Analysis of Strong Performance of Guoke Jun Gong (688543): Driving Factors and Sustainability Judgment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

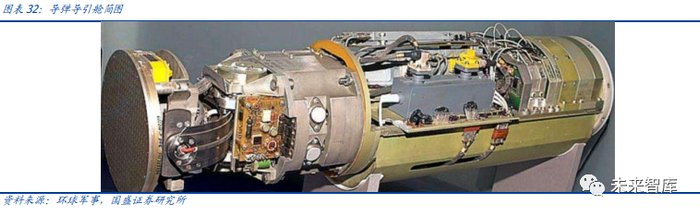

Guoke Jun Gong (688543) is a military industry enterprise listed on the Science and Technology Innovation Board, focusing on the R&D and production of solid engine power module products for missiles (rockets) [0]. The company is transitioning from a supporting enterprise to a final assembly enterprise. In 2024, it invested 343 million yuan to build an aerospace power project [0]. In November 2025, its wholly-owned subsidiary signed a 466 million yuan annual order contract for engine charging of military trade products [0], providing support for performance growth.

The recent strong performance of the stock price is mainly driven by multiple factors:

- International event catalysis: At the 2025 Dubai International Air Show, Chinese military equipment was displayed in a concentrated manner, and Guoke Jun Gong rose 5.28% on that day [6]

- Market capital inflow: On November 24, the single-day increase was 11.60% to hit a 60-day high, with a net inflow of 155 million yuan from main funds [4][5]

- Overall strength of the sector: The national defense and military industry sector rose across the board, with many individual stocks hitting their daily limit [1][8]

- Policy expectation drive: Expectations for the “15th Five-Year Plan” and the approaching goal of the centenary of the founding of the army [3]

- Improvement in industry fundamentals: In the first three quarters of 2025, the revenue of the national defense and military industry sector increased by 6.74% year-on-year [0]

- The resonance between international defense exhibition events and domestic policy expectations strengthens the investment logic of the military industry sector [3][6]

- The company’s transformation strategy and growth in military trade orders show long-term development potential [0]

- Capital flow reflects the market’s recognition of the improved prosperity of the national defense and military industry sector [4][5]

- The national defense and military industry sector has entered a new round of prosperity cycle, with clear policy support [3]

- The expansion of the company’s military trade business opens up growth space [0]

- The military industry sector is greatly affected by changes in the international situation [1]

- Technical or production capacity challenges may be faced during the transformation process [0]

The recent strong performance of Guoke Jun Gong is the result of the combined effect of industry prosperity, international events, policy expectations, and the improvement of the company’s fundamentals. In the short term, the sector’s popularity is expected to continue; in the long term, the company’s transformation and order growth lay the foundation for sustained development. Investors should pay attention to subsequent policy implementation and contract execution [0][3][5]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.