Rayco Defense (002413) Limit-Up Analysis and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

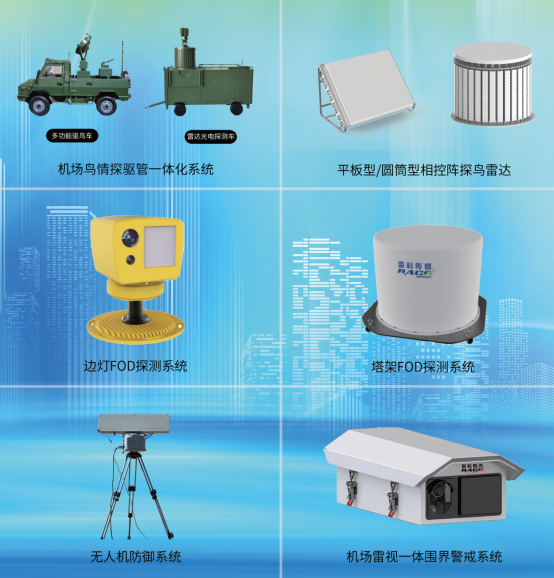

This analysis is based on Tushare’s limit-up pool data [0]. Rayco Defense (002413) entered the limit-up list on November 25, 2025. Key points of the event include: the company’s main business is military electronics and radar system business, benefiting from order growth in the military industry in 2025 and expansion into the 5G market [0][2]; the stock price has risen by 14% this year [1], but the 2025 net profit was -352 million yuan [0]. The most critical finding is that market sentiment prioritizes growth expectations for the military industry, with main impacts reflected in short-term stock price fluctuations and increased industry attention.

Rayco Defense (Beijing Rayco Defense Technology Co., Ltd.) focuses on military electronics fields such as radar systems and satellite applications [0]. In 2025, the military industry saw strong order growth [2], and the company received a large number of orders. At the same time, expansion into the 5G market brought new growth points [0], driving outstanding stock price performance (14% increase this year [1]). However, financial data shows that 2025 revenue was 1.48 billion yuan but net profit was -352 million yuan, with earnings per share of -0.27 yuan [0]. In terms of financial structure, cash reserves were 464 million yuan and total liabilities were 237 million yuan, which is relatively stable [0]. Market liquidity is moderate, with an average three-month trading volume of 47.41 million shares [0].

In terms of cross-domain correlation, the combination of military industry trends and 5G technology applications has become a driving factor for the company’s stock price, despite weak short-term financial performance. The deeper implication is that the market values military technology enterprises more on long-term growth potential rather than current profitability. In addition, the company’s name change in 2023 (from Jiangsu Rayco Defense to Beijing Rayco Defense) may reflect an adjustment in its strategic focus [0].

Rayco Defense (002413) achieved a limit-up due to military order growth and 5G expansion, with significant stock price increases this year, but attention should be paid to the current negative net profit situation. The company has a stable financial structure, moderate market liquidity, and its military technology sector is highly concerned.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.