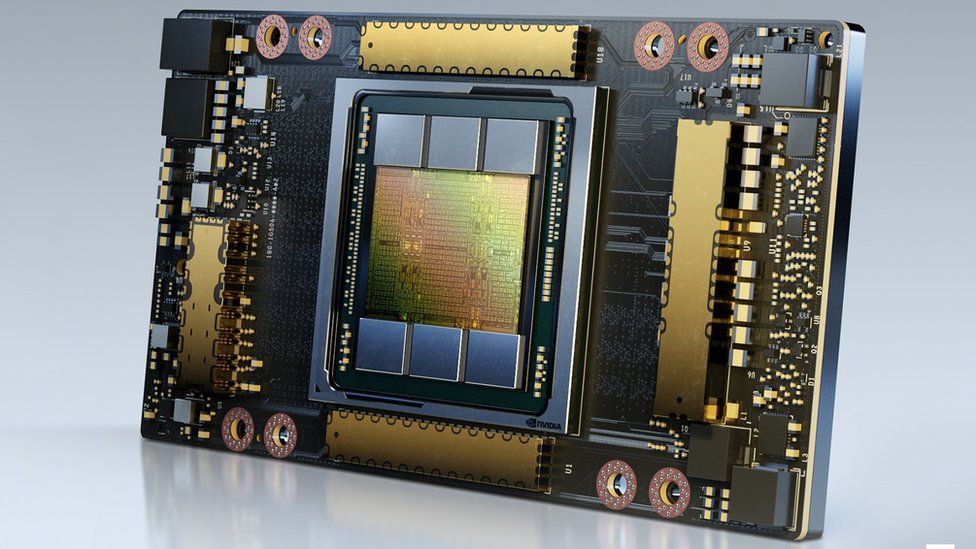

Global Markets Rise Amid AI Bubble Concerns: Impact on NVDA and Sector Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 24, 2025, global markets rose ahead of Thanksgiving, with U.S. indices posting gains: S&P500 (+1.03%), NASDAQ (+1.73%), and NVDA (+1.70%)—a key AI stock—despite growing concerns over an AI bubble [1]. Internal data shows that while tech sectors rose, they were outperformed by Healthcare (+1.445%) and Industrials (+1.241%), suggesting investor caution toward AI amid valuation debates [0]. The market continued its upward trend on Nov25, with S&P500 gaining another +1.03% and Dow Jones +1.36%, reflecting resilience to AI bubble talks [0].

- Sector Rotation Trend: Non-tech sectors (Healthcare, Industrials) led gains, indicating a shift toward diversification away from AI stocks amid bubble concerns.

- Market Resilience: The ability to absorb AI bubble worries and continue rising suggests underlying confidence in economic fundamentals.

- NVDA’s Mixed Performance: NVDA’s Nov24 gain (+1.70%) followed by a Nov25 drop (-2.6%) hints at ongoing uncertainty—driven by later news of Google’s AI chip competition and fraud allegations [3].

- Cautious Optimism: Tech sector’s moderate gain (0.78%) vs broader market strength shows investors are balancing AI exposure with non-tech assets.

- AI Bubble Volatility: AI-related stocks like NVDA face valuation concerns that could lead to short-term price swings. Users should be aware of these risks [3].

- Competitive Pressure: NVDA’s later drop links to Google’s AI chip competition, a threat to its market dominance [3].

- Sector Rotation: Shift away from tech may reduce returns for AI-focused portfolios.

- Diversification: Non-tech sectors (Healthcare, Industrials) offer growth potential amid AI uncertainty.

- Market Resilience: The market’s ability to handle AI bubble concerns suggests stable underlying economic conditions.

This summary provides objective context for decision-making:

- Nov24 Gains: S&P500 (+1.03%), NASDAQ (+1.73%), NVDA (+1.70%) [0].

- Sector Performance: Tech (+0.78%) vs Healthcare (+1.445%) [0].

- NVDA’s Nov25 Drop: -2.6% due to competition and fraud allegations [3].

This analysis does not constitute investment advice; it is for informational purposes only.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.