2025 Chinese Concept Internet Industry Trends and Investment Environment Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

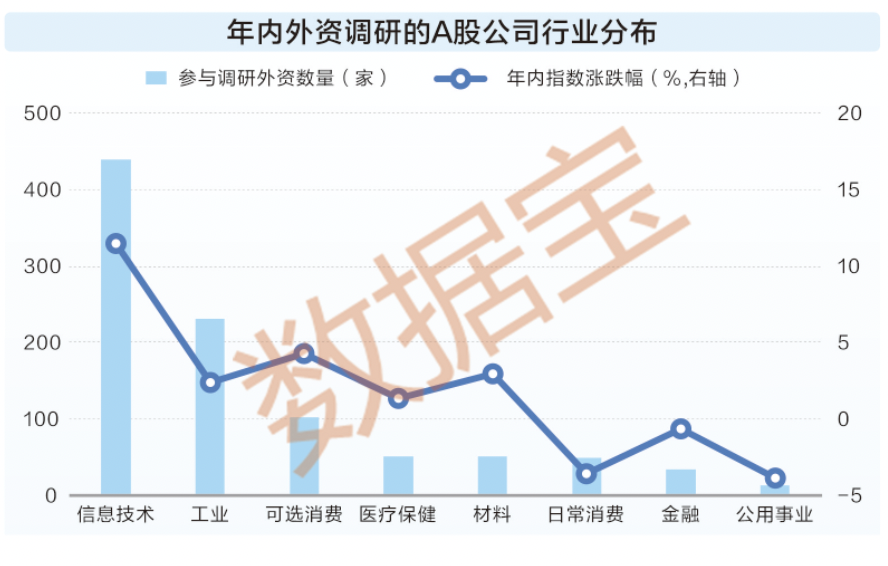

China continues to promote capital market opening-up, optimize foreign strategic investment rules, while strengthening technological autonomy and data security supervision. According to China Daily, since the end of 2024, China has increased efforts to open up its capital market to attract more foreign capital inflow [1]. CNBC noted that in February 2025, China released a new action plan to enhance the attractiveness of foreign investment amid geopolitical tensions [2].

- AI-driven Growth: JPMorgan upgraded Chinese internet service stocks on November 24, 2025, optimistic about the growth potential brought by AI transformation [6]. Baidu Cloud revenue is expected to accelerate to about 61% in 2026, and AI-native marketing service revenue may grow 55% year-on-year.

- Diversified Revenue: JOYY’s non-live streaming revenue in Q1 2025 increased 25.3% year-on-year, benefiting from its diversified growth strategy [3].

- Profit Pressure: PDD Holdings’ Q1 2025 revenue missed expectations, reflecting intensified market competition [4].

- Industry Competition: Competition in sectors like food delivery has pressured the EPS of companies such as Alibaba.

- Headline Enterprise Dynamics: JD Industrial plans to IPO in late November 2025, raising up to $500 million, indicating expansion trends in the industrial internet sector [7].

- Valuation and Performance: Tencent’s valuation is reasonable (about 20x PE in 2025, future EPS growth of 12-15%), and PDD’s valuation is about 12x in 2026 due to overseas business options [8].

In the medium to long term, opportunities from AI and the normalization of competition outweigh risks. Leading enterprises like Tencent and Alibaba have obvious early advantages in AI layout, but changes in regulatory policies and overseas expansion should be monitored.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.