Analysis Report: Reddit Post on 'Silent Default' Algo & U.S. Debt Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

A Reddit post (r/wallstreetbets) argued the U.S. will use

Top comment criticisms included:

- Irrelevant historical context (1946 U.S. was sole manufacturing superpower, not today)

- Unrealistic GDP projections (7-8% vs current forecasts)

- Contradictory short-term positions (2 months) vs long-term thesis (10-15 years)

- Risk of runaway inflation from YCC

- Repackaging of basic real interest rate concepts

##2. Market Impact Analysis

The post’s recommendations align with recent equity/bond movements but contradict hard asset performance:

- Bonds: TLT (long-term Treasury ETF) declined0.71% over30 days (supports short thesis) [0].

- Equities: SPY (+1.76%) and QQQ (+1.65%) gained over30 days; S&P500 (+4.74%) and NASDAQ (+8.47%) rose over60 days (supports long-equity thesis) [0].

- Hard Assets: Gold (-0.6% over30d) and copper (-1.24% over30d) underperformed (contradicts hard asset recommendation) [1].

- Sectors: Utilities (+3.225%, safe haven) and Energy (+2.087%, inflation hedge) led gains; Tech (+2.086%) benefited from AI optimism [0].

##3. Key Data Interpretation

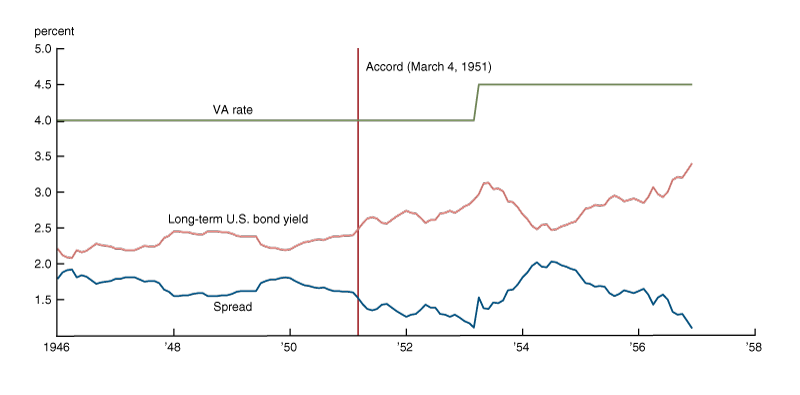

- Debt Levels: U.S. debt reached $38T (125% of GDP) in Nov2025 vs106% in1946 [1].

- Inflation: Sept2025 CPI was3.0% (annualized), with10-year forecasts at2.38% [1].

- AI Impact: Goldman Sachs projects AI could boost global GDP by7% over a decade (not7-8% annually) [1].

- Equity/Bond Trends: Long-term bonds underperformed equities as inflation expectations remained elevated [0].

- Hard Asset Trends: Gold (+50% YoY) and copper (+19.61% YoY) are up annually but down over30 days [1].

##4. Information Gaps & Context for Decision-Makers

Critical gaps requiring further investigation:

- Full Post Mechanics: The Reddit post was blocked, so we lack details on the OP’s “Silent Default Algo” [2].

- Fed YCC Plans: No recent Fed statements on YCC validate the thesis [1].

- AI Growth Assumptions: The OP’s7-8% annual GDP projection lacks supporting data (Goldman’s 7% is over a decade) [1].

- TLT Short Risks: Shorting TLT (liquid ETF) has low immediate risk but could face margin calls if yields fall [0].

- Strike Price Realism: SPY’s current price (~$668) makes the600C Jan2026 call in-the-money, but short-term positions contradict long-term thesis [0].

##5. Risk Considerations & Factors to Monitor

- Unrealistic GDP Projections:7-8% annual growth is far above 10-year forecasts (2.38% inflation-adjusted). Users should be aware this could lead to overexposure to equities [1].

- Runaway Inflation Risk: YCC could trigger hyperinflation (1970s-style), hurting bonds and stocks. This raises concerns about the strategy’s sustainability [2].

- Short-Term vs Long-Term Mismatch: The OP’s10-15 year thesis conflicts with2-month positions, signaling potential lack of conviction [2].

- Historical Context Mismatch: The1946 U.S. was the sole manufacturing superpower—this context does not apply today [2].

- Hard Asset Discrepancy: Recent underperformance of gold/copper vs the OP’s recommendation warrants careful monitoring [1].

Note: The Reddit post crawl was blocked, so event content is based on the user-provided summary. This analysis is for informational purposes only and not investment advice. Always conduct your own research before making decisions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.