Deep Analysis of Leike Defense (002413.SZ) Limit-Up: Driving Factors, Market Sentiment, and Future Outlook

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on Tushare’s limit-up pool data (Leike Defense (002413.SZ) hit the limit-up on November 25, 2025), combined with industry reports and market dynamics, to analyze the reasons for its limit-up, market sentiment, and potential impacts. Leike Defense’s stock price rose 10.05% to 7.01 yuan [1], mainly benefiting from policy support for the military electronics sector [2], the strategic importance of radar and satellite technology [0], and the strong performance of the global defense industry [3].

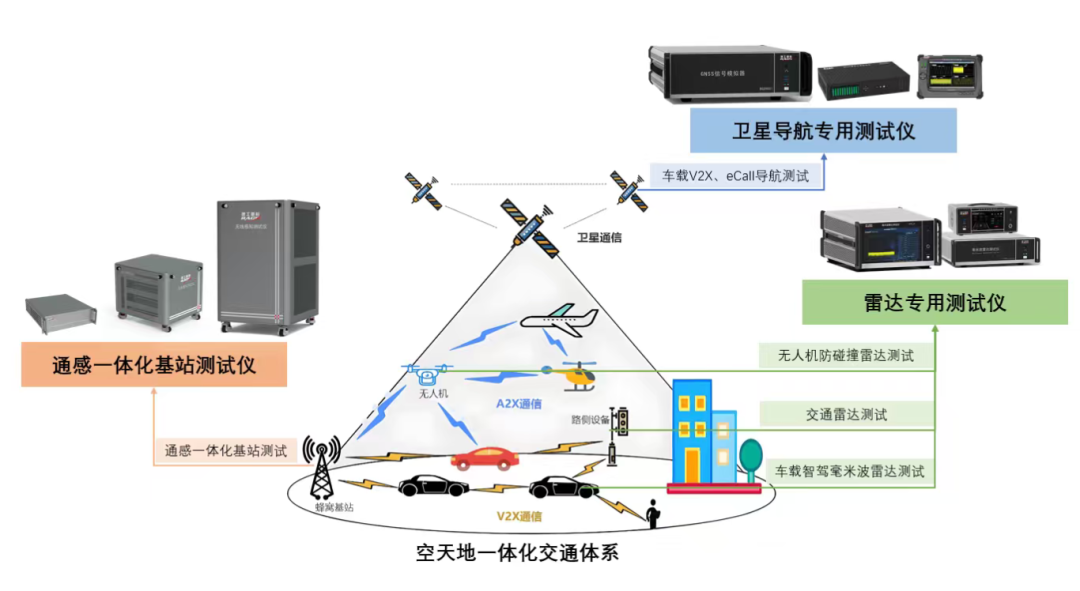

Leike Defense mainly engages in military technology products such as radar systems, satellite applications, and intelligent control [0]. In 2025, the military electronics sector was driven by favorable policies, and the demand for defensive electronics grew significantly [2]. At the same time, global defense technology companies are shifting to the space warfare field, and Leike Defense’s satellite application business aligns with this trend [3]. The company’s stock hitting the limit-up that day reflects the market’s positive expectations for its business prospects [1].

- Resonance of Policy and Industry Trends: Policy support for military electronics combined with growing demand for space technology brings development opportunities for the company [2][3]

- Technical Barrier Advantage: Radar and satellite navigation technology have high strategic value, and the company’s layout in this field enhances its competitiveness [0]

- Positive Market Sentiment: The limit-up reflects investors’ confidence in the military sector and the company [1]

- Continuous policy support for the military electronics sector [2]

- Growing demand in the space technology field [3]

- The company’s technical advantages may bring more orders [0]

- Risk of industry policy changes [0]

- Risk of technology R&D falling short of expectations [0]

- Market volatility risk [1]

Leike Defense (002413.SZ)'s limit-up is mainly driven by policy support for the military electronics sector, the strategic value of radar and satellite technology, and the growth of the global defense industry. Subsequent attention should be paid to policy continuity, the company’s order status, and industry dynamics.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.