Meta's Potential Google TPU Deployment: Impact on GOOG, NVDA, and META

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

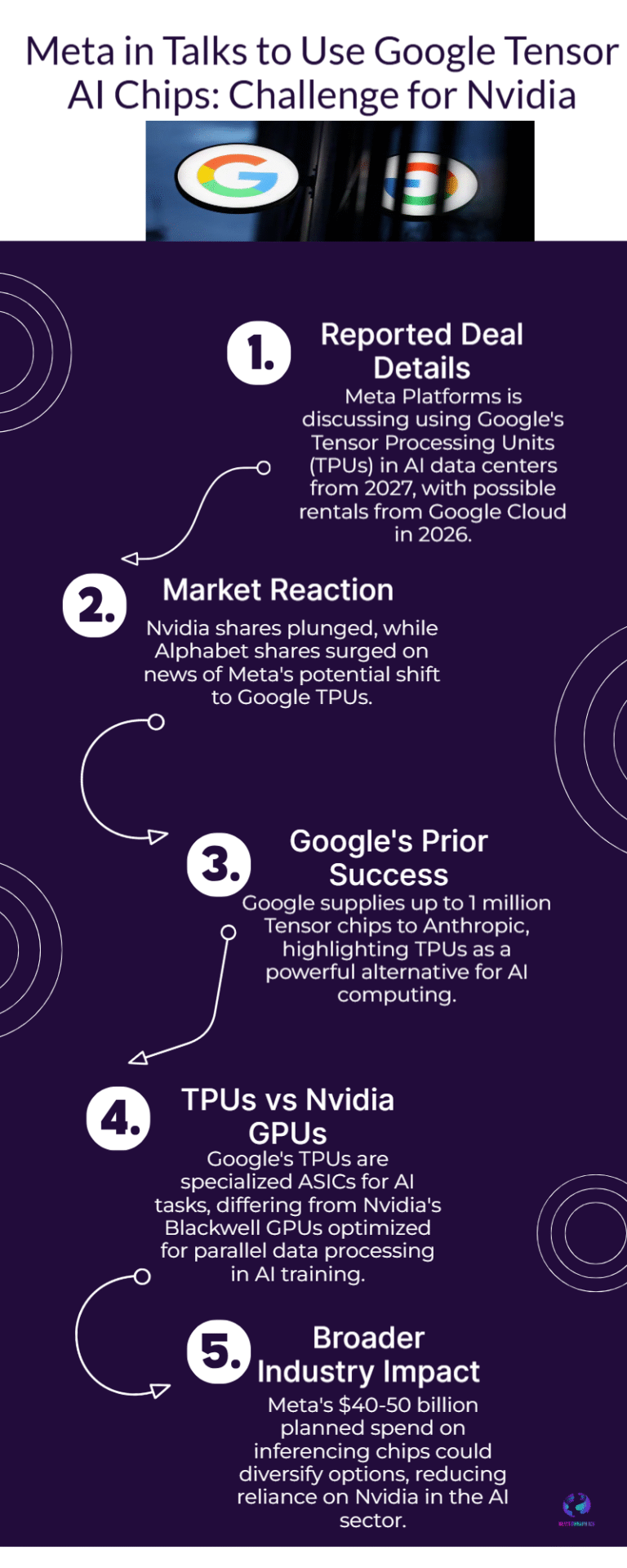

Meta Platforms (META) is reportedly negotiating a multi-year deal to use Google’s Tensor Processing Units (TPUs) in its data centers, a move that could disrupt the AI infrastructure landscape [2]. Alphabet Inc. (GOOG) shares rose ~2% in after-hours trading following the news, extending its recent rally (up ~52% since mid-September) [0][1]. Conversely, Nvidia (NVDA) faced downward pressure, with shares falling ~3% premarket as investors priced in potential competition for GPU demand [3]. This development reflects a broader trend: Google is expanding its TPU market beyond internal and cloud tenants to third-party data centers, directly competing with Nvidia’s dominance [2].

- GOOG’s AI Narrative Strengthening: The TPU deployment talks reinforce Google’s position in AI, supporting its rally toward a $4 trillion valuation [1]. The company’s AI progress (including Gemini 3) and chip commercialization efforts are driving investor sentiment [4].

- NVDA’s Competition Risk: The potential Meta-Google partnership highlights growing competition for Nvidia in the hyperscaler segment, a key revenue driver [2][3].

- Meta’s Cost-Saving Opportunity: Adopting TPUs could lead to significant cost savings for Meta, potentially boosting its earnings per share (EPS) [0].

- Risks:

- For GOOG: Valuation sensitivity as it approaches $4 trillion, with potential profit-taking or regulatory scrutiny [1].

- For NVDA: Increased competition from Google’s TPUs, which may erode market share in the long term [2][3].

- For META: Execution risk associated with migrating workloads to a new hardware stack [4].

- Opportunities:

- GOOG: Expanding its TPU addressable market to third-party data centers [2].

- META: Locking in lower-cost inferencing capacity to support future capex plans [0].

- GOOG: Market cap ~$3.88 trillion, YTD gain ~70% [0].

- NVDA: Market cap ~$4.30 trillion, down ~3% premarket [0].

- META: Shares ticked higher, reflecting potential cost-saving benefits [0].

- The Meta-Google deal remains unconfirmed, with details on scope and timing still unknown [2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.