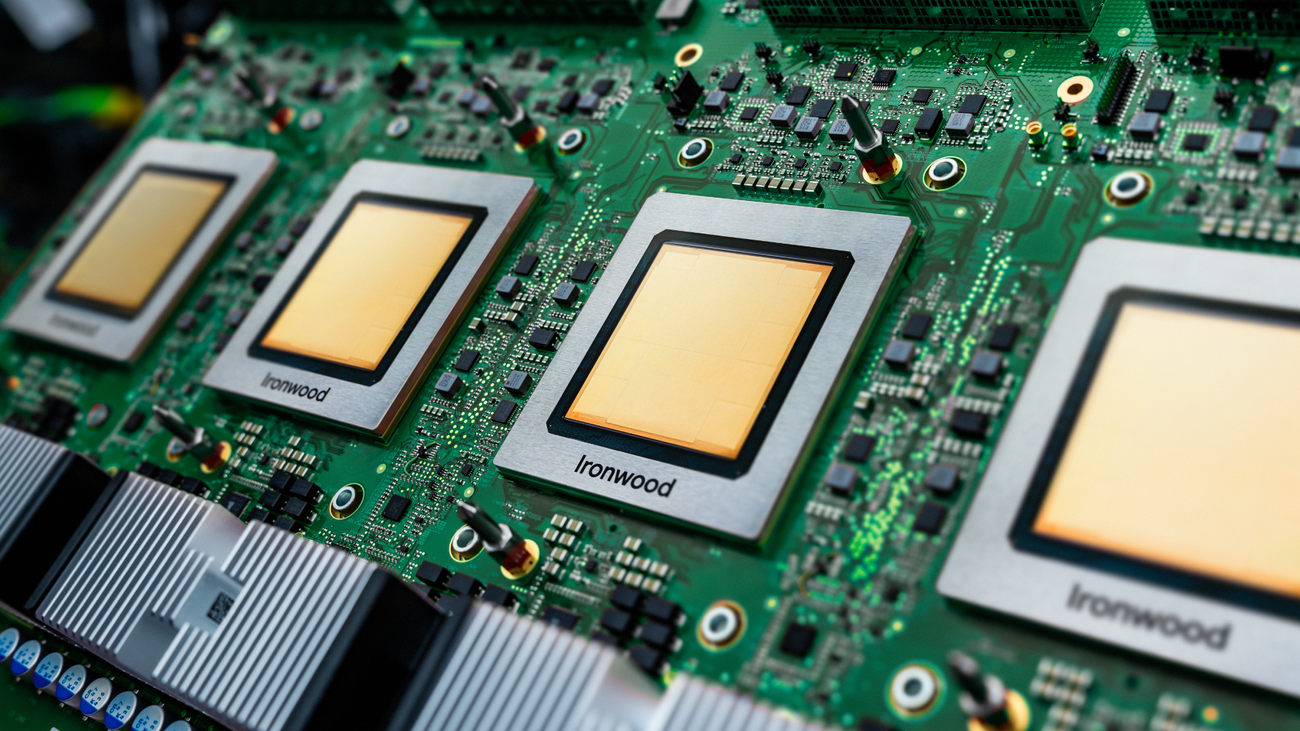

Google's TPU & Gemini3 Breakthroughs: Assessing Competitive Impact on NVIDIA's AI Dominance

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- According to Internal Research Database [0]:Google’s 7th-gen TPU (Ironwood) achieves 4614 TFLOPS (10x 5th-gen), and Gemini3 Pro outperforms GPT-5 Pro in 19/20 benchmarks (Humanity’s Last Exam:41% vs31.64%) [1][2].

- Research shows:NVIDIA holds ~80-90% AI accelerator market share, with CUDA ecosystem as core moat; 2025 Q3 revenue $57B (+62% YoY), data center revenue $51.2B [5].

- Research findings:TPU excels in inference tasks (15-30x GPU performance,30-80x energy efficiency), but switching from CUDA faces high costs (software compatibility, code refactoring) [4].

- Reddit user [3]:Google’s TPU+OCS architecture has advantages but relies on NVIDIA GPUs for flexibility; bullish on compute supply chain (LITE, Xuchuang, Shenghong) and NAND flash.

- Xueqiu user (Antique Fish) [3]:Gemini3 shows Google’s strength, but TPU lacks CUDA ecosystem and global supply chain; NVIDIA builds compute backbone for others, while energy infrastructure is a key bottleneck.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.