Analysis of Zhongji Innolight (300308.SZ) Popularity Reasons and Impact on AI Supply Chain

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Zhongji Innolight (300308.SZ) is a global leader in the optical module industry [0], focusing on R&D and manufacturing of high-end optical communication transceivers, serving cloud computing data centers, 5G, and telecommunication transmission networks [0]. In 2025, its stock price rose by 246.79% with a market capitalization exceeding 515.5 billion yuan [0], becoming a market favorite for the following main reasons:

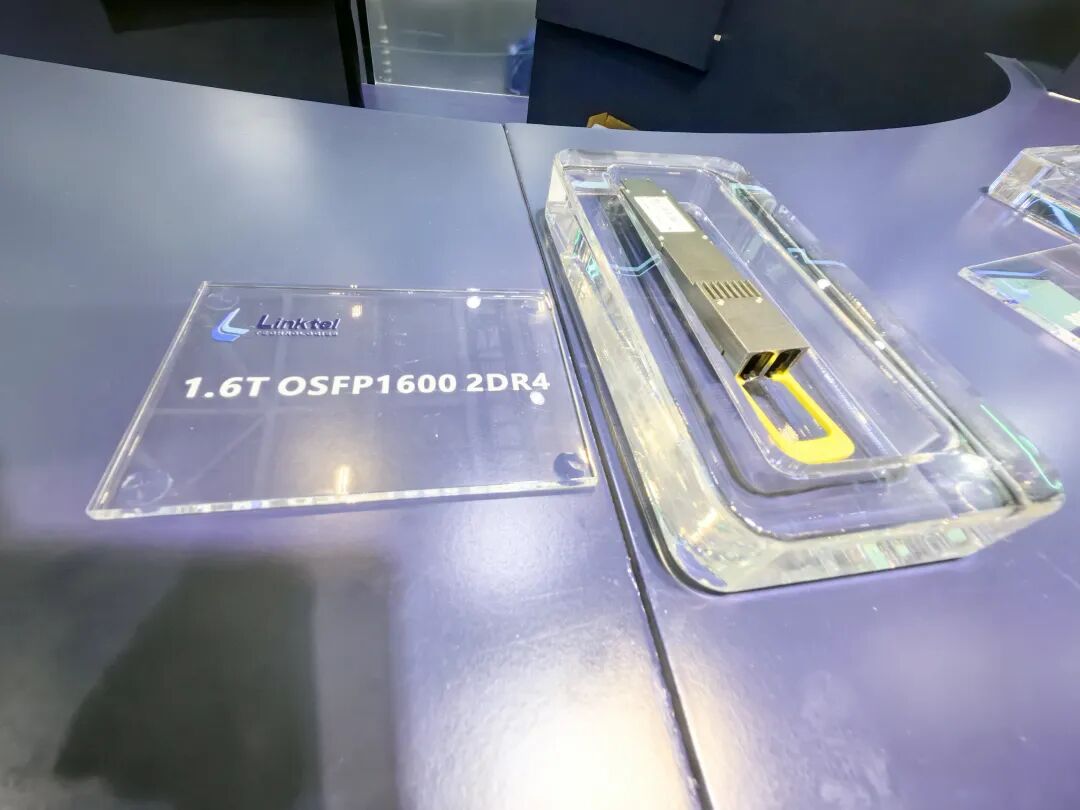

- Explosive Demand for AI Optical Modules: Accelerated AI data center construction drives rapid growth in demand for 800G/1.6T high-speed optical modules [0,4], and the company directly benefits as a core supplier.

- Hong Kong Listing Plan: The company is reportedly considering listing in Hong Kong to raise at least US$3 billion [6], aiming to enhance international influence and supplement capital for technological R&D.

- Institutional Optimism: Institutions like CMB International have reaffirmed “Buy” ratings [0], optimistic about the prospects of the AI supply chain.

- NVIDIA’s Catalyst: NVIDIA (NVDA.US)'s strong performance has alleviated market concerns about the AI bubble [7], driving up stocks related to the AI supply chain.

- Technology Upgrade Cycle: The optical module industry has entered a critical cycle of upgrading from 800G to 1.6T [0,8], and the company has a significant leading edge in technology.

- AI Supply Chain Linkage: The demand expansion of AI giants like NVIDIA and Zhongji Innolight’s performance growth form a positive cycle [0,7], highlighting the synergy of the AI supply chain.

- International Market Expansion: The Hong Kong listing plan will help the company enter the international capital market [6], deepening cooperation with global AI customers.

- Technical Barriers: The technical barriers for 800G/1.6T products are high [0], and as an industry leader, the company is expected to maintain its market share advantage.

- AI Demand Volatility: If AI data center construction falls short of expectations, it may lead to a decline in optical module demand [0].

- Increased Industry Competition: More participants in the optical module industry may squeeze profit margins [0].

- Valuation Pressure from Hong Kong Listing: Uncertainties in Hong Kong market valuations for tech stocks may affect financing outcomes [6].

- AI Data Center Expansion: Global AI data center construction continues to advance, and optical module demand is expected to maintain high growth [0,8].

- Technology Leading Advantage: The company’s leading technology in 800G/1.6T products is expected to capture more market share [0].

- International Market Penetration: After listing in Hong Kong, the company can further expand overseas customers and increase the proportion of international revenue [6].

As a leader in the optical module industry, Zhongji Innolight (300308.SZ) benefits from the development of the AI industry and the technology upgrade cycle, with strong growth potential. Its Hong Kong listing plan and institutional optimism further enhance market confidence, but attention should be paid to risks from AI demand volatility and industry competition. Investors should make decisions based on comprehensive information and their own risk tolerance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.