Analysis of the Strong Performance of Tengjing Technology (688195): Driven by Leading CPO Technology and AI Computing Power Boom

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

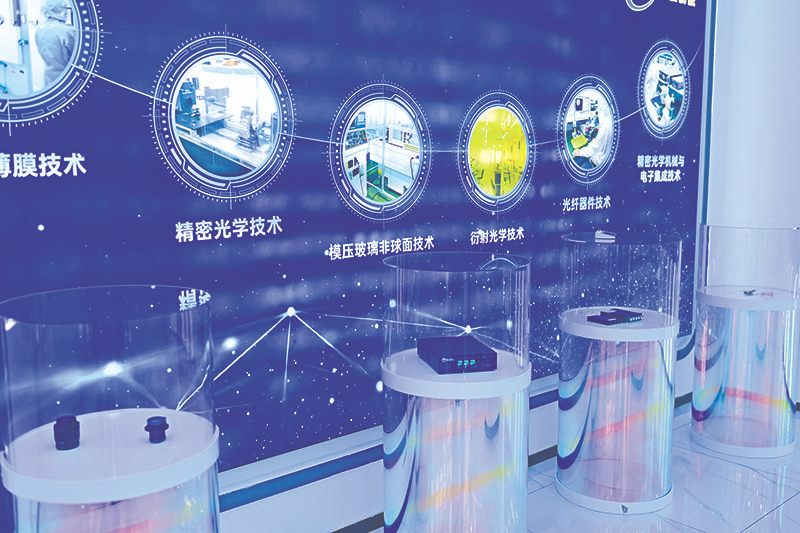

Tengjing Technology (688195), as a STAR Market optical device enterprise, has become a major beneficiary of the AI computing power hardware boom by virtue of its leading position in CPO (Co-packaged Optics) and OCS (All-optical Switch) technology fields [0]. NVIDIA’s Q3 2025 revenue of 57 billion US dollars increased by 62% year-on-year [1], detonating the global AI computing power sector and driving up demand for related optical components. Google’s OCS all-optical switch industry chain has received incremental capital support [3], further promoting the company’s business growth.

The company’s fundamentals are excellent. The 2025 third-quarter report shows that revenue was 425 million yuan, an increase of 28.11% year-on-year [0], and net profit maintained high growth. Capital inflows are obvious: on November 20, the single-day increase exceeded 10%, with a turnover of 2.474 billion yuan [0], showing the market’s confidence in its prospects.

- Synergy between AI Hardware and Optical Components: The explosion of AI computing power demand directly drives the demand for optical devices, and Tengjing Technology’s technical layout accurately aligns with industry trends [0].

- Resonance of Capital and Sentiment: The combination of sector benefits and the company’s fundamentals attracts both institutional and retail capital to participate together [4], promoting the continuous rise of the stock price.

- The stock price has risen sharply in the short term, and the valuation is at a historical high, with correction pressure [2].

- Changes in AI industry policies or technical routes may affect demand stability [0].

- Global AI computing power construction continues to advance, and the optical component market has broad space [1].

- The company’s technical advantages are expected to translate into long-term market share growth [0].

The strong performance of Tengjing Technology (688195) stems from the superposition of technical leadership and industry dividends. Investors need to pay attention to AI industry dynamics and the company’s subsequent order situation to evaluate its long-term growth potential [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.