GOOG After-Hours Surge Amid Meta TPU Talks: AI Chip Market Dynamics Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

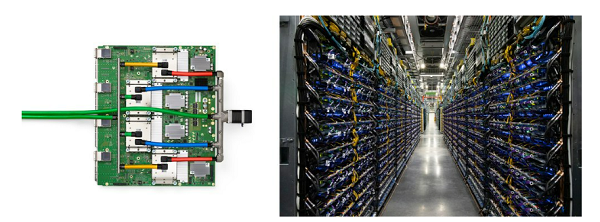

GOOG’s after-hours surge to $327 stems from Meta’s potential adoption of Google’s TPUs, signaling growing competition in the AI chip market [3]. GOOG has rallied ~52% since mid-September, boosted by Gemini 3’s positive reception and expansion into AI infrastructure [0]. NVDA’s ~2.05% AH drop reflects investor concerns over market share risk from Google’s TPUs [1]. Meta’s consideration of TPUs could lead to significant cost savings, potentially boosting its EPS [3].

- Cross-domain impact: AI chip competition directly influences stock performance, with GOOG benefiting from expanded use cases beyond search/ads [0].

- NVDA’s market leadership is facing threats from Google and other players, though it retains a dominant position (80%+ market share) [1].

- GOOG’s valuation (31.57x P/E) is high, leaving limited room for disappointment if AI chip adoption slows [0].

- Risks: NVDA faces eroding market share from Google’s TPUs [1]; GOOG’s high valuation may trigger volatility [0]; Meta faces execution risks for TPU deployment [3].

- Opportunities: GOOG could diversify revenue via AI chip sales [1]; Meta may gain EPS boosts from cost savings [3].

- GOOG: $319.80 (-1.19% regular hours), $327 AH, $3.86T market cap, ~52% rally since mid-Sept [0].

- NVDA: $180.73 (+1.64% regular hours), ~2.05% AH drop, $4.40T market cap [0].

- Meta: $637.50 (+0.20% regular hours), considering TPUs for cost savings [0][3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.