NVDA Chip Obsolescence Analysis: AI Bubble Concerns vs. Industry Adaptation Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

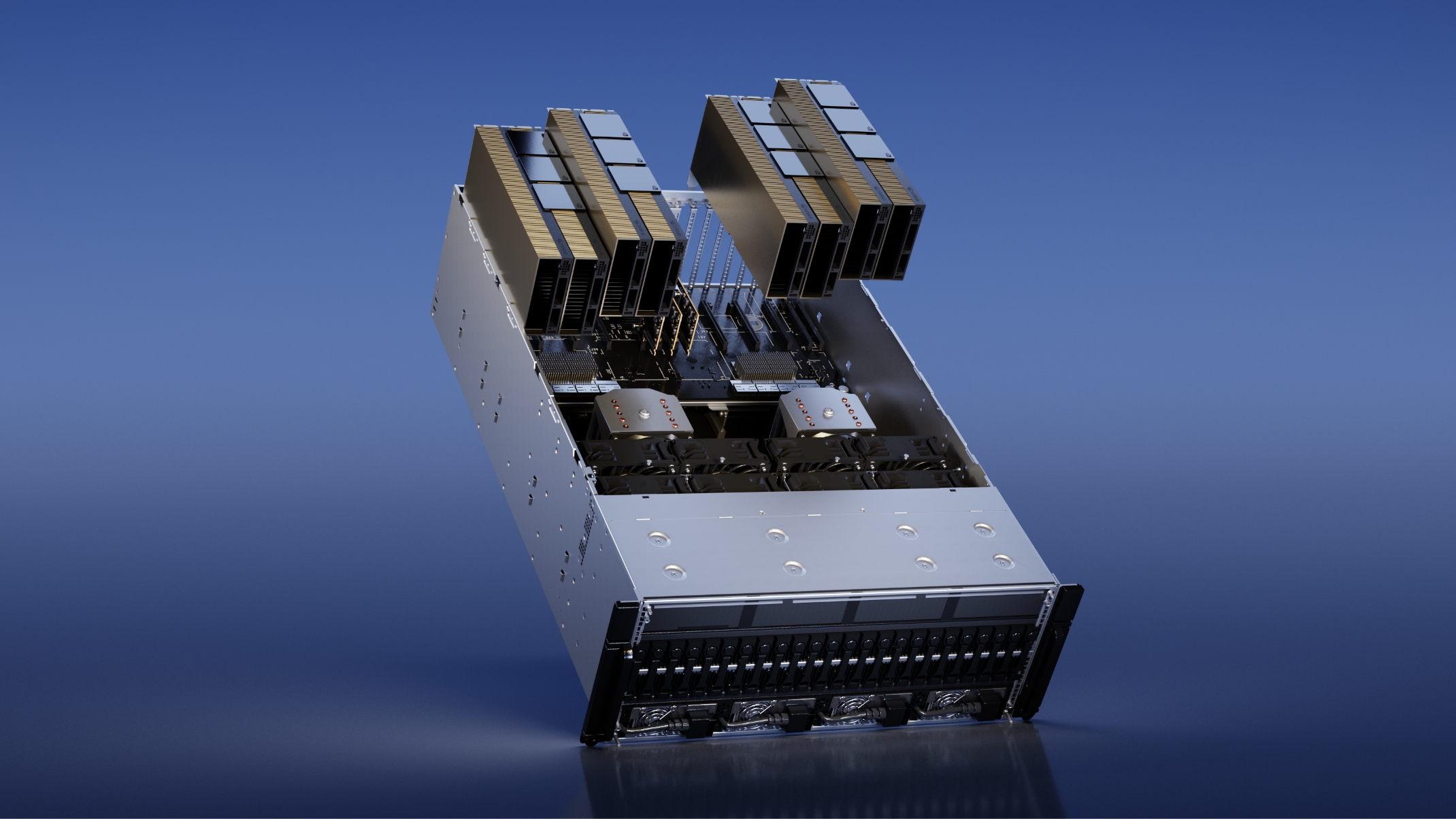

The 2025 Reddit discussion on NVDA chip obsolescence highlighted core concerns: unsustainable yearly capex, inflated earnings via extended GPU depreciation, and AI bubble risks. Industry analysis reveals nuanced realities: NVDA H100 GPUs have a 1-3 year useful life for training tasks [1], but reuse for inference extends their utility [4]. The depreciation debate (Burry’s claim of inflated earnings vs. Bernstein’s support of 5-6 year schedules) underscores accounting transparency issues [2,3]. NVDA’s dominance (88.3% data center revenue share [0]) is supported by ecosystem growth (data center rack market CAGR 8.5% [5]) and innovations like liquid cooling [5] and heterogeneous compute [4].

- GPU lifecycle is task-dependent: Training requires 1-3 year replacements, while inference allows longer reuse (up to 5+ years for older chips).

- Heterogeneous compute (mixing new/old GPUs) mitigates obsolescence risks and optimizes costs.

- Depreciation practices are a double-edged sword: Extended schedules reduce short-term capex but attract regulatory scrutiny.

- NVDA’s product cycle (Blackwell → Rubin) balances demand generation with ecosystem sustainability.

- Risks: Regulatory scrutiny of depreciation practices [2], capex pressure on data centers [6], and competitive threats from AMD in inference workloads.

- Opportunities: Growth in inference workloads (driving reuse of older GPUs), adoption of liquid cooling to extend GPU lifespan [5], and NVDA’s leadership in high-density rack optimization [5].

NVDA’s chip obsolescence debate reflects broader AI industry dynamics. While bubble concerns exist (due to unsustainable capex and free adoption models), ecosystem adaptations (reuse, heterogeneous compute, liquid cooling) provide mitigation. Investors should focus on accounting transparency and task-specific GPU lifecycle management, while data center operators optimize reuse strategies. NVDA’s ability to balance innovation with ecosystem sustainability will shape its long-term performance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.