002153 (Shiji Information) Limit-Up Analysis and Driving Factors Related to Alibaba Ecosystem

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

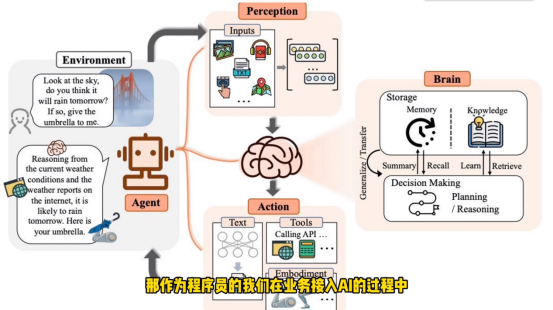

This analysis is based on Tushare’s limit-up pool data [0]. Shiji Information (002153) hit the limit-up on November 26, 2025. Key driving factors include: 1) Deep integration with the Alibaba AI ecosystem (Taobao China is the second largest shareholder [1]); 2) Singapore’s National AI Plan shifting to adopt the Alibaba Tongyi Qianwen architecture [2]; 3) Rotation effect in the AI application sector [3]. The key finding is that Alibaba ecosystem concept stocks benefit from both policy and technical events; they may continue to benefit from the boom in the AI application market.

As a strategically invested enterprise of the Alibaba system, Shiji Information’s main business covers information systems for big consumption fields such as hotels, catering, and retail [4], and there is significant synergy potential with Alibaba in directions like “hotel+AI” and “retail+AI” [1]. Recently, Singapore’s National AI Plan abandoned the Meta model and shifted to the Tongyi Qianwen open-source architecture, directly benefiting Alibaba ecosystem chain enterprises [2]. Meanwhile, the AI application sector saw explosive growth in November 2025; the Cloud Computing ETF (159890) rose over 4% intraday in the afternoon [3], driving related AI concept stocks to strengthen collectively.

- Cross-domain Correlation: Singapore’s AI policy adjustment (technical level) and A-share AI sector rotation (market level) form resonance, pushing up the valuation of Alibaba ecosystem concept stocks.

- Deep Implications: Shiji Information’s limit-up reflects the market’s high expectations for AI technology landing applications in vertical industries (like hotels, retail), especially companies bound to the ecosystem of leading tech enterprises are more likely to be favored by the market.

- Systemic Impact: The boom in the AI application sector may mark a trend of the market shifting from computing infrastructure (like optical modules) to application scenarios [3].

The AI application market continues to grow; as a core beneficiary of the Alibaba ecosystem, Shiji Information is expected to gain more business opportunities in the “AI+big consumption” field [2].-

Under the sector rotation effect, the AI application sector may maintain short-term popularity [3].

Rapid short-term stock price increases may lead to overvaluation and correction risks [0].-

The business model relying on the Alibaba ecosystem may be affected by adjustments to Alibaba’s AI strategy [1].-

Overall market volatility risks (e.g., A-share index fluctuations) [5].

Shiji Information’s limit-up is the result of multiple favorable factors overlapping: Alibaba ecosystem binding, Singapore’s AI policy shift, and AI application sector rotation. Investors should pay attention to the landing progress of AI applications in vertical industries and the business synergy effects of Alibaba ecosystem-related enterprises, but need to note short-term valuation risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.