Analysis: OpenAI's Competitive Challenges Amid Google's Gemini 3 Resurgence

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

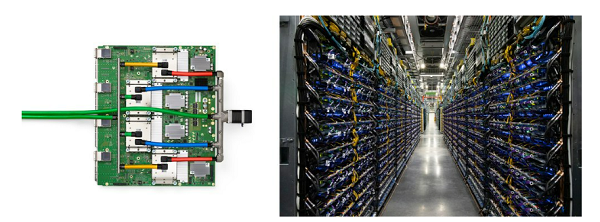

OpenAI faces significant competitive challenges from Google, driven by Google’s full-stack data and infrastructure advantages (own TPUs, zettabytes of data) and ecosystem integration [1][3]. OpenAI’s cash burn is unsustainable ($8.7B in Q1-Q3 2025) due to its for-profit shift, and it relies heavily on Microsoft’s $13B funding [6][10]. Google’s Gemini3 launch has narrowed the gap, leading OpenAI’s CEO to warn of headwinds [4][11].

- Google’s full-stack model (hardware + data + ecosystem) gives it a long-term edge over OpenAI [1][2].

- OpenAI’s cash burn rate (57% projected for 2026-27) threatens its viability without additional funding [9].

- Google’s Gemini3 integration into Chrome and Workspace expands its reach to billions of users [11].

- OpenAI risks insolvency if cash burn isn’t reduced or Microsoft funding dries up [6][9].

- Google’s Gemini3 could erode OpenAI’s market share [11][12].

- OpenAI could leverage Microsoft’s ecosystem to mitigate competitive pressures [10].

- Cost-cutting or pricing adjustments may improve OpenAI’s financial health [9].

- Timeline: Nov 2025 (Gemini3 launch, OpenAI CEO memo).

- Metrics: OpenAI’s $8.7B inference spend (Q1-Q3 '25), Microsoft’s $13B funding commitment [6][10].

- Key Events: OpenAI CEO’s headwinds warning, Google Gemini3 launch with Antigravity platform [4][11].

- OpenAI’s current valuation (Reddit claims $1B, unconfirmed).

- Microsoft’s acquisition intent for OpenAI.

- Exact market share changes post Gemini3 launch.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.