NVIDIA (NVDA) Q3 FY25 Earnings Analysis & Mixed Market Sentiment Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

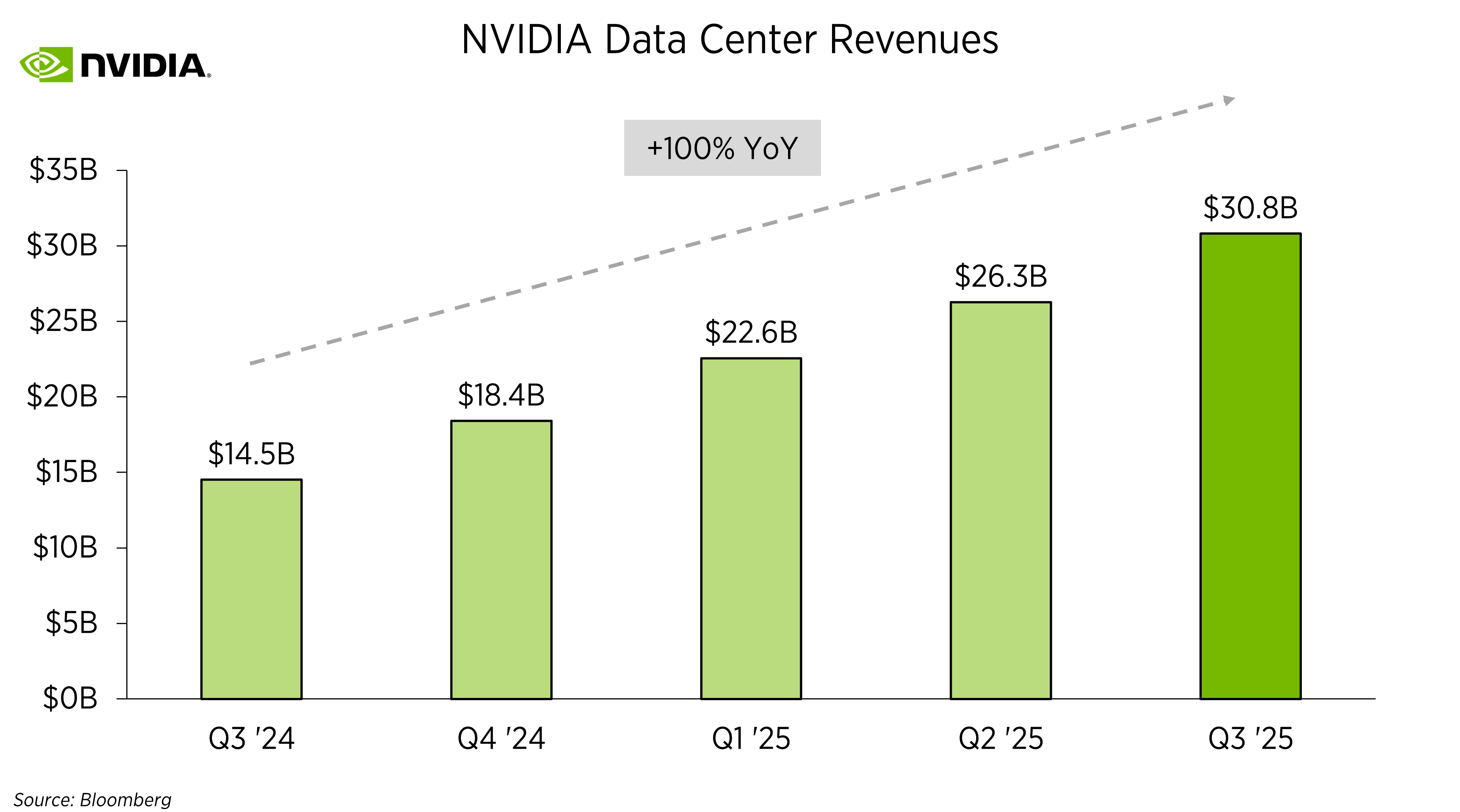

NVIDIA’s Q3 FY25 earnings exceeded expectations, with total revenue of $35.1B (up 94% YoY) and data center revenue of $30.8B (up112% YoY) [0]. Despite this, NVDA stock dropped7.81% on Nov20 and an additional1.30% on Nov21, totaling ~9% decline [1]. This underperformed the tech sector, which rose0.78% on Nov23 [2]. The mixed sentiment stems from short-term bearish factors (macro economic concerns like delayed inflation data [3] and potential rate impacts on GPU demand) and long-term bullish drivers (AI growth from Blackwell GPU ramp and H200 sales [0]). Affected instruments include NVDA directly, tech sector, semiconductors (TSMC, Micron), and cloud providers (AWS, Azure) [0].

- Information Gaps: The Reddit claim of $33B revenue from 4 customers was not verified in credible sources [0, 1]. No accounting issues were found in reputable reports [2,3].

- Short-Term vs Long-Term Contrast: The stock decline is viewed as part of a broader market correction rather than NVDA-specific [5].

- Macro Influence: Delayed Nov2024 CPI data (until Dec18 [3]) and upcoming Fed policy decisions will impact short-term GPU demand.

- Macro Economic Risk: Persistent inflation and higher interest rates may reduce enterprise spending on AI infrastructure [3].

- Potential Customer Concentration: Unverified claim of heavy reliance on a few customers warrants further investigation [5].

- Short-Term Valuation Risk: Post-earnings stock drop indicates investor concerns about near-term growth [1].

- AI Growth: NVDA’s Blackwell architecture (2.2x performance over Hopper) and H200 GPU (fastest ramp in company history) position it for long-term AI market leadership [0].

- Long-Term Profitability: Analyst targets range from $220 to $230 [4], reflecting confidence in future earnings.

NVIDIA’s Q3 FY25 results highlight strong growth in AI infrastructure, but short-term headwinds persist. Key metrics include Q4 guidance of $37.5B ±2% [0], analyst price targets of $220-$230 [4], and a ~9% post-earnings stock drop [1]. Decision-makers should monitor Blackwell ramp progress, upcoming Fed policy, and verified customer concentration data.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.