Google's TPU Advances vs Nvidia's Dominance: Competitive Dynamics and Investment Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

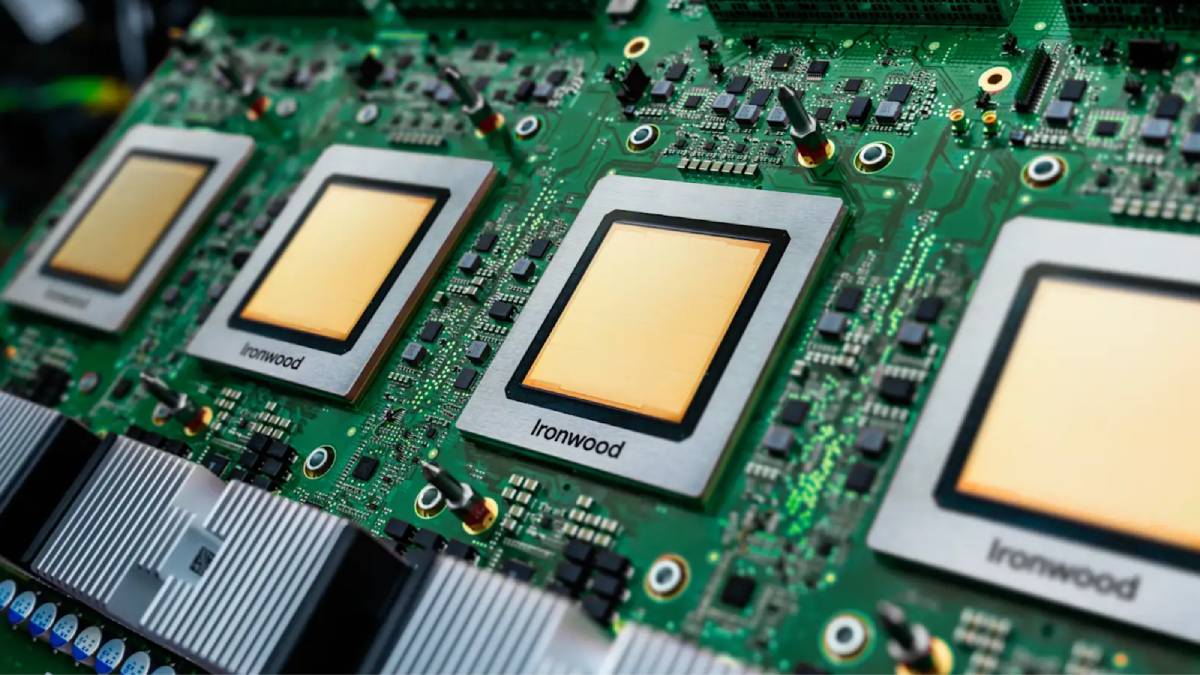

- Google’s Ironwood TPU: The 7th-gen TPU delivers significant performance improvements, targeting Nvidia’s dominance in AI workloads [3].

- Meta Partnership Talks: Meta is negotiating to use Google’s chips, signaling potential for broader non-Nvidia chip adoption [4].

- Nvidia Market Share: Nvidia holds ~92% of data center GPU market, supported by CUDA ecosystem [1,5].

- Anthropic TPU Deal: Anthropic signed for up to 1M Google TPUs, underscoring alternative compute demand [6].

- Users note Google’s TPU+OCS architecture has advantages but still relies on Nvidia GPUs for flexibility [11].

- AI chip race is long-term; supply chain and energy infrastructure are critical enablers [11].

- Supply Chain: Lumentum (LITE) benefits from AI chip demand [11].

- Storage: NAND flash sees growing AI-driven demand [11].

- Energy: Power bottlenecks create opportunities in energy/storage [11].

- Google: TPU reduces CUDA dependency but lacks third-party developer support [1, 10].

- Nvidia: CUDA ecosystem and chip-as-a-service (CaaS) model strengthen market moat [5,9].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.