Google TPU vs. NVIDIA GPU: Competitive Dynamics and Investment Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

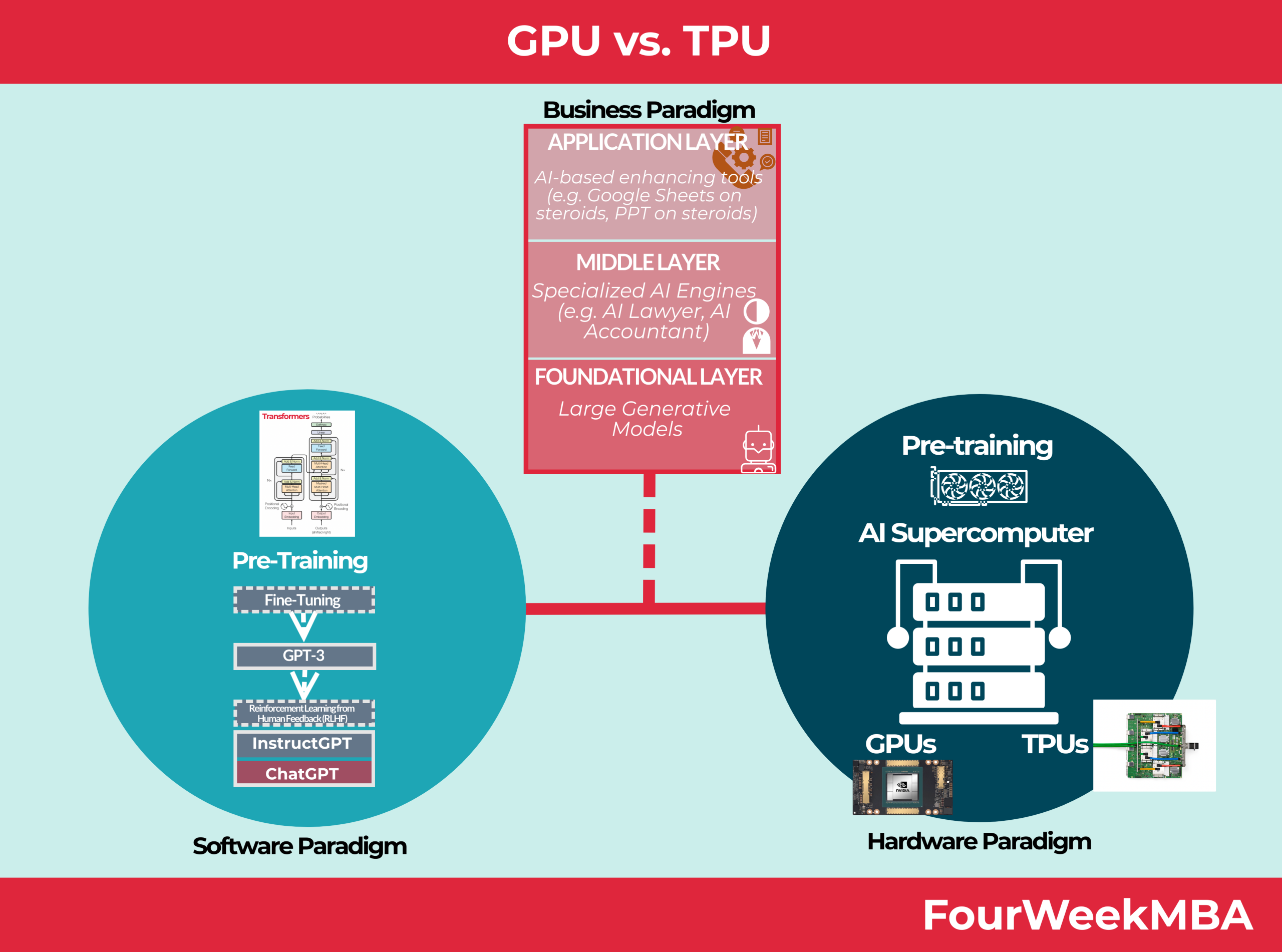

- According to The Silicon Arms Race: An Architectural and Strategic Analysis of AI Accelerators, NVIDIA’s GPU dominates the AI chip market with ~80% share, driven by its CUDA ecosystem and technical leadership in Blackwell architecture.

- Research from Google Cloud TPU Performance Guide highlights TPU’s superior energy efficiency in large-scale AI workloads via JAX/XLA integration.

- A Sina Finance report notes NVIDIA’s 500 billion USD backlog and strategic shift to AI factory services, while Google targets 1000x performance improvement in 4-5 years.

- 雪球用户 argues Google’s TPU has technical advantages but lacks NVIDIA’s CUDA ecosystem and global supply chain, so it won’t disrupt NVDA.

- Reddit discussions point to investment opportunities in AI supply chains like Lumentum (LITE) and energy infrastructure due to power bottlenecks.

NVIDIA maintains market leadership via CUDA and massive backlogs, but Google’s TPU is gaining traction in cloud-scale AI. Supply chain winners include optical component makers (LITE) and storage providers. Energy infrastructure and storage are critical due to increasing power demands from AI chips.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.