AI Market vs Dot-Com Bubble Debate: Key Insights & Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

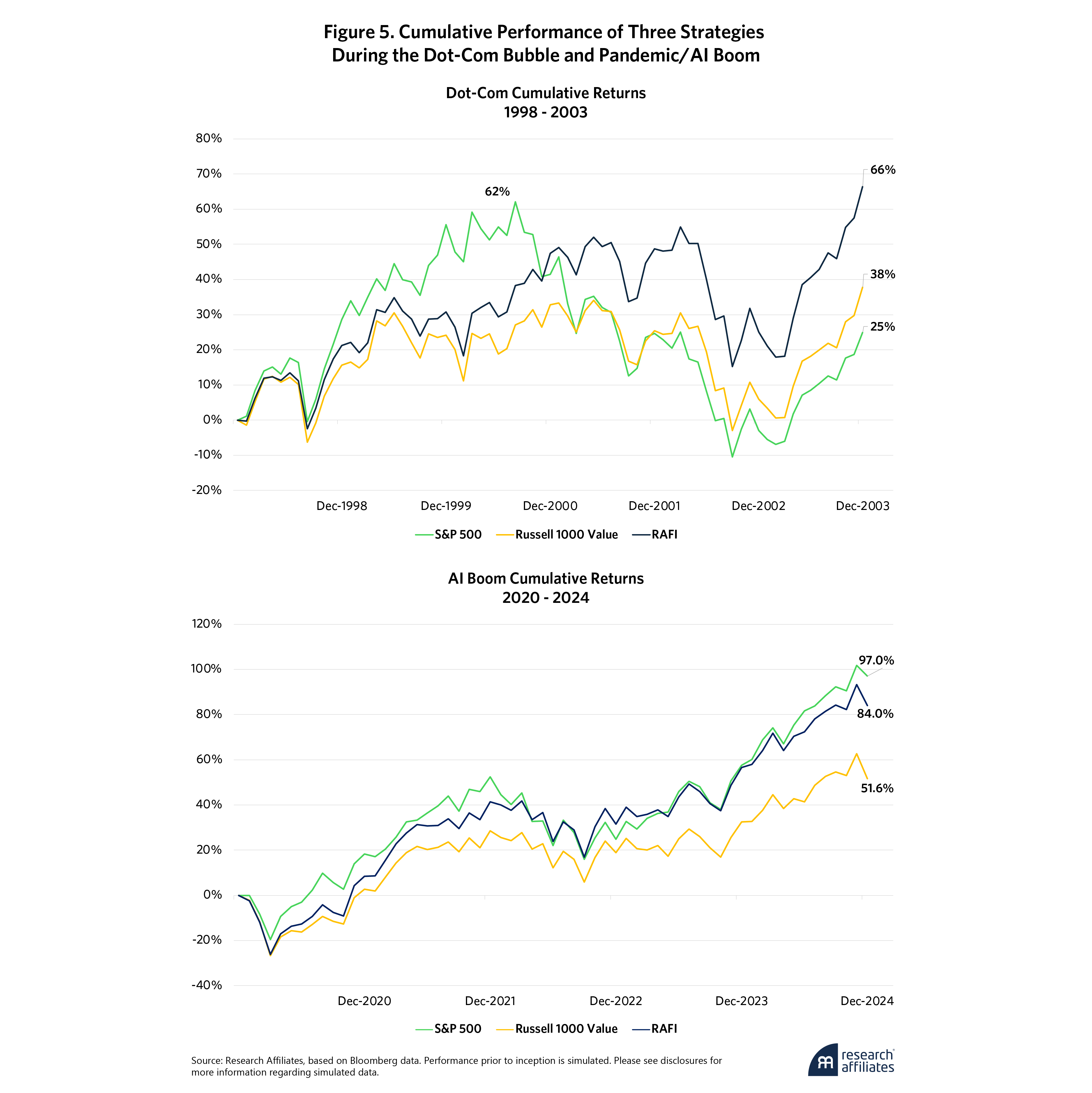

This analysis is based on the Reddit post [1] debating parallels between the current AI-driven market rally and the dot-com bubble. Key arguments include AI firms having real earnings vs the overused parallel claim. Analyst reports [0] provide data on Fed Chair Powell’s views, Gemini3 Pro’s release, Nvidia’s performance, AI capex projections, and valuation metrics.

Fed Chair Powell emphasizes AI firms have tangible earnings, a critical difference from dot-com era companies [2]. For example, Microsoft and Alphabet report significant AI-related revenue growth [0].

Alphabet released Gemini3 Pro on Nov 18, 2025, using 7th-gen TPUs with Deep Think mode, outperforming leading models [3]. This could shift the AI race and reduce reliance on Nvidia GPUs [3].

Nvidia’s 30-day stock change (Oct14-Nov24) is -1.2% with 2.52% volatility [4]. While Q3 data center revenue surged 66% to $51.2B [0], circular financing (investing in customers who buy its chips) raises concerns [3].

AI capex is projected at $390B in 2025 (Goldman Sachs) and $1.2T by 2030 (Bank of America) [5]. Current Nasdaq forward P/E (~26x) is half of dot-com’s peak (~60x) [6].

- Earnings Distinction: AI firms have real earnings, unlike dot-com era companies [2], but startup sustainability remains a risk.

- Innovation Impact: Gemini3 Pro’s release could challenge Microsoft’s OpenAI partnership [3].

- Valuation Gap: While P/E is lower than dot-com, Buffett Indicator suggests overvaluation [6].

- Circular Financing: Nvidia’s customer investments raise sustainability concerns [3].

- Valuation: Elevated market cap to GDP ratio indicates correction risk [6].

- Startup Failures: Unprofitable AI startups could trigger a shakeout [0].

- Innovation: Ongoing AI advancements (Gemini3 Pro) drive sector growth [3].

- Long-Term Capex: AI capex growth signals long-term industry commitment [5].

- Nvidia’s Performance: 30-day change (-1.2%), volatility (2.52%) [4].

- AI Capex: $390B (2025), $1.2T (2030) [5].

- Valuation: Nasdaq P/E (26x vs dot-com’s 60x) [6].

- Innovation: Gemini3 Pro outperforms leading models [3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.