Meta-Meta Talks to Use Google's TPUs: Impact on GOOG, META, and NVDA

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

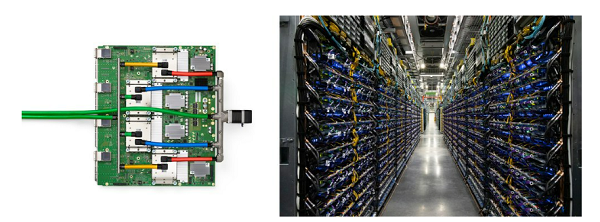

On November 24, 2025 (EST), reports emerged that Meta Platforms (META) is in talks to use Google’s AI chips (TPUs) in its data centers, competing with NVIDIA (NVDA). This caused Alphabet (GOOG) shares to rise ~2% in after-hours trading, Meta to gain ~3.78%, and NVIDIA to drop ~2.59% AH. The deal is a potential multi-billion dollar agreement, with Meta possibly renting TPUs from Google Cloud as early as next year and purchasing chips starting in 2027 [1][2].

- GOOG: Up 1.62% to $323.64 (after-hours) due to new revenue opportunities from TPU sales/rental [0].

- META: Up 3.78% to $636.22 as investors anticipate cost savings vs NVIDIA’s GPUs [0].

- NVDA: Down 2.59% to $177.82 due to competition threats [0].

- GOOG: Has rallied 85.91% over 6 months (May-Nov 2025) driven by AI momentum [0].

- NVDA: 30-day performance down 3.78% as competition from TPUs emerges [0].

- Sector: Technology sector was up 0.78% on November 24, 2025, despite NVDA’s decline [0].

- Bullish for GOOG (AI chip expansion) and META (cost efficiency).

- Bearish for NVDA (market share risk).

| Metric | GOOG | META | NVDA |

|---|---|---|---|

| Real-time Price | $323.64 | $636.22 | $177.82 |

| Daily Change | +1.62% | +3.78% | -2.59% |

| Market Cap | $3.91T | $1.60T | $4.33T |

| Volume (vs Avg) | 50.58M (23.81M) | 24.72M (16.30M) | 309.77M (193.47M) |

| 6-month Change | +85.91% | N/A | N/A |

| 30-day Change | N/A | N/A | -3.78% |

Source: [0]

- Stocks: GOOG (Alphabet), META (Meta Platforms), NVDA (NVIDIA).

- Technology (AI chip manufacturing).

- Cloud Services (Google Cloud’s TPU rental).

- Upstream: Chip component suppliers for Google’s TPUs.

- Downstream: Data centers using AI chips (Meta, other tech companies).

- Exact deal size and timeline (reported as multi-billion dollars, 2026 rentals/2027 purchases).

- Finalization status (current: in talks).

- Adoption of TPUs by other companies.

- GOOG: Expands TPU market reach beyond internal use; strengthens Google Cloud’s position.

- META: Reduces dependency on NVIDIA; potential EPS boost from cost savings [1].

- NVDA: Faces competition risk (Google execs target 10% of NVDA’s annual revenue [1]).

- Deal finalization between Meta and Google.

- Competitor responses (NVIDIA’s new chip launches/price adjustments).

- TPU adoption rate by other tech firms.

- Users should be aware that NVIDIA’s dominance in AI chips is facing significant competition from Google’s TPUs, which may impact its future revenue growth [1].

- The Meta-Google deal is still in negotiations; failure to finalize could reverse recent price movements for GOOG, META, and NVDA [1].

- Regulatory approval for the deal (if applicable).

- Technical compatibility of TPUs with Meta’s existing infrastructure.

[0] Ginlix Analytical Database.

[1] Yahoo Finance. (2025, Nov 25). Meta reportedly in talks to buy billions-worth of Google chips. URL: https://ca.finance.yahoo.com/news/meta-reportedly-talks-buy-billions-121009740.html.

[2] Reddit Post. (2025, Nov 24). Google UP AH to $327: Meta mulls deploying Google TPU’s in its data centers.

Note: This analysis is based on available data as of November 26, 2025. Market conditions and deal status may change.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.