NVIDIA (NVDA) Mixed Sentiment Analysis: Strong Earnings vs. Short-Term Market Correction Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

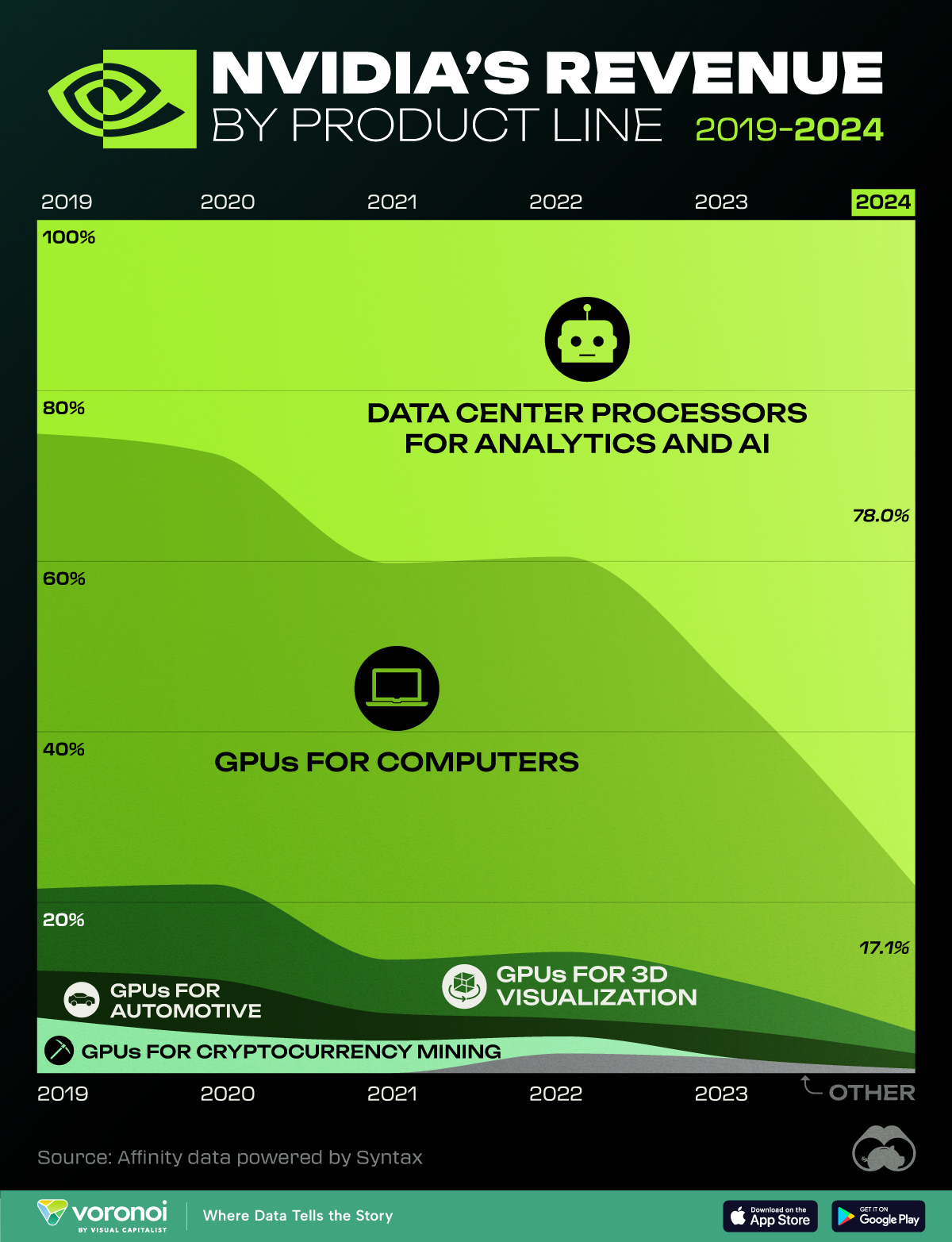

NVIDIA (NVDA) faces mixed sentiment following its claimed Q3 FY26 earnings report (alleged $57.0B revenue, $31.9B net income, Q4 guidance $65B ±2%) [0]. Despite these strong results, NVDA’s stock has declined sharply: 1-day drop of -4.72% to $173.93 [1], and a 5-day decline of -11.24% [6]. This drop aligns with broader tech sector weakness—NASDAQ Composite fell by 4.25% on November 20 [5], and the tech sector was down -0.46% on November23 [4]. The company’s dominant position in AI GPUs is reflected in its data center segment contributing 88.3% of FY2025 revenue [6], supporting long-term bullish sentiment. However, short-term bearish concerns include macroeconomic factors (inflation/jobs data impacting GPU demand), customer concentration risk (unverified claim of $33B from 4 customers [0]), and valuation (P/E ratio of42.66x [6]).

- Short-Term vs Long-Term Disparity: While short-term sentiment is bearish due to market correction and valuation concerns, long-term sentiment remains bullish driven by AI growth and strong analyst targets ($250 consensus, +43.7% from current price [6]).

- Market Context: NVDA’s drop is not isolated—broader tech sector decline contributes significantly to its recent performance [4,5].

- Unverified Claims: Customer concentration risk (33B from4 customers [0]) and Q3 FY26 earnings details (lack of official transcript [3]) are key information gaps requiring verification.

- Valuation Risk: High P/E ratio (42.66x) may lead to further corrections if growth slows [6].

- Gross Margin Pressure: Blackwell GPU ramp is expected to reduce gross margins to low70s [3].

- Market Volatility: Tech sector weakness (NASDAQ down4.25% [5]) may continue to pressure NVDA’s stock in the short term.

- Customer Concentration: Unverified claim of heavy reliance on4 customers poses potential revenue risk [0].

- Long-Term AI Growth: Dominant position in AI GPUs (data center88.3% of revenue [6]) supports sustained profitability.

- Analyst Confidence: Consensus price target of $250 indicates strong long-term belief in NVDA’s value [6].

NVIDIA’s recent performance reflects a mix of positive long-term fundamentals and short-term market headwinds. The claimed Q3 FY26 earnings are strong, but the stock has dropped due to broader tech correction and valuation concerns. Key factors to monitor include Blackwell ramp progress, customer retention, macroeconomic trends (inflation/interest rates), and tech sector performance. Unverified claims (customer concentration, Q3 FY26 earnings details) need confirmation for informed decision-making.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.