Analysis of Bloomberg Video on Elevated Market Volatility

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

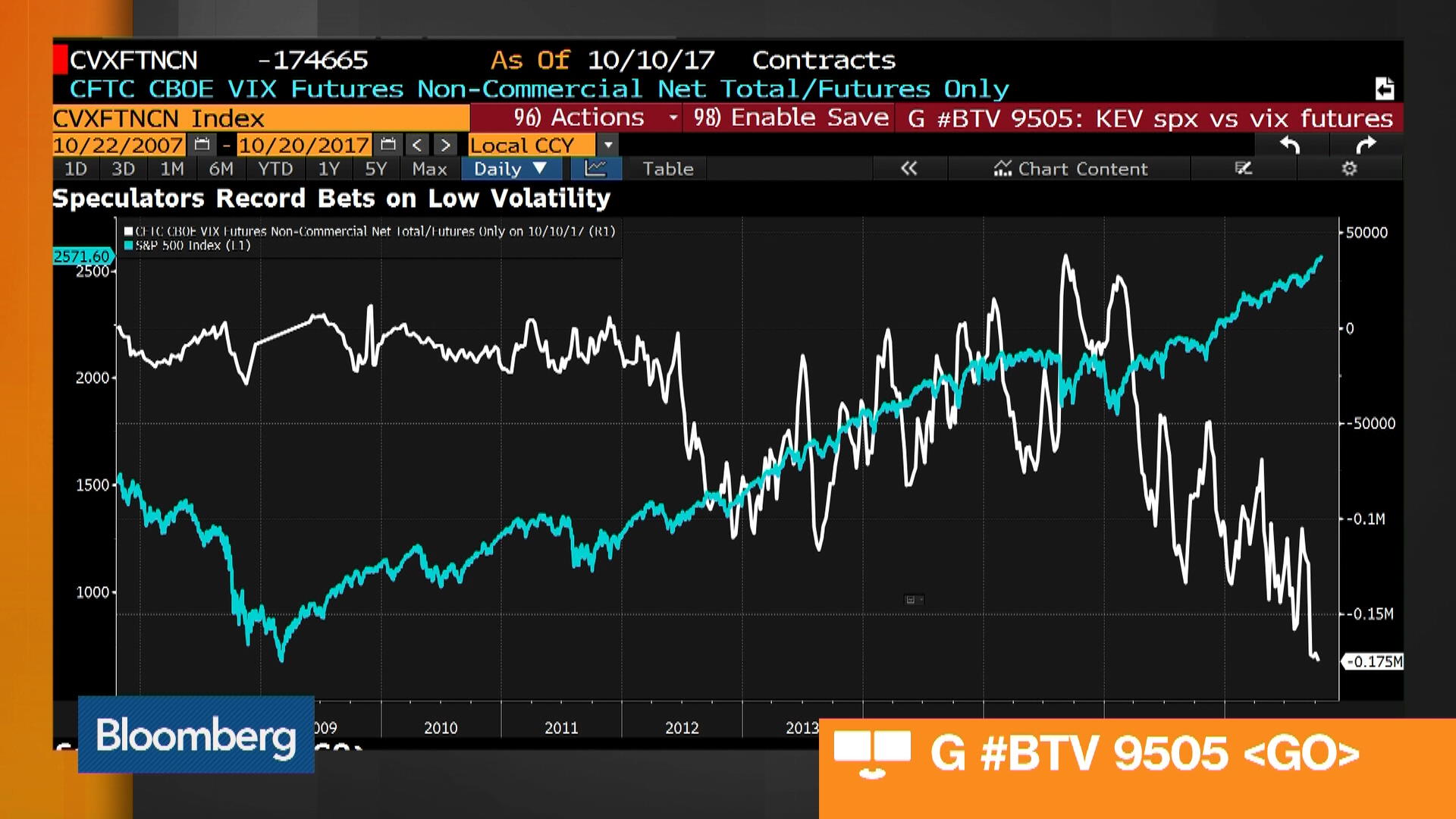

The Bloomberg video [1] emphasizes market volatility will remain elevated due to Federal Reserve policy uncertainty and economic data releases. This aligns with internal market data [0] showing significant swings: NASDAQ dropped 4.25% (Nov20) then rose1.73% (Nov24); S&P500 fell2.96% then gained1.03%. Sector performance [0] on Nov24 reflects mixed sentiment: utilities (3.22% gain, defensive) and tech (2.09% gain, growth) led.

- Dual Sentiment: Defensive and growth sector gains indicate conflicting investor strategies—safety-seeking and dip buying.

- Data Alignment: Video’s volatility forecast matches recent market swings, confirming policy/data as key drivers.

- Persistent Uncertainty: Fed policy and data will continue fueling volatility.

The video’s theme of elevated volatility is confirmed by market data. Mixed sector performance reflects investor ambiguity. Ongoing uncertainty impacts behavior, with both risks and opportunities present.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.