Speculative Stocks Sell-Off vs. Index Strength: Reddit Discussion & Market Data Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

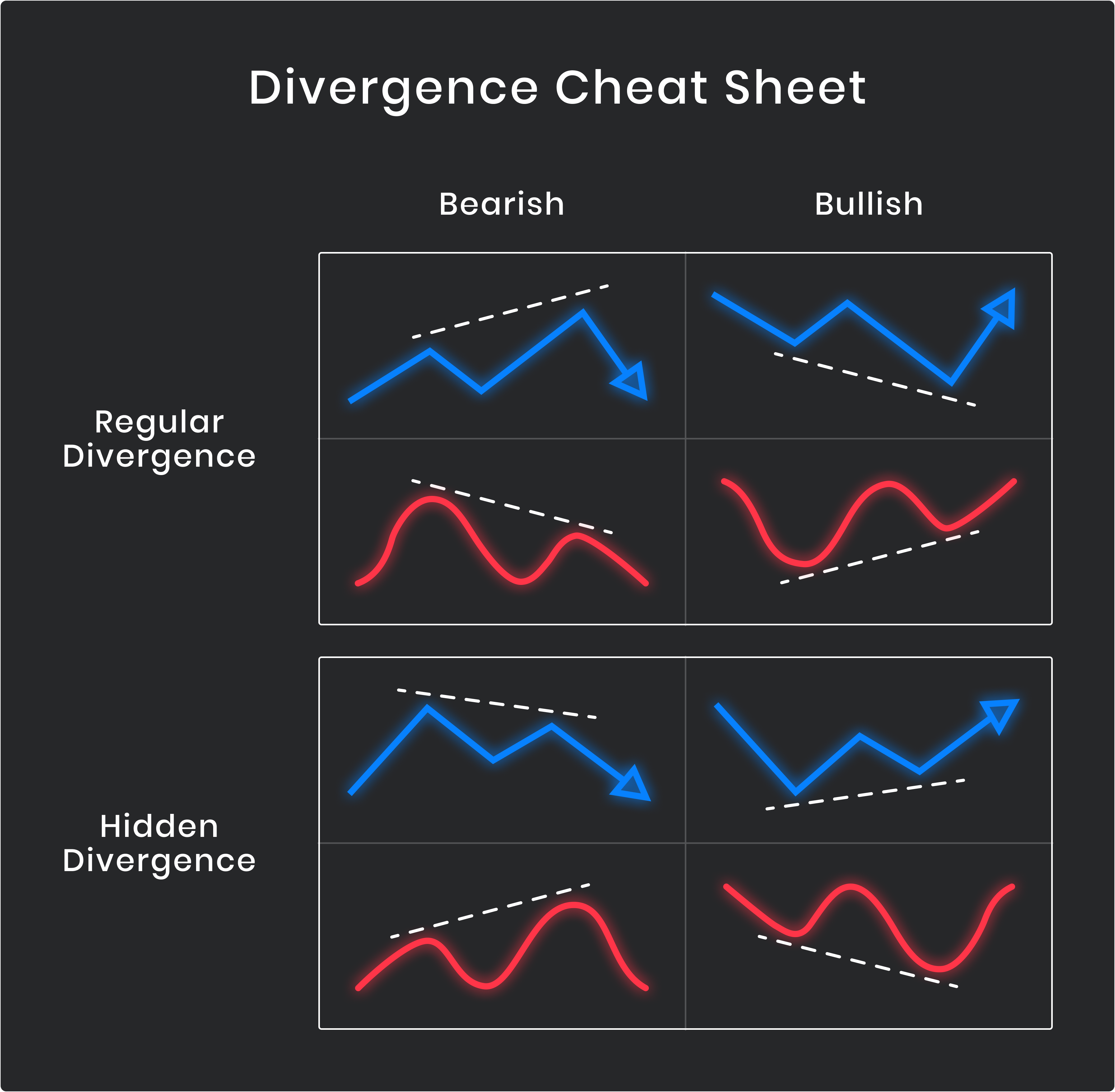

This analysis combines a Reddit discussion [7] with market data [0,1,2,3,4,6] to examine the divergence between index performance and speculative stocks. While major indices like the S&P 500 (+1.51%) and NASDAQ (+2.20%) have shown strength from October 1 to November 25 [6], several speculative stocks mentioned in the Reddit post have experienced significant declines: CRWV (-47.55%) [1], NBIS (-20.44%) [2], ACHR (-22.15%) [4]. Bitcoin, another speculative asset, dropped ~21% from October 25 to November 25 [6]. The Reddit discussion highlights two key perspectives: bullish (these stocks are undervalued and may rebound [7]) and bearish (they are unprofitable meme stocks, not legitimate investments [7]).

- Market divergence: Indices’ strength masks the sell-off in specific speculative stocks, indicating a fragmented market.

- Data gap: Profitability information for CRWV, NBIS, ACHR, and ASTS is unavailable due to IP limits [0], which is critical to evaluating the bearish argument about unprofitable stocks.

- Crypto alignment: Bitcoin’s ~21% drop aligns with the volatility of other speculative assets mentioned.

- Risks: High volatility (e.g., CRWV’s daily standard deviation of ~4.71% [1]), lack of profitability data, and reliance on executive orders as an investment basis (a concern raised in the Reddit discussion [7]).

- Opportunities: Rebound potential if stocks retrace to October levels (as per the Reddit OP [7]), though this carries significant risk given the lack of profitability data.

Major indices are performing well, but some speculative stocks and crypto assets have experienced notable declines. The Reddit discussion underscores conflicting views on these assets, with a critical gap in profitability data for the mentioned stocks. This analysis provides objective context for decision-making without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.