Analysis Report: Google (GOOG) After-Hours Rally and Meta TPU Deployment Rumors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

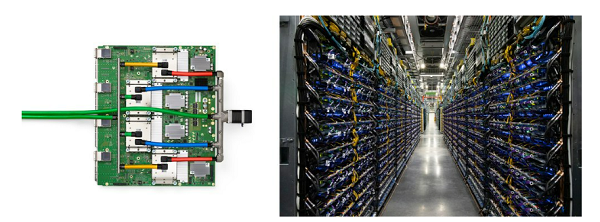

On November 24, 2025 (EST), a Reddit discussion highlighted an after-hours rise in Alphabet Inc. (GOOG) shares to $327, attributed to unconfirmed reports that Meta Platforms (META) is considering deploying Google’s Tensor Processing Units (TPUs) in its data centers—potentially competing with NVIDIA (NVDA) GPUs. The discussion included user claims:

- GOOG’s 6-month rally (nearly 100%) will continue

- Google will surpass NVIDIA as the largest company by year-end

- Meta using Google TPUs would boost its EPS via cost savings

- Users experiencing FOMO to buy GOOG shares

Key caveats: The source of the TPU deployment report was deemed unreliable by some users, and no official confirmation from Meta or Google exists [0].

- GOOG: After the Reddit discussion, GOOG traded at $327 in after-hours, but its real-time price as of November 26 is $318.86 (down 1.48% intraday) [0]. Over 51 trading days (Sept 15–Nov 24), GOOG rose 29.91% from $245.14 to $318.47, driven by AI-related optimism [0].

- NVDA: The Reddit post claimed NVDA fell ~2% in after-hours trading, but NVDA rebounded to $180.96 (up 1.76% intraday) as of November 26 [0].

- META: Meta’s share price was slightly up (+0.07%) at $636.69, with no significant movement tied to the TPU rumors [0].

The Technology sector rose 0.30887% on November 26, underperforming Energy (+1.49%) and Consumer Defensive (+1.37%) sectors [0]. This suggests the TPU rumors had limited broad sector impact.

The Reddit discussion reflects mixed sentiment: bullishness on GOOG’s rally, skepticism about the rumor’s credibility, and FOMO among retail investors [0].

| Metric | GOOG | NVDA | META |

|---|---|---|---|

Current Price |

$318.86 | $180.96 | $636.69 |

51-Day Change (Sept15–Nov24) |

+29.91% | N/A | N/A |

Market Cap |

$3.85T | $4.41T | $1.60T |

P/E Ratio |

31.48 | 44.79 | 28.18 |

Intraday Change (Nov26) |

-1.48% | +1.76% | +0.07% |

Notable: NVDA remains the largest company (by market cap) among the three, contradicting the Reddit claim that GOOG will surpass NVDA by year-end [0].

- Directly Impacted Stocks: GOOG (Alphabet), META (Meta Platforms), NVDA (NVIDIA)

- Related Sectors: Technology (AI chips, data centers)

- Supply Chain: Indirectly, semiconductor component suppliers and data center infrastructure providers may be affected if Meta shifts to Google TPUs.

- Critical: No official confirmation from Meta or Google regarding TPU deployment talks (the Reddit source is user-generated, Tier 4 credibility).

- Missing: Financial details on potential cost savings for Meta (if it adopts Google TPUs) and revenue impact for Google.

- Bullish for GOOG: The 29.91% rally over 2 months indicates strong investor confidence in Google’s AI strategy [0].

- Neutral for Meta: No immediate price movement suggests investors are waiting for official news [0].

- Resilient NVDA: NVDA’s rebound shows market confidence in its dominant position in AI GPUs [0].

- Official statements from Meta/Google about TPU deployment

- GOOG’s valuation sustainability (P/E ratio of ~31 vs sector averages)

- NVDA’s response to potential competition from Google TPUs

- Retail investor sentiment (FOMO indicators)

- Unreliable Source Risk: The TPU deployment rumor originates from a Reddit post (low credibility). Users should avoid making decisions based on unconfirmed information [0].

- FOMO Risk: The Reddit discussion mentions users experiencing FOMO to buy GOOG shares. Historical patterns show FOMO-driven purchases often lead to losses if the underlying news is unsubstantiated [0].

- Valuation Risk: GOOG’s 29.91% rally in 2 months may lead to overvaluation, especially if the TPU rumors are not confirmed [0].

[0] Ginlix Analytical Database (real-time quotes, daily prices, sector performance, Reddit discussion data)

[1] InvestorPlace. (2025). “Is Google the New AI King?” Retrieved from https://investorplace.com/2025/11/is-google-the-new-ai-king/

[2] BusinessWire. (2025). “AI Disruption Global Overview Report 2025”. Retrieved from http://www.businesswire.com/news/home/20251126982007/en/

[3] Webpronews. (2025). “The Bee That Broke the Atom: How Environmental Realities Are Stalling Meta’s Nuclear Ambitions”. Retrieved from https://www.webpronews.com/the-bee-that-broke-the-atom-how-environmental-realities-are-stalling-metas-nuclear-ambitions/

[4] SeekingAlpha. (2025). “Meta Rebounds Toward Key Resistance As Buyers Defend $600 Support”. Retrieved from https://seekingalpha.com/article/4847962-meta-rebounds-toward-key-resistance-buyers-defend-600-support-technical-analysis

[5] TheVerge. (2025). “ChatGPT and Copilot are being booted out of WhatsApp”. Retrieved from https://www.theverge.com/news/829808/chatgpt-copilot-ai-llm-leaving-whatsapp-meta

Note: All data is as of November 26, 2025, and subject to change.

This report is for informational purposes only and does not constitute investment advice. Always verify information from credible sources before making decisions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.