In-depth Analysis of Yingxin Development (000620) Limit-Up: Multi-Dimensional Drivers and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The core driving factors for the limit-up of Yingxin Development (000620) on November 25, 2025 can be summarized into four dimensions [0]:

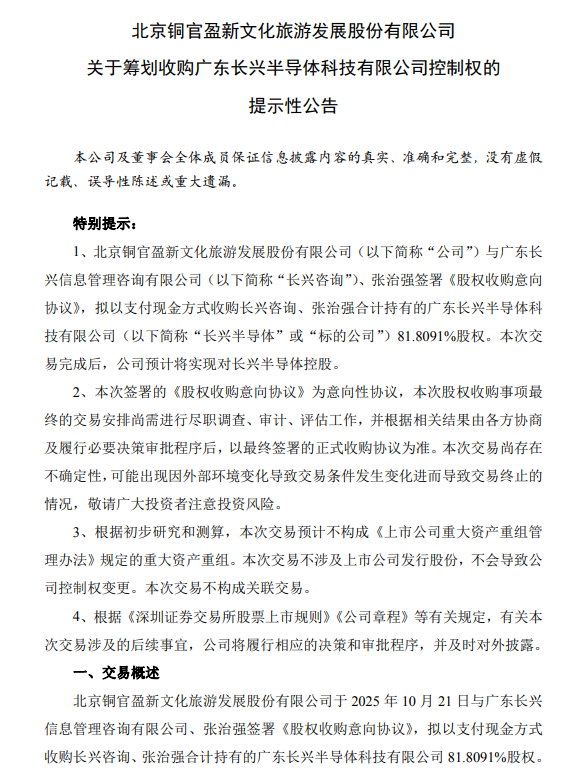

- Strategic Transformation: The company plans to acquire an 81.8091% stake in Changxing Semiconductor for cash, promoting the dual main business layout of “Cultural Tourism + Technology” and realizing cross-border transformation from the traditional cultural tourism industry to the high-growth semiconductor field [2][3].

- Policy Benefits: The 20th Central Committee’s Fourth Plenary Session clearly proposed accelerating self-reliance in science and technology, with embodied intelligence listed as a key future industry [6]; the 15th Five-Year Plan also emphasizes scientific and technological innovation-driven development [7], which is highly aligned with the company’s transformation direction.

- Industry Prosperity: The semiconductor industry was in a high prosperity cycle in 2025, AI technology reshaped the growth logic, and memory chip prices continued to rise, bringing strong growth expectations for the company’s new business [5].

- Concept Superposition: The company has multiple popular concepts such as semiconductor, embodied intelligence, and short drama, attracting concentrated pursuit of market funds and forming a concept-driven upward trend [1][4].

- Cross-border Synergy Potential: Although cross-border integration of cultural tourism and semiconductors faces integration challenges, it is expected to empower semiconductor product research and development with cultural tourism scene data, forming a differentiated competitive advantage [0].

- Policy-Market Resonance: The company’s transformation strategy accurately matches the direction of the national science and technology strategy, and the resonance between policy dividends and market enthusiasm for the semiconductor sector has amplified the limit-up effect [6][7].

- Concept-Driven Characteristics: This growth has obvious concept speculation characteristics, and the stock price performance has not yet fully matched the company’s current fundamentals. Subsequent attention should be paid to the completion of the acquisition and the actual performance contribution of the new business [1][4].

- Integration Risk: The cultural tourism and semiconductor industries have large differences in attributes, and there are uncertainties in technical integration, team management, and business synergy after the acquisition [0].

- Market Volatility Risk: The stock price rise is highly dependent on popular concepts. If market sentiment turns or concept popularity fades, it may trigger a sharp correction [1].

- Performance Uncertainty: The profit contribution of the semiconductor business needs time to verify, and it is difficult to change the company’s existing profit structure in the short term [0].

- Valuation Reconstruction Opportunity: If the acquisition is successful and business synergy is achieved, the company’s valuation is expected to be reconstructed from the traditional cultural tourism sector to the semiconductor sector, opening up long-term growth space [2][3].

- Policy Dividend Window: The country’s continuous support for the technology industry will provide policy guarantees and resource inclination for the company’s new business [6][7].

The limit-up of Yingxin Development (000620) reflects the market’s positive expectations for its cross-border transformation, driven by strategic acquisition, policy support, industry prosperity, and concept superposition. Investors should focus on the following information:

- Progress and approval status of the acquisition of Changxing Semiconductor [2][3];

- Integration effect of the semiconductor business with the existing cultural tourism business;

- Market expansion capability of the new business under policy support;

- Volatility characteristics of concept-driven stocks [1][4].

This summary aims to provide objective information and does not constitute any investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.