Google TPU Ironwood vs NVIDIA: Competition and Coexistence in AI Chip Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

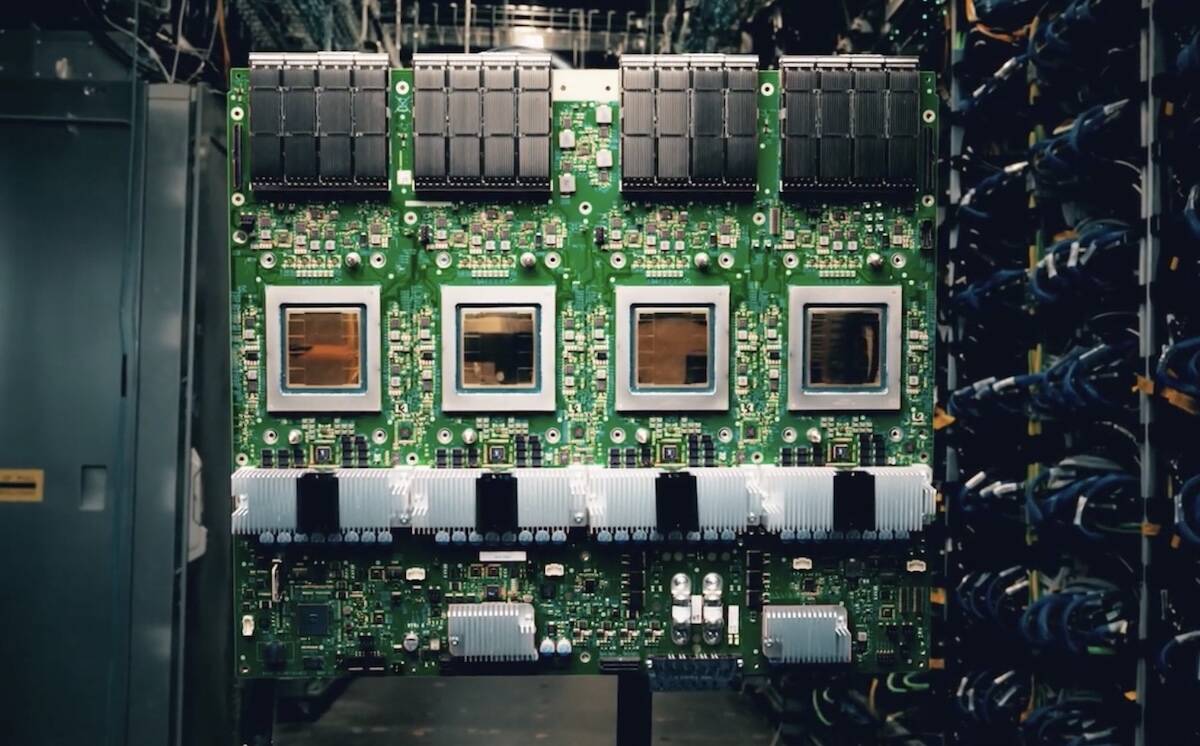

- 据谷歌最强AI芯片Ironwood即将登场:挑战英伟达:谷歌第七代TPU Ironwood单芯片峰值算力达4614 TFLOPS(FP8精度),支持9216芯片组成超级集群,总算力42.5 ExaFLOPS;Anthropic签署100万个TPU的协议,降低对NVIDIA GPU依赖度至40%以下。

- 据英伟达的大型科技客户或成其最大竞争威胁:NVIDIA占据全球AI处理器市场约80%份额,2025年Q3营收570.1亿美元,CUDA生态拥有600万开发者和300+加速库,客户迁移成本高昂。

- 据计算机行业2025年7月投资策略:TPU适合Google生态内大规模推理任务,能效比高且成本低;GPU仍是通用AI计算首选,支持多框架和灵活部署。

- Reddit用户:谷歌TPU+OCS架构在算力基建具优势,但谷歌仍依赖NVIDIA GPU满足灵活性需求;杰文斯悖论下算力需求爆发,AI非静态软件反驳泡沫论(来源:Reddit讨论)。

- 雪球用户:TPU仅适用于谷歌封闭技术栈,无CUDA支持和全球供应链;推荐投资光模块(LITE)、PCB(胜宏)、NAND闪存(闪迪)及能源基建(储能)(来源:雪球帖子)。

研究与社交媒体均认可TPU的技术实力,但一致认为NVIDIA的CUDA生态是核心护城河。TPU与GPU将长期共存:TPU主导Google生态内大规模推理,GPU覆盖通用计算与创新研究。投资上,算力供应链(光模块、PCB、NAND)和能源基础设施(储能、供电)是关键方向。

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.