Analysis of Leike Defense (002413) Limit-Up Event: Causes, Market Sentiment, and Trend Forecast

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on Tushare’s limit-up pool data [0]. Leike Defense (002413) hit the limit-up on November 25, 2025. Key points: The company is a high-tech enterprise in the national defense and military industry sector. It recently received a net institutional buy-in of 137 million yuan [2]. The sector is driven by geopolitical factors [4], and the company has a solid risk-adjusted return (Sharpe ratio of 8.81 [0]).

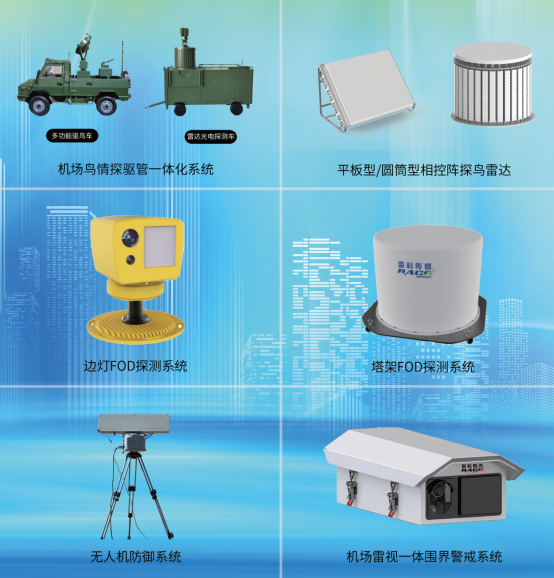

Leike Defense focuses on defense technology fields such as radar systems and satellite applications [0]. It showed strong investment value in 2025: a two-year total return of 14.36%, an annualized return of 6.94%, and a maximum drawdown of only 0.99% [0]. The limit-up event was accompanied by the release of an abnormal fluctuation announcement [1]. Dragon and Tiger List data shows that GF Securities Taizhou Donghai Avenue Branch had a net buy-in of 137 million yuan [2]. Geopolitically, the WSJ reported that China restricted the supply of key minerals [4], which may further increase attention to the national defense and military industry sector.

- Sector Linkage Effect: The national defense and military industry sector is affected by both geopolitical and supply chain changes. As a company in a niche area, Leike Defense benefits from the warming sentiment in the sector;

- Financial Stability: The low drawdown and high Sharpe ratio reflect the stability of the company’s operations and stock price performance [0];

- Capital Signal: The net institutional buy-in shows the market’s confidence in the company’s short-term growth potential [2].

- Restrictions on key mineral supplies may affect the stability of the upstream supply chain [4];

- After abnormal fluctuations, it is necessary to pay attention to regulatory developments and the risk of stock price correction [1].

- Business expansion space brought by the demand growth in the national defense and military industry sector;

- The company’s technical advantages in niche areas such as radar and satellites [0].

The limit-up event of Leike Defense is the result of the combined effect of the sentiment in the national defense and military industry sector, institutional capital movements, and the company’s fundamentals. Investors need to comprehensively evaluate sector trends, the company’s financial performance, and changes in the external environment, and rationally view short-term fluctuations and long-term value.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.