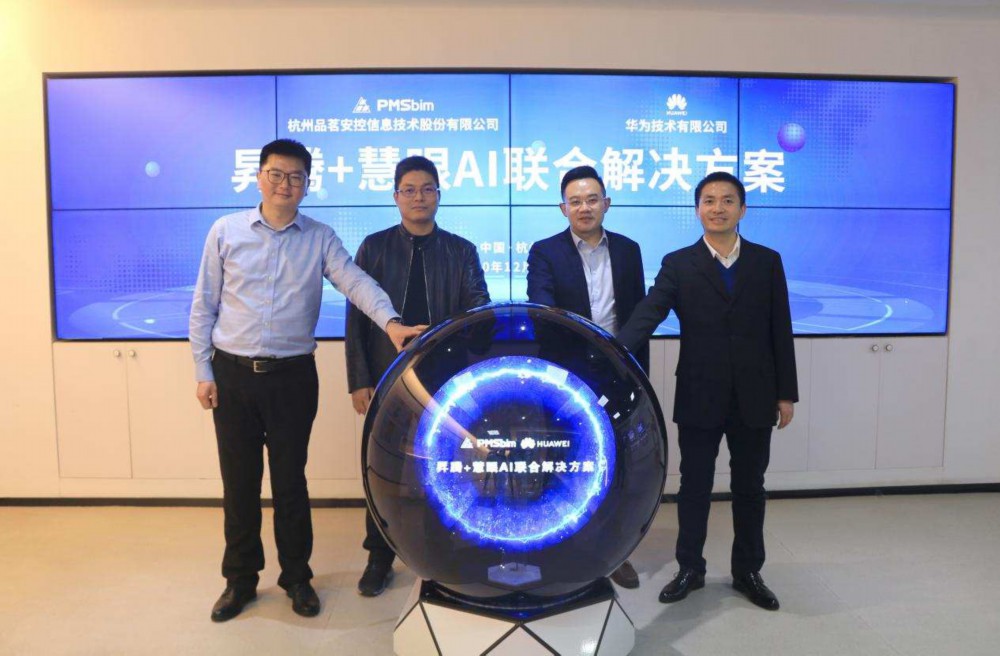

- Technical Cooperation: Reached strategic cooperation with Huawei Ascend to empower the new blue ocean of construction informatization [3].

- Market Attention: Suspension due to control rights change in September attracted high market attention [0].

- Policy and Technology Resonance: National intelligent construction policies [4] and Huawei technical cooperation [3] form a synergistic effect, accelerating the company’s business expansion.

- Improved Profit Efficiency: Net profit growth far exceeds revenue, indicating enhanced cost control or product premium capability [0].

- Market Sentiment Driven: The control rights change event increased market attention, combined with the industry trend, driving the stock price to rise rapidly [0].

- Short-term Volatility Risk: The recent stock price increase is too large, and there is a correction pressure [2].

- Capital Outflow Signs: Main funds had a net outflow of 676,100 yuan [2].

- Uncertainty of Control Rights Change: The follow-up progress of the suspension event remains to be clarified [0].

- Industry Growth Space: The penetration rate of construction informatization is still low, and the market scale will expand under policy support [4].

- Technical Cooperation Potential: Huawei Ascend’s empowerment is expected to open up new markets [3].

Pinming Technology has achieved strong performance through performance growth, policy dividends, and technical cooperation. Attention should be paid to short-term market volatility and control rights change risks, while focusing on long-term industry development opportunities.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.